As a rule of thumb, anytime you place a trade in the options market, you should assume that you’re at a disadvantage. After all, the derivatives arena tends to be where the smart money congregates — and these folks stand upstream of the informational space. In other words, by the time you get a juicy tip, the opportunity may have already been filtered several times over.

That’s not to say that retail traders can’t enjoy a leg up on the competition — and I believe Marathon Petroleum (MPC) provides a rare case where regular folks may have the advantage over Wall Street elites.

At first glance, the narrative surrounding MPC stock doesn’t seem all that original. As you know, the capture and extradition of Venezuela’s Nicolas Maduro has sparked seismic activity, especially in the oil market. For Marathon, it’s possible that the increased supply of heavy oil creates a more competitive market for feedstocks. As such, in the trailing five sessions, MPC has moved up nearly 2%.

Even more encouraging, Marathon’s unusual options activity points to controlled upside. Predominantly, many of the big-ticket transactions have centered on near-the-money calls (around the $180 to $185 strike price area) for front-dated expirations. As such, these transactions are skewed toward aggressive execution rather than passive hedges.

Mainly, the clue is in the expiration dates. Because a ton of these big-ticket strikes are near the current spot price, the premiums would ordinarily be quite expensive. But because they’re about to expire relatively soon, these contracts can be bought rather cheaply. So, the transactions demonstrate confidence — but over a shorter-term horizon.

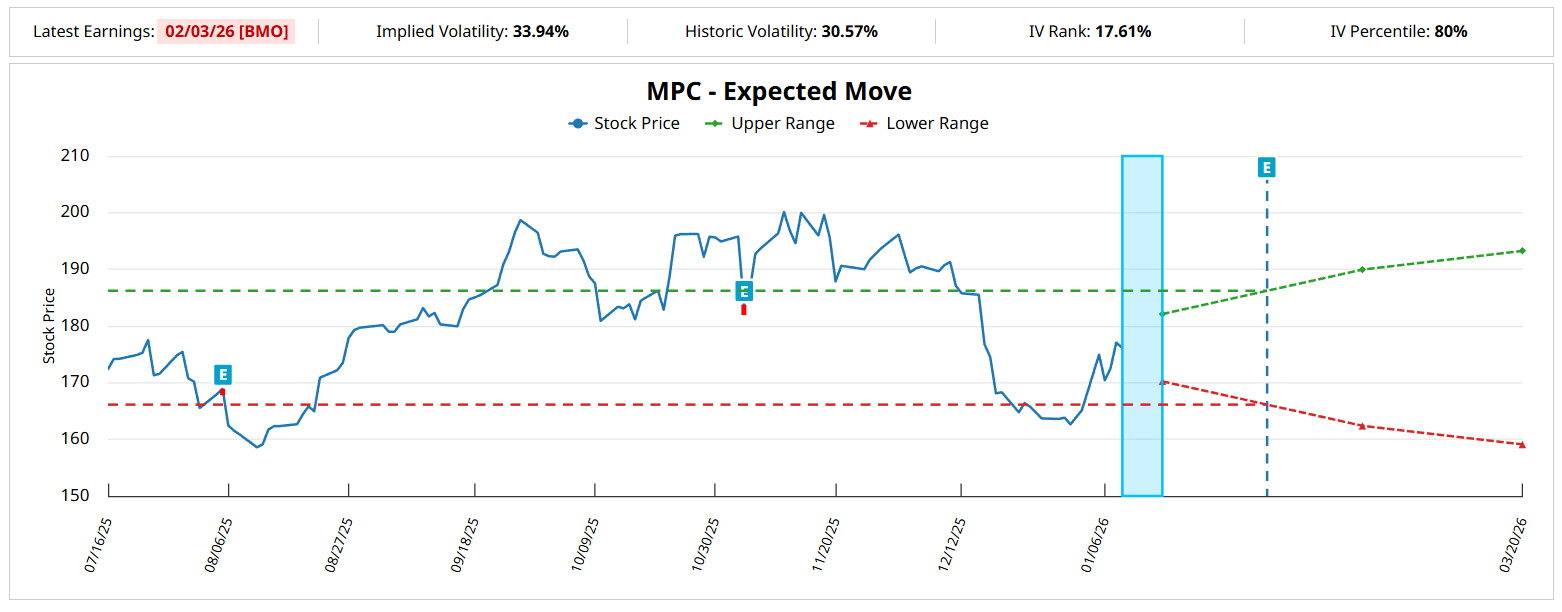

Looking at Marathon’s Expected Move calculator — a formulation derived from the Black-Scholes model — MPC stock shows a possible dispersion between $162.38 and $189.96 for the Feb. 20, 2026, expiration date. This projection helps to explain why the smart money optimists are targeting the $180 to $185 range.

Essentially, it’s aggressive but not too aggressive. However, the smart money could potentially be leaving money on the table.

Monotonic Risk Pricing for MPC Stock Might Be Inefficient

While Black-Scholes-derived calculations undergird options-related calculations, they force a worldview that might not necessarily be the most optimal for understanding a security’s true risk structure. Subsequently, it’s in this inefficiency that retail traders can potentially extract alpha.

Fundamentally, Wall Street uses models like Black-Scholes to price risk monotonically. This simply means that risk increases in proportion to distance away from the spot price. To use a sports analogy, a layup is easier to make than a three-pointer, mostly because you’re much closer to the basket when attempting the former over the latter.

However, during in-game situations, the path to the layup could be heavily defended. Under those circumstances, the open player standing outside the arc may offer the most probabilistically prudent shot attempt — even though they may be further away from the basket.

Roughly speaking, the probability of profit for MPC stock reaching $190 by the Feb. 20 expiration date is only about 26%. However, I’m looking at data that would seem to imply that this figure may be overly pessimistic.

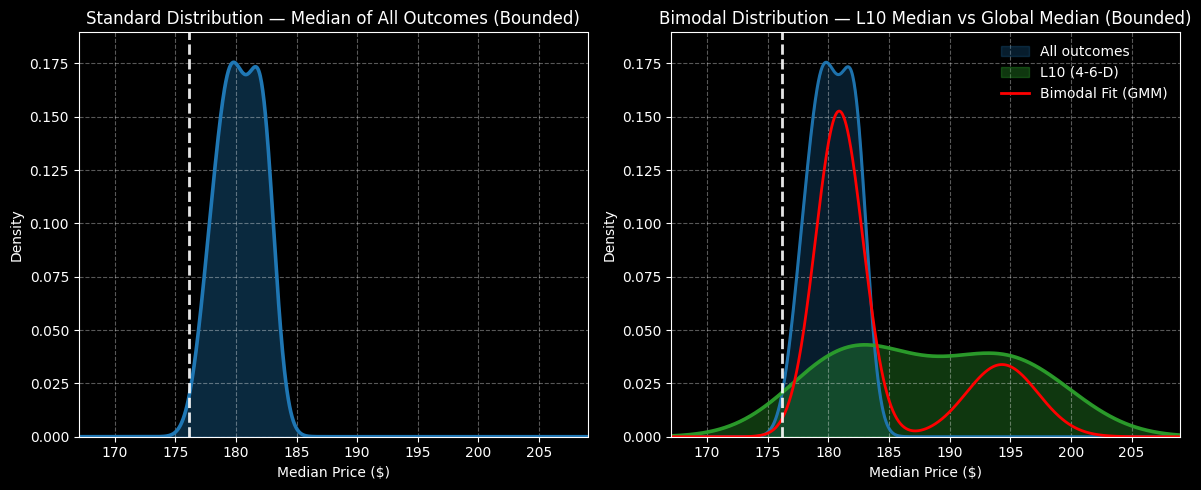

Looking at MPC stock hierarchically, a random 10-week return would typically land somewhere between $174 and $186 (assuming a spot price of $176.17, Friday’s close). Over many trials, MPC would terminate at the 10-week mark between $179 and $182.20. Therefore, it’s no surprise that Black-Scholes-derived formulas peg MPC hitting $190 as a low-probability affair.

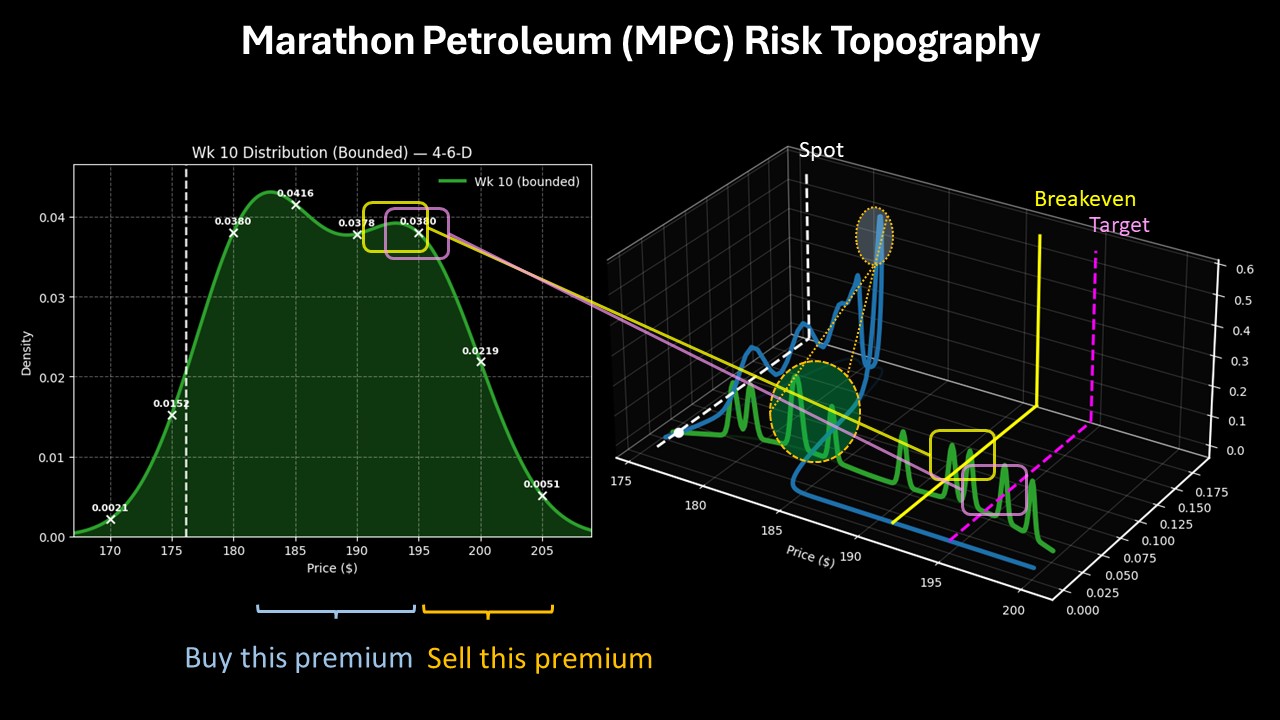

However, in the last 10 weeks, MPC stock printed only four up weeks, leading to an overall downward slope. Under this 4-6-D sequence, the typical response tends to be reflexively positive, with outcomes usually landing between $165 and $210. Moreover, probability density would likely stand at its peak between $180 and $195. What’s notable about this price range is the lack of probability decay across the entire period.

While it sounds kind of kooky at first, under 4-6-D conditions, the likelihood of MPC stock terminating between $180 and $195 over the next 10 weeks is relatively equal. Given the dramatic geopolitical events, there’s good reason for speculators to be more ambitious than usual.

Setting Up a High-Risk, High-Reward Wager

Thanks to Wall Street’s monotonic price modeling, the further away a strike price is from MPC stock’s spot of $176.17, the riskier the underlying (debit-based) trade. However, I’m arguing that greater distance alone doesn’t necessarily translate to a probabilistically lower chance of reaching profitability.

Still, market makers can’t just assign prices using unorthodox methodologies, which means that retail traders can attempt to exploit this potential inefficiency. In my opinion, the most tempting trading idea is the 190/195 bull call spread expiring Feb. 20. If MPC stock manages to rise through the $195 strike at expiration, the maximum payout would clock in at 233.33%.

Two factors help make this trade enticing. First, the breakeven price lands at $191.50, adding to the wager’s overall probabilistic credibility. Second, probability decay accelerates sharply beyond $195. Thus, by setting the second-leg strike here, the trade limits the possibility of incurring a hefty opportunity cost.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart