Strategy (MSTR), formerly MicroStrategy, stock has witnessed significant volatility in 2025. In July, MSTR stock touched 52-week highs of $457. However, there has been a correction of 60% from highs, which has been triggered by downside in Bitcoin (BTCUSD).

To navigate uncertain times and volatility in the crypto asset, Strategy announced that it has established $1.44 billion in dollar reserves.

The objective is to support payment of dividends on preferred stock coupled with coverage of debt servicing costs. While the cash buffer provides some cushion from a credit health perspective, the possibility of a sustained correction in Bitcoin remains a risk.

About Strategy Stock

Strategy is the largest Bitcoin treasury company in the world. The company offers exposure to Bitcoin through a range of securities that includes equity and fixed-income instruments. As of December 2025, the company has 650,000 Bitcoin holdings.

Additionally, Strategy is also a provider of AI-powered analytics software. For Q3 2025, the software business reported 10.9% growth in revenue to $128.7 million.

With Bitcoin correcting sharply from all-time highs, MSTR stock has also declined by 53% in the last six months.

Reserves to Cover for Dividends

Strategy recently announced the creation of a $1.44 billion reserve. With $800 million in dividend payments annually, the reserves imply a dividend coverage of 1.8.

Strategy has further announced that it targets to hold dollar reserves that cover 24 months of dividends. This is likely to improve the company’s creditworthiness.

It’s also worth noting that as of December 2025, Strategy reported an enterprise value of $68 billion. For the same period, the company’s convertible debt was $8.2 billion. This implies a low loan-to-value of 11% and provides Strategy with financial flexibility.

Bitcoin Volatility Remains a Risk

When Strategy reported Q3 2025 results, the company’s Bitcoin net asset value was $71 billion. In the most recent update, the company’s Bitcoin NAV has declined to $59 billion. Clearly, high volatility in crypto assets is a risk.

To elaborate further, Strategy believes that it’s likely to report an operating profit of $9.5 billion in 2025 if Bitcoin trades at $110,000 by the end of the year. However, if Bitcoin trades at $85,000 at EOY, the company expects an operating-level loss of $7 billion.

Assuming a scenario where Bitcoin remains in a downtrend, Strategy is likely to witness higher credit stress. This will translate into a selling of Bitcoin assets and potential erosion of value. Recently, former NYSE president Tom Farley opined that Bitcoin volatility will stay “for a long time.”

Having said that, global expansionary monetary policies are likely to support asset classes with limited supply. That’s one catalyst for Bitcoin coupled with the factor of wider adoption globally.

What Analysts Say About MSTR Stock

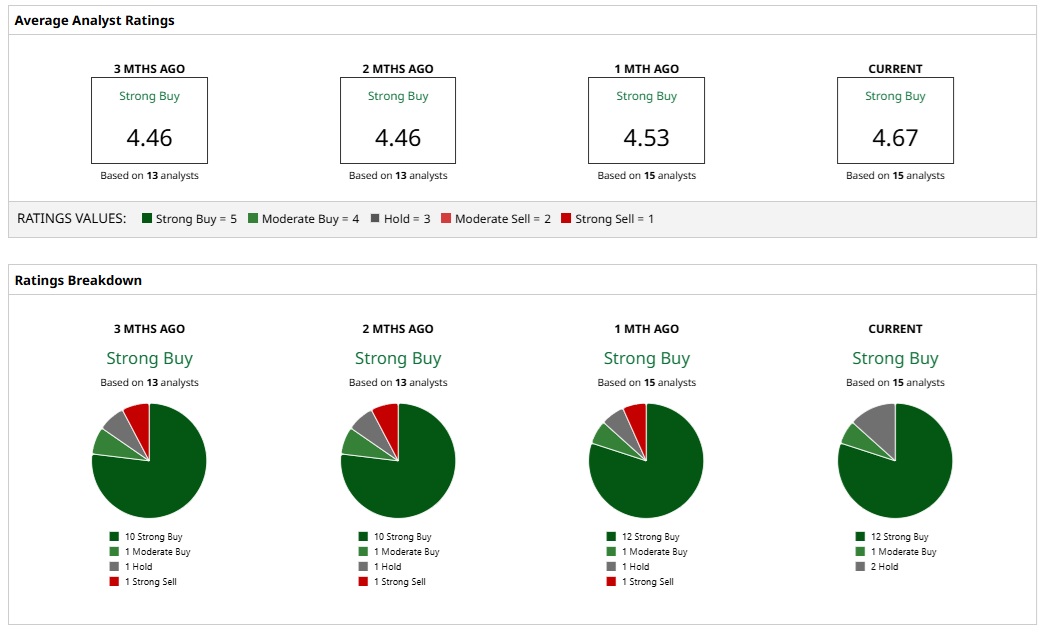

Based on the rating of 15 analysts, MSTR stock is a consensus “Strong Buy.”

While 12 analysts have assigned a “Strong Buy” rating, one analyst believes that the stock is a “Moderate Buy.” Further, two analysts have “Hold” ratings.

Based on the ratings, analysts have a mean price target of $541.62 for MSTR stock. This would imply an upside potential of 199%. Also, the most bullish price target of $705 implies an upside potential of 289%.

Last month, J.P. Morgan warned that Strategy is at risk of being excluded from MSCI’s equity indices. The reason being MSCI considering the exclusion of companies with digital assets representing more than 50% of total assets.

J.P. Morgan noted that an exclusion could trigger billions of dollars in outflows. While the company has been boosting its dollar reserves, it’s focused on dividend payment. It therefore makes sense (even after a deep correction) to remain cautious with a stock that has a 60-month beta of 3.40.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MicroStrategy Is Turning to a U.S. Dollar Reserve Amid Bitcoin Volatility. Should You Buy, Sell, or Hold MSTR Stock Here?

- Jamie Dimon Once Called Bitcoin a ‘Fraud.’ Now, JPMorgan Is Quietly Making Blockchain History and Betting This ‘Crypto Winter’ Will Be Short-Lived.

- Argus Just Slashed Its Earnings Estimates for Coinbase. Should You Dump COIN Stock Here?

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?