In a market where growth stocks often steal the spotlight, reliable income still matters, especially during periods of uncertainty. High-yield dividend stocks with solid business models and steady cash flows continue to earn Wall Street’s confidence, offering investors a blend of income and stability.

Here are three high-yield dividend stocks Wall Street still trusts to deliver dependable income, even when markets turn volatile.

Dividend Stock #1: Verizon Communications (VZ)

Valued at $170.7 billion, Verizon Communications (VZ) is one of the largest telecommunications companies in the United States, providing wireless, broadband, and enterprise connectivity services. The company’s core strength lies in its wireless business, which generates consistent, recurring revenue from millions of subscribers. This stability supports Verizon’s attractive dividend, making it a favorite among income-focused investors looking for consistency rather than quick growth.

Verizon pays a high dividend yield of 6.8% and maintains a healthy payout ratio of 57.6%, which leaves room for dividend growth as well as business expansion. It also has been paying and increasing dividends for the past 20 years, backed by steady cash generation from essential communication services. Verizon expects to generate free cash flow between $19.5 billion and $20.5 billion for the full year; that should help it continue the payouts.

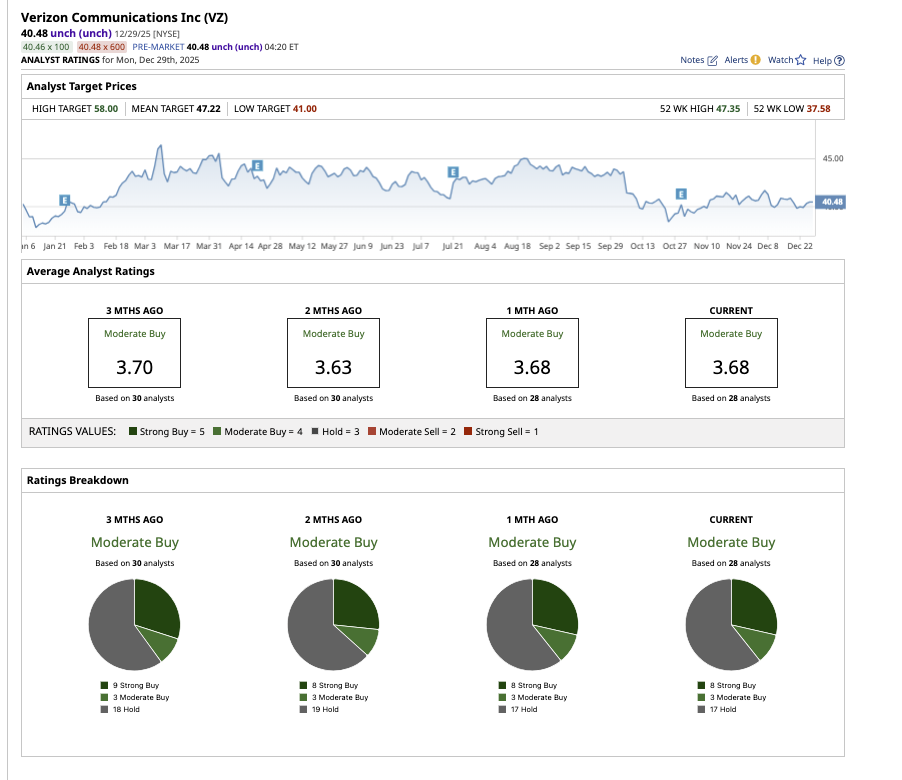

Overall, Wall Street rates VZ stock as a “Moderate Buy.” Of the 28 analysts that cover the stock, eight rate it a “Strong Buy,” three recommend a “Moderate Buy,” and 17 suggest a “Hold.” Based on the average target price of $47.22, the stock has an upside potential of 16.6% from current levels. Its Street-high estimate of $58 further implies VZ stock can go as high as 43.3% in the next 12 months.

Dividend Stock #2: AT&T (T)

AT&T (T) remains a high-yield dividend stock that Wall Street continues to trust, thanks to its essential role in U.S. communications infrastructure. Valued at $177.1 billion, AT&T is one of the country’s largest telecom providers, delivering wireless, broadband, and enterprise connectivity services to millions of customers nationwide. AT&T’s wireless segment provides mobile voice and data services to consumers and businesses, generating steady, recurring revenue that allows it to pay consistent dividends.

AT&T’s dividend yield is 4.5%, which is significantly higher than the communications sector average of 2.6%. Its healthy payout ratio of 50% is supported by consistent cash flows from critical communication services. The company intends to generate free cash flow in the low-to-mid $16 billion range for the full year 2025, leaving the door open for dividend increases.

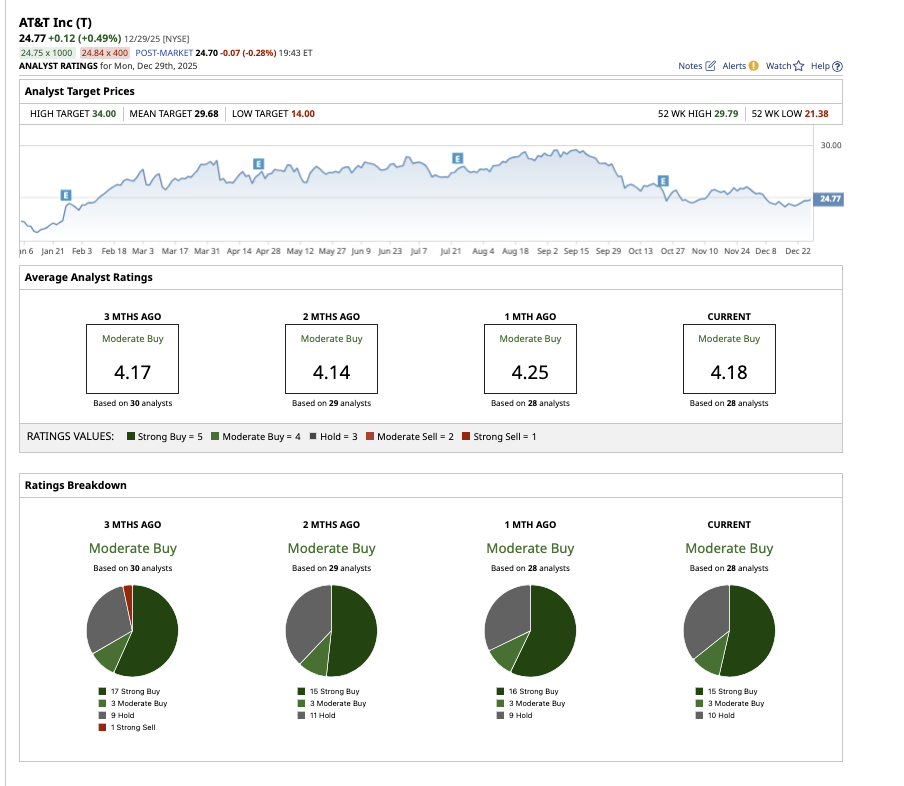

Overall, Wall Street rates AT&T stock as a “Moderate Buy.” Of the 28 analysts that cover the stock, 15 rate it a “Strong Buy,” three say it is a “Moderate Buy,” and 10 rate it a “Hold.” Based on the average target price of $29.68, the stock has an upside potential of 19.8% from current levels. Its Street-high estimate of $34 further implies the stock can go as high as 37.2% in the next 12 months.

Dividend Stock #3: Altria (MO)

Altria Group (MO) is one of Wall Street’s most trusted high-yield dividend stocks, built on decades of steady cash generation and disciplined capital returns. Best known for owning the iconic Marlboro brand in the U.S., Altria dominates the domestic tobacco market and has long been a cornerstone holding for income-focused investors.

Valued at $96.7 billion, Altria sells cigarettes and smokeless tobacco products, generating highly predictable revenue thanks to strong brand loyalty and pricing power. Even as cigarette volumes decline industry-wide, Altria has consistently offset this trend through regular price increases, protecting margins and cash flow. That resilience underpins one of the most reliable dividend profiles in the market. Altria’s high dividend yield of 7.4% is higher than the consumer staples average of 1.9%. Altria has earned the title of a Dividend King by increasing its dividend 60 times in the past 56 years, reassuring its status as one of the most reliable dividend profiles in the market.

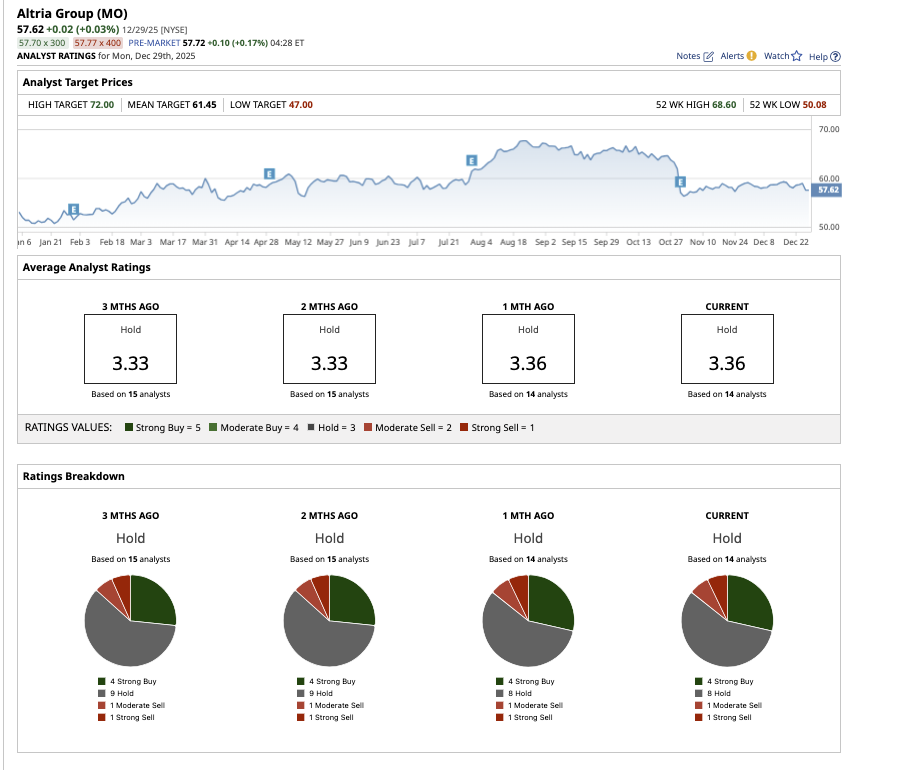

Overall, on Wall Street, Altria stock is a “Hold.” Of the 14 analysts covering the stock, four rate it a “Strong Buy,” eight rate it a “Hold,” one says it is a “Moderate Sell,” and one rates it a “Strong Sell.” Based on the average target price of $61.45, the stock has an upside potential of 6.6% from current levels. Its Street-high estimate of $72 further implies the stock can go as high as 25% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart