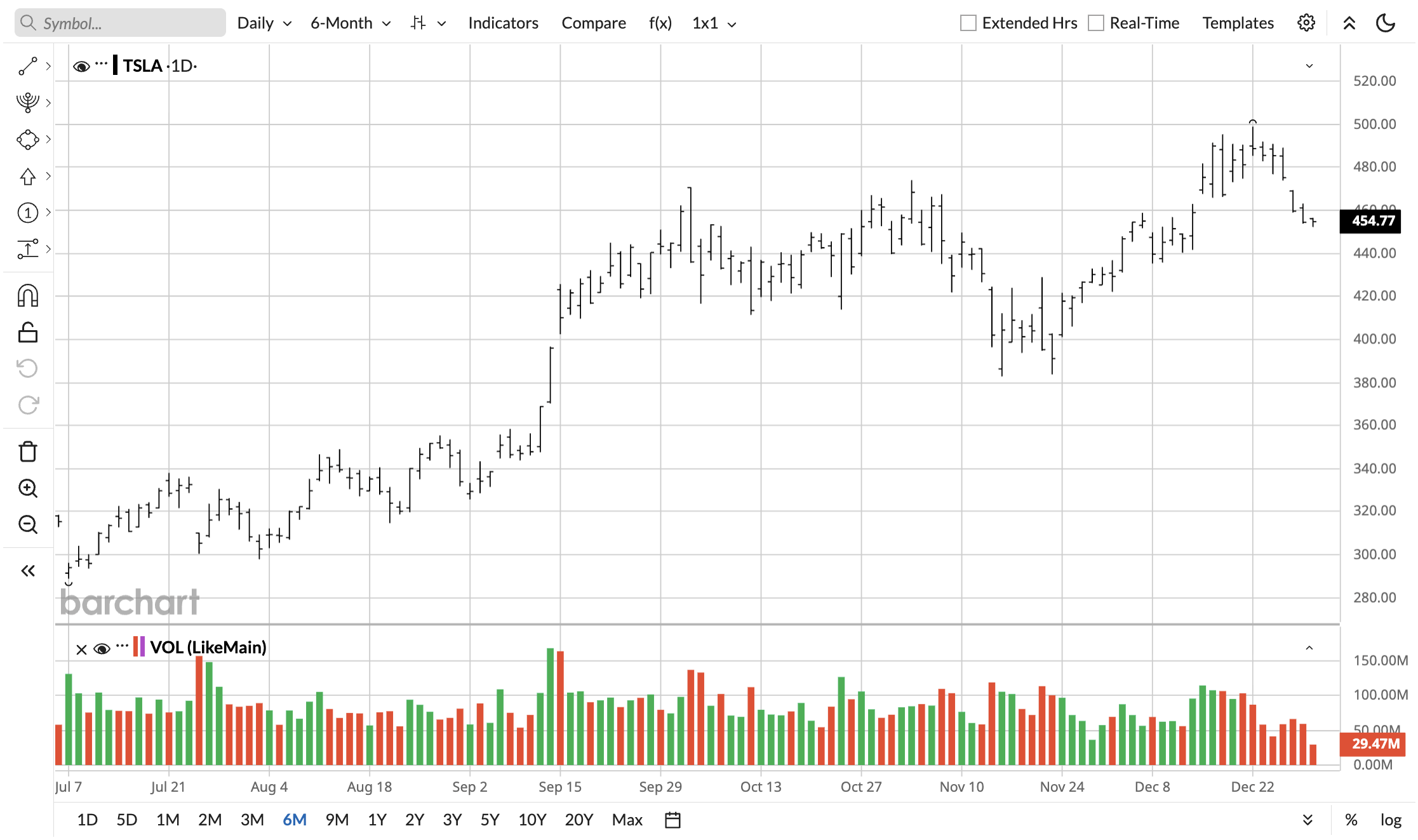

Tesla (TSLA) just reported Q4 2025 deliveries of 418,227 vehicles. This means a 16% year-over-year (YoY) drop against Q4 2024's 495,570 vehicle deliveries, at a time when bears and value investors have been up in arms about the premium you're paying for the stock.

Tesla's electric vehicle segment has been in a lull for multiple quarters now, and even successive interest rate cuts by the Federal Reserve have yet to have a substantial impact. Both delivery, growth, and margin figures have either stalled or declined in the past year.

Net income halved, and revenue flatlined in 2024, and 2025 was widely anticipated to be a recovery year. Unfortunately, the numbers are not cooperating with expectations.

Let's take a look at what this means for the stock.

Tesla's Dismal Q4 Delivery Figures

Ahead of the print, estimates called for Q4 deliveries to be down 15%. So it is not surprising that Wall Street is not taking kindly to the fact the real numbers were even worse. Demand has been dwindling worldwide for quite some time, and even U.S. demand is losing support after the $7,500 tax credit was eliminated.

Tesla's competitors in the EV market were already on their last legs in this segment. The consumers who did buy them did so because they did not want to buy a Tesla or were okay with spending more for a more different product. Thus, the disappearance of the tax credit didn't paradoxically help Tesla by wrecking competitors as expected.

What the Delivery Figures Mean

The “growth phase” of Tesla's EV segment is likely over and will never return to the 30-40% annual growth rates seen in earlier years.

It is now a maturing business that may actually lose out on profitability. EVs are on the back burner when it comes to the U.S. government's priorities. Internationally, many consumers are hostile to Tesla. Plus, administrations that start taking EVs seriously are unlikely to be chummy with Elon Musk at the same time.

All in all, I expect Wall Street to focus on margins and, more importantly, the non-auto businesses Tesla has.

Do the Delivery Figures Even Matter?

Tesla stock is down just 1% after reporting the bad news. If anything, one could argue that the -16% YoY figures are already baked into the stock. This is because investors are no longer pricing the company based on its EV segment's performance. Bulls have moved on to robotaxis and Optimus robots.

Both are far-flung prospects, but they are prospects nonetheless, and Wall Street is evidently buying the promise. The stock trades at an enormous 205 times forward earnings despite the subpar growth figures, as the hope is that cheap Optimus robots, Robotaxis, and FSD will transform the company into a multi-trillion behemoth.

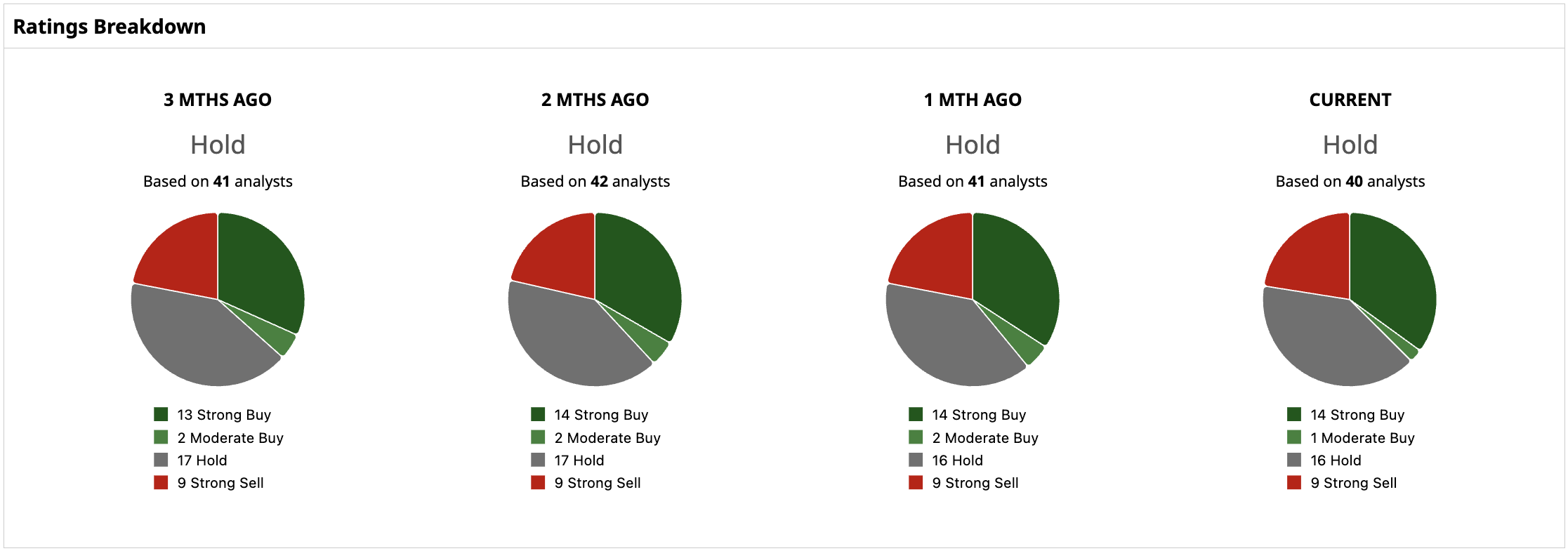

Numerous analysts have maintained “Buy” ratings on TSLA stock, but the overall consensus is still “Hold.”

As such, even a future delivery print showing -25% YoY figures may not translate into a big decline for Tesla. Analysts have their eyes somewhere else entirely, so I believe these delivery figures are already baked into the price.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is UnitedHealth Stock a Buy, Sell, or Hold for January 2026?

- Looking for the Next Berkshire Hathaway? Experts Are Circling In on This 1 Little-Known Stock

- Looking for the Big AI Winners of 2026? This Analyst Says Reddit Stock Should Top Your List.

- 1 Lesser-Known Stock Set to Steal the Spotlight in 2026