Cincinnati, Ohio-based Fifth Third Bancorp (FITB) operates as the bank holding company, providing a wide range of financial products and services. Valued at $27.5 billion by market cap, the firm operates through Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management segments.

The banking major has notably underperformed the broader market over the past year. FITB stock has dipped 31 bps on a YTD basis and declined 1.6% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 15.1% gains in 2025 and 18.5% surge over the past year.

Narrowing the focus, Fifth Third has also underperformed the Financial Select Sector SPDR Fund’s (XLF) 8.5% uptick in 2025 and 13.3% gains over the past 52 weeks.

Fifth Third Bancorp’s stock prices gained 1.3% in the trading session following the release of its Q3 results on Oct. 17. The quarter was marked by a strong balance sheet, diverse revenue streams, and disciplined expense management, leading the solid earnings. Further, the company observed notable improvement in net interest margin, leading to a 7% year-over-year growth in net interest income to $1.5 billion. Moreover, its non-interest income grew 10% year-over-year to $781 million. Overall, its topline came in at $2.3 billion, beating the consensus estimates by 51 bps. Further, its adjusted EPS of $0.93 surpassed the Street’s expectations by 6.9%, boosting investor confidence.

For the full fiscal 2025, ending in December, analysts expect FITB to deliver an adjusted EPS of $3.51, up 4.2% year-over-year. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

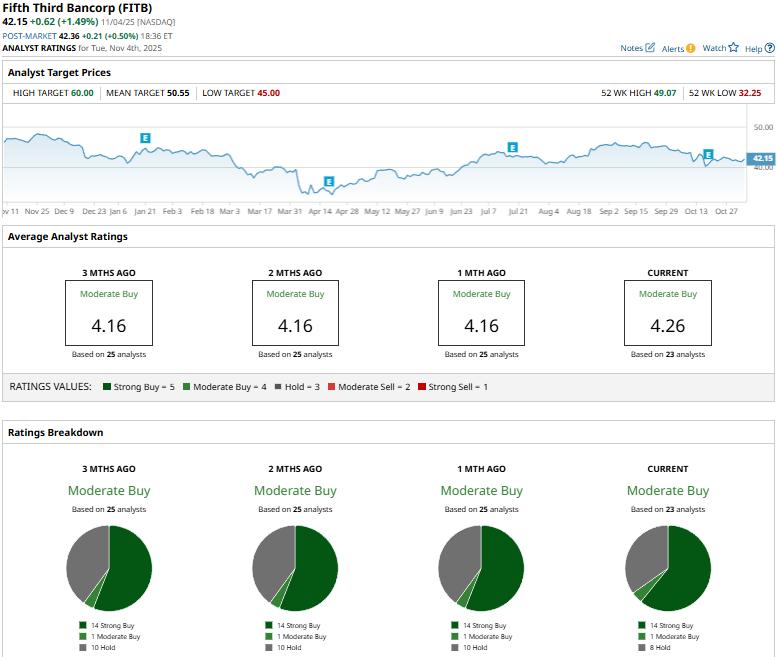

The stock maintains a consensus “Moderate Buy” rating overall. Of the 23 analysts covering the stock, opinions include 14 “Strong Buys,” one “Moderate Buy,” and eight “Holds.”

This configuration has remained mostly stable over the past three months.

On Oct. 20, TD Cowen analyst Steven Alexopoulos reiterated a “Buy” rating on FITB and raised the price target from $57 to $58.

FITB’s mean price target of $50.55 represents a 19.9% premium. Meanwhile, the Street-high target of $60 suggests a notable 42.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart