Last month, I recommended shorting 10% out-of-the-money (OTM) put options in Palantir, Inc. (PLTR) to yield 4.24% over one month. PLTR closed with no assignment to buy shares. A 3.5% yield is possible for a 9.8% one-month OTM short put play.

This was in the October 19, 2025, Barchart article, “How to Make a 4.2% Yield By Shorting Palantir Put Options Over the Next Month.” At the time, PLTR was at $178.15, and I suggested shorting the $160.00 put option expiring Nov. 14 for a $6.78 midpoint premium, or 4.2438% (i.e., $678/$16,000 invested).

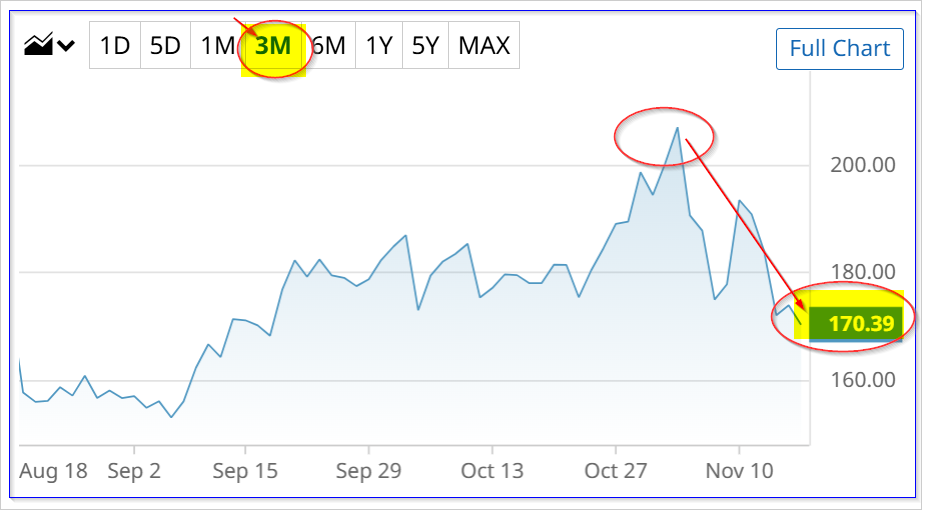

PLTR closed at $174.01 on Friday and is now at $170.89. So, it closed above the short strike price and therefore remained OTM. That means the investor not only kept the income but had no assignment of the secured cash to buy 100 shares at $160.00

Rinse and Repeat

Palantir's put option premiums remain high. That means an investor, with released collateral, can now repeat this short-put play over the next month.

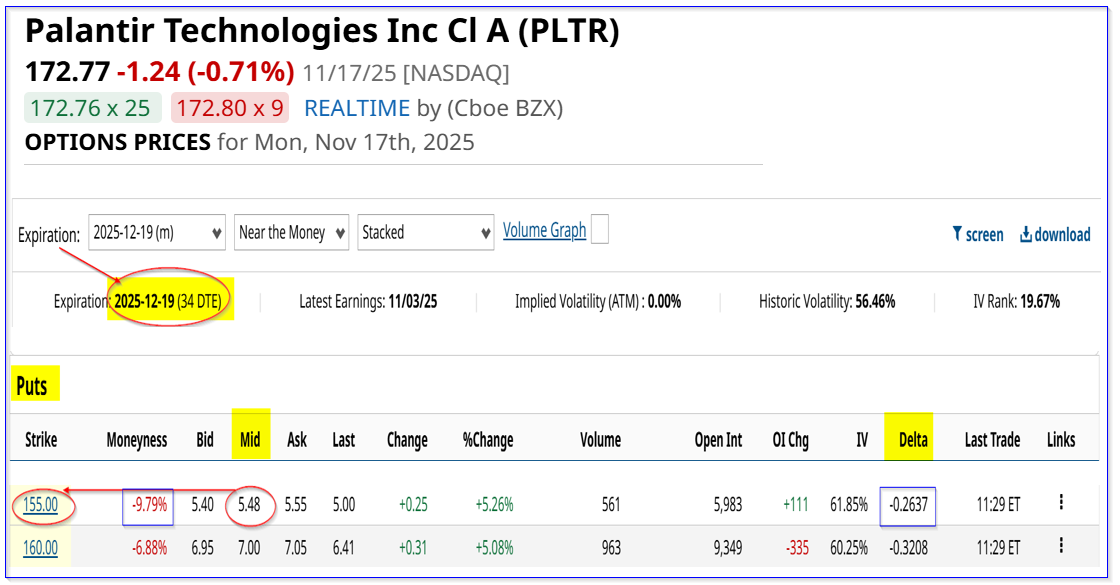

For example, the Dec. 19, 2025, expiry period shows that a 9.78% lower put option contract, at the $155.00 strike price, has a midpoint premium of $4.75.00

That means an investor who secures $15,500 in cash collateral or buying power with their brokerage firm, can immediately earn $548.00. In other words, the one-month short-put yield of 3.535% (i.e., $548/15,500).

This is lower than last month's 10% OTM yield of 4.24%, but still very high. Moreover, the delta ratio is just -0.26, implying just a 26% chance that PLTR will fall 9.8% to $155.00 over the next month.

That is similar to the -0.2655 delta in last month's short-put play by shorting a $160.00 put. That worked out well.

In fact, more risk-averse investors might be willing to short the 12-19-25 expiry $160 put (see above). That is just 6.9% out-of-the-money, yielding 4.375% (i.e., $7.00/160.00).

Downside Risks

There is no guarantee that PLTR might fall below the $155.00 or $160.00 strike price. In that case, the account will be assigned to buy 100 shares using the collateral.

And that might result in an unrealized capital loss.

But there are mitigating factors and ways to improve this situation, should it occur.

Mitigating Factors and Plays

For example, the breakeven point is lower after accounting for the short-put income:

$155.00 - $5.48 = $149.52 breakeven

That is -13.46% below today's price of $172.77. So, PLTR would have to really tank to incur an unrealized loss.

Similarly, with the $160.00 strike price short-put play, the breakeven is $153.00 (i.e., $160-$7.00), or -11.44% lower than today.

Moreover, the investor could always sell short out-of-the-money covered calls at that point. That extra income could mitigate any unrealized loss.

And my prior price target, shown in the Oct. 19 article, was $219.00. I have not yet updated that target based on its recent results, but I suspect it will be higher.

Finally, the investor could always short more out-of-the-money (OTM) puts if assignment occurs. That could also help mitigate any unrealized losses.

So, the bottom line here is that selling short PLTR puts with strike prices well below today's price may turn out to be a good strategy. So, far that has worked better than buying PLTR stock over the last month.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why MP Materials’ (MP) Implosion Presents a Rare Upside Opportunity for Quants

- Wedbush Says to Push Through the ‘Whiteknuckle Moment’ and Keep Buying Palantir Stock

- Micron Stock Jumped 24% in a Month: Should You Buy, Sell, or Hold MU?

- The Crypto Selloff Is Weighing Down Robinhood Stock, but Bridgewater Is Betting Big