The lead story on financial television early Thursday morning was Denmark and its allies sending troops to Greenland, to stand up to a common enemy - the United States.

Meanwhile, crude oil cooled a bit based on the latest social media post by the US president.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.Gold hit a new all-time high Wednesday while silver extended its rally to a new market overnight through early Thursday morning.

Morning Summary: Steve Sedgwick, host of CNBC’s Squawk Box Europe, started today’s segment by saying he had to read the “nuttiest headline”: Denmark and its allies send troops to Greenland. He was absolutely correct. The members of NATO still considered allies against a common enemy: the United States. This after a meeting between the US administration, Denmark, and Greenland reportedly didn’t go well Wednesday. Meanwhile, the Cash Gold Index (GCY00) hit a new high of $4,642.74 yesterday, up $56 (1.2%) before slipping back through the close and seeing follow-through pressure overnight. Similarly, the Cash Silver Index (SIY00) posted a new high of $93.52 overnight but has dipped back into the red by $3.47 (3.7%) at this writing. Energies were in the red across the board with only the spot-month natural gas contract showing green after falling 10% yesterday. Lastly, the US dollar index ($DXY) was slightly firmer to start the day. The common theme is what it has been for the last decade: Global markets and governments continue to have to adjust to the loss of the US as a stabilizing force. As we can see in the long-term trends of the greenback and gold, the US is viewed as an unstable factor.

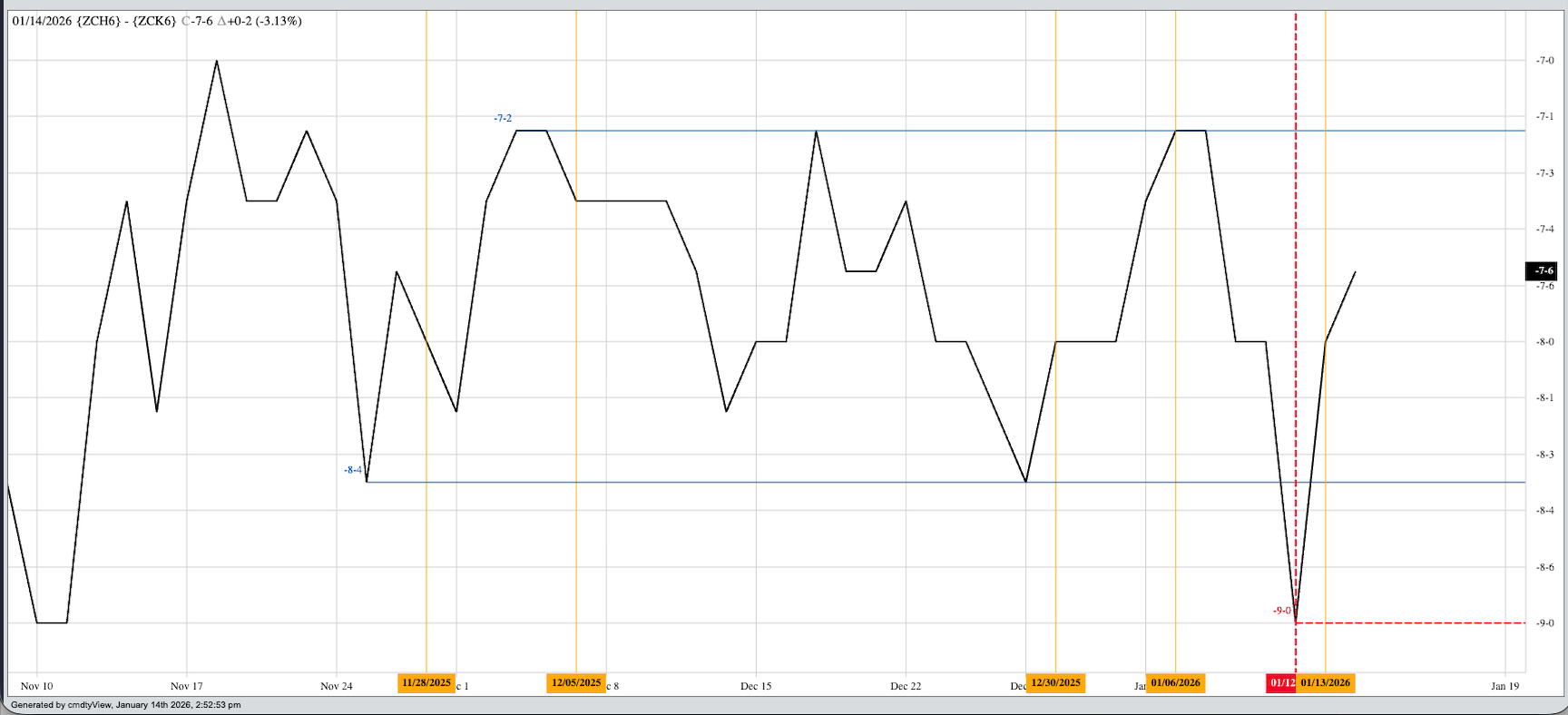

Corn: The corn market was quietly higher early Thursday morning. The March issue posted a 1.75-cent trading range, all of it above unchanged, and was sitting 1.75 cents higher, one tick off its session high while registering 15,000 contracts changing hands. Recall March closed yesterday at $4.22, up 2.25 cents for the day indicating Watson had started the new positioning week in a buying mood. The previous week, Tuesday to Tuesday, March closed 24.25 cents lower, due to this past Monday’s post-report meltdown of 24.75 cents. The question is if the noncommercial net-long futures position, last reported at 60,110 contracts, was erased through Tuesday’s close. Fundamentally, the corn market has grown more – bullish. Wednesday’s settlement saw the March-May spread cover 37% calculated full commercial carry while the May-July covered 30%. This is likely a reflection of bin doors being slammed shut following this week’s activity that put the National Corn Index ($CNCI) at $3.83, its lowest price since October 21. The Index was priced Wednesday night at $3.86, up 2.75 cents for the day meaning national average basis firmed. The latest calculation was 36.0 cents under March futures, as compared to the previous 5-year low weekly close for this week of 32.25 cents under March.

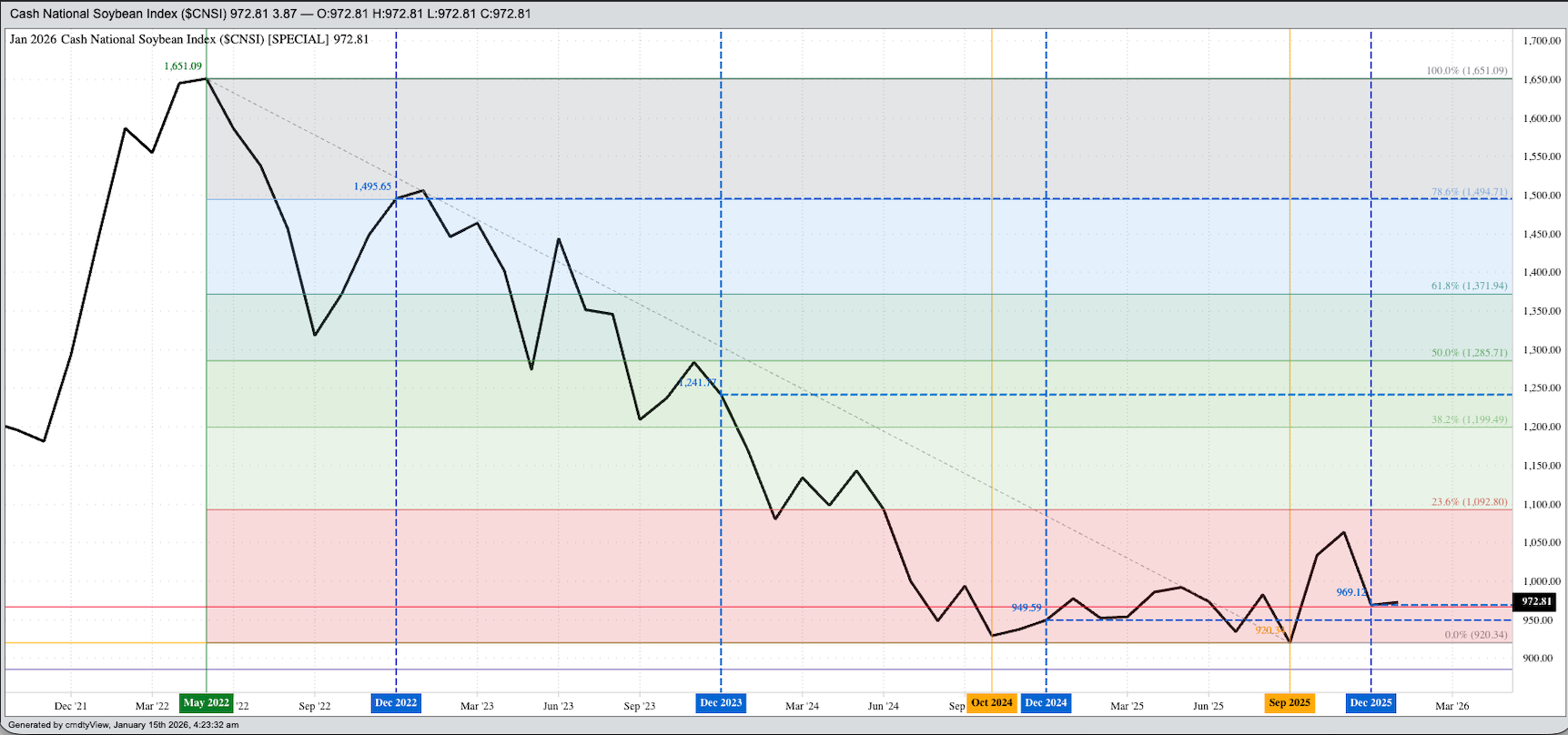

Soybeans: The soybean market was also quietly higher pre-dawn with the March issue up 1.5 cents on trade volume of about 10,000 contracts. A look back at Wednesday’s session, the first day of the new fund positioning week, and we see March rallied as much as 10.5 cents before closing 3.75 cents higher for the day. The previous week, Tuesday to Tuesday, saw March close 17.5 cents lower indicating funds were once again decreasing their net-long futures position, last reported at 104,770 contracts. Fundamentally, the National Soybean Index ($CNSI) was priced near $9.7275, up 3.75 cents for the day but still below its previous 5-year end of January low price of $9.78. Based on the Law of Supply and Demand, this tells us the US fundamental situation is more bearish than it has been over that same time frame. National average basis held at 69.75 cents under March futures as compared to the previous 5-year low weekly close for this week of 60.5 cents under March. Later this morning we’ll get the next round of weekly export sales and shipments numbers, for the week ending Thursday, January 8, with the focus on total sales (total shipments plus unshipped sales) to China and the marketing year pace projection for exports.

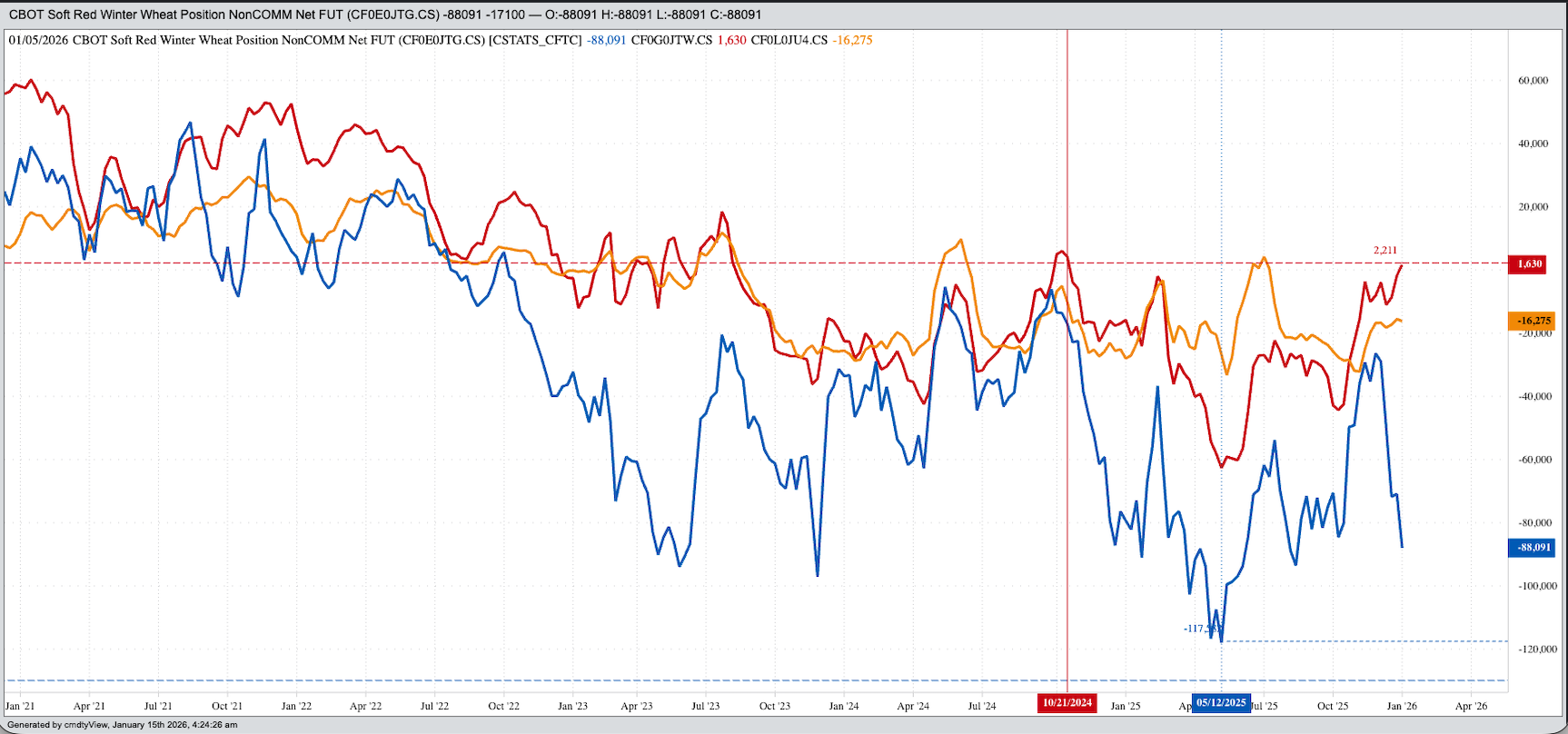

Wheat: The wheat sub-sector was mostly in the green to start the day as well, also on light overnight trade volume. The March HRW issue was up 3.0 cents at this writing and one tick off its session high on trade volume of 1,700 contracts. Similarly, March SRW was up 2.0 cents while registering 4,000 contracts changing hands with the nearby HRS issue sitting unchanged on trade volume of 60 contracts. We know US wheat fundamentals haven’t changed, with all three National Cash Indexes ($CSWI) ($CRWI) ($CRSI) running below previous 5-year end of January low prices. That hasn’t changed for months and is not expected to change anytime in the near future. This shifts the focus, at least partially, to the noncommercial side. Recall the latest Commitments of Traders report showed Watson had switched to a small net-long futures position in HRW, followed by the March issue closing the positioning week, Tuesday to Tuesday, with a loss of 2.0 cents. Was the net-long futures position erased? Was it being rebuilt as March closed 2.75 cents higher Wednesday? Time will tell. Meanwhile, Watson increased its net-short futures positions in SRW and HRS as of the previous update. As for today, we’ll have the next round of weekly export sales and shipments numbers to discuss.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart