NEW YORK CITY, NY / ACCESS Newswire / October 28, 2025 / CasinoRank's analysis shows that the US live casino sector is changing fast, moving from traditional desktop platforms toward mobile-first experiences. The rise of electronic table games (ETGs) is driving this shift, offering automated versions of live dealer tables that cut costs and make games more accessible. As more players choose to play on the go, casinos are gradually replacing resource-heavy live setups with smarter digital solutions.

Market Evolution

The transition from traditional brick-and-mortar and desktop platforms to digital and mobile ecosystems has reshaped the US casino landscape. Mobile gaming adoption has surged, with players shifting preferences toward convenient, anytime access over stationary desktop sessions. This evolution impacts casino operations by streamlining workflows and reducing dependency on human dealers, particularly amid labor shortages post-COVID. ETG adoption rates, though slower in the US compared to Asia, are rising due to tax advantages and higher game turnover- for instance, in Pennsylvania, ETGs are taxed at 16% versus 55% for slots. Player preferences are tilting toward mobile for casual play, while desktop retains appeal for immersive, extended sessions, reflecting a broader demographic appeal among younger users.

Key Highlights:

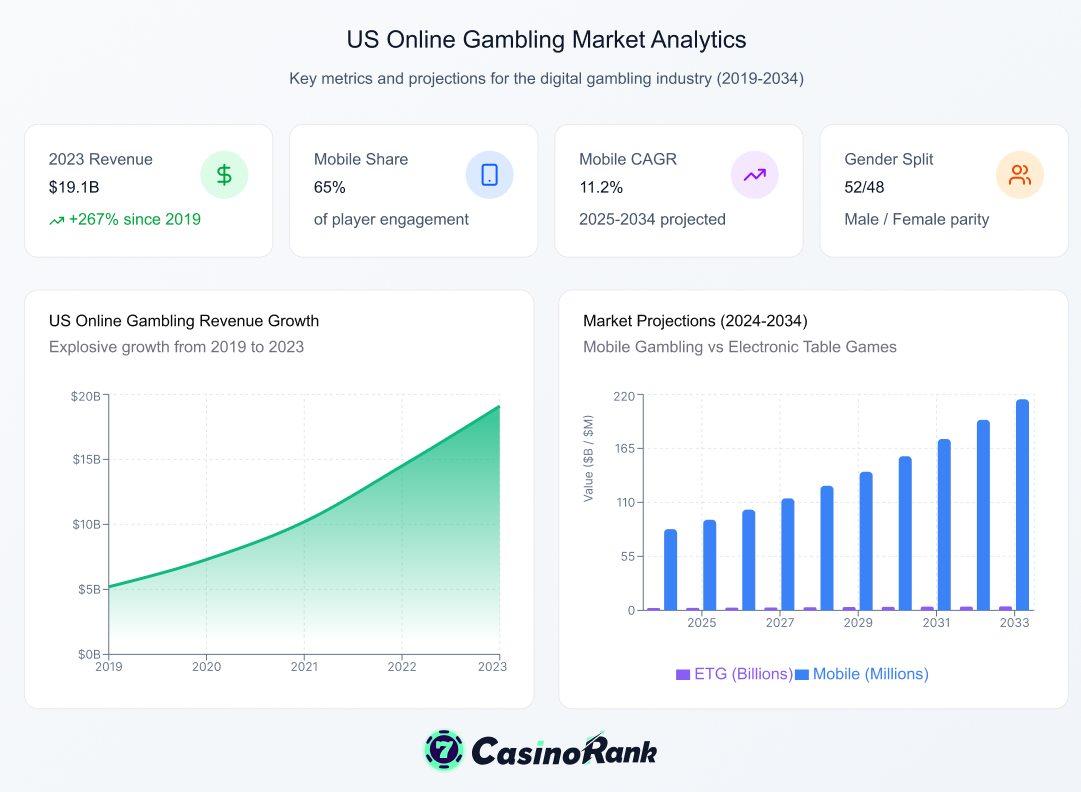

US online gambling revenue grew from $5.2 billion in 2019 to $19.1 billion in 2023, marking a 267% increase and year-over-year growth averaging over 40% from 2020 onward.

Mobile gambling's global market is projected to expand from $82.84 million in 2025 to $215 million by 2034 at a CAGR of 11.2%, with the US capturing a significant share driven by smartphone penetration.

ETG market in the US was valued at $2.4 billion in 2024, expected to reach $4.1 billion by 2033, reflecting an adoption growth rate fueled by post-pandemic demand for contactless gaming.

Operational costs for ETGs are significantly lower than live dealers, with reduced labor expenses and higher efficiency.

Mobile player engagement metrics show 65% of social casino activity on mobile versus 35% on desktop, with mobile sessions boasting higher retention through intuitive interfaces and real-time notifications.

Player demographics indicate 52% male and 48% female participation, with the 18-24 age group dominating, representing nearly 60% of millennial and Gen Z users in online casinos.

For more information, check out our data-driven article of ETG's in the US, explore here.

As ETGs gain traction, US casinos stand to boost accessibility and revenue, positioning the market for sustained expansion amid shifting player behaviors. This data-driven evolution promises a more inclusive, efficient gaming future.

Contact Information

Lukas Mollberg

Marketing Manager

lukas@casinorank.com

SOURCE: CasinoRank

View the original press release on ACCESS Newswire