Bellevue, Washington-based PACCAR Inc. (PCAR) designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks for the over-the-road and off-highway hauling of commercial and consumer goods. With a market cap of $51.2 billion, PACCAR operates through Truck, Parts, and Financial Services segments.

The company has notably lagged behind the broader market over the past year. PCAR stock prices have declined 6.8% on a YTD basis and 7.5% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 15.1% gains in 2025 and 18.5% surge over the past year.

Narrowing the focus, PACCAR has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 15.8% surge in 2025 and 14% uptick over the past 52 weeks.

PACCAR’s stock prices rose 2.4% in the trading following the release of its better-than-expected Q3 results on Oct. 21. Due to macro softness, the company’s topline has remained under pressure; its net sales for the quarter dropped 20.7% year-over-year to $6.1 billion, but surpassed the consensus estimates by 1.5%. It registered 31,900 global truck deliveries during the quarter and reported record PACCAR Parts revenues of $1.7 billion. Further, PACCAR Financial Services also observed solid profitability. Although its EPS decreased from $1.85 in the year-ago quarter to $1.12, it was in line with the Street’s expectations.

For the full fiscal 2025, ending in December, analysts expect PCAR to deliver an EPS of $5.06, down 36% year-over-year. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates twice over the past four quarters, it met or surpassed the projections on two other occasions.

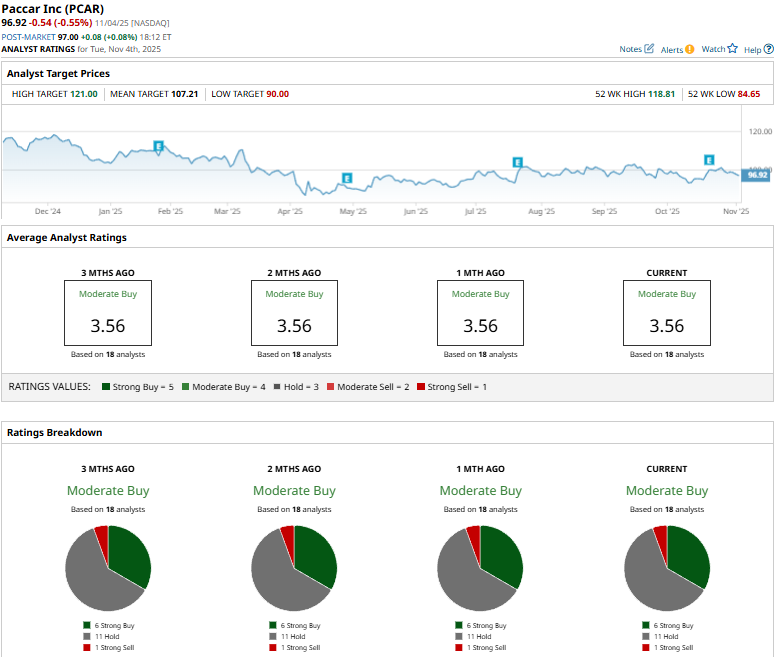

Among the 18 analysts covering the PCAR stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buys,” 11 “Holds,” and one “Strong Sell.”

This configuration has remained stable in recent months.

On Oct. 22, JP Morgan (JPM) analyst Tami Zakaria maintained a “Neutral” rating on PCAR and raised the price target from $103 to $108.

PCAR’s mean price target of $107.21 represents a 10.6% premium. Meanwhile, the Street-high target of $121 suggests a notable 24.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart