Southwest Airlines Co. (LUV) is a major passenger airline known for its extensive domestic network and near-international service. The company operates scheduled air transportation across the United States and to several nearby international destinations with a uniform fleet of Boeing 737 aircraft, while also offering ancillary services such as loyalty programs and online travel tools. Southwest is headquartered in Dallas, Texas, and has a market cap of around $21.5 billion.

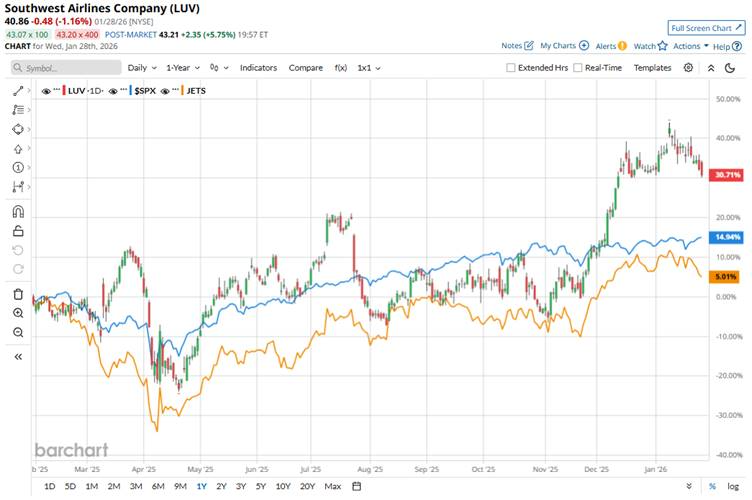

Shares of this leading airline company have outperformed the broader market over the past year. LUV has gained 28.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied about 15%. However, in 2026, LUV is down 1.1%, compared to the SPX’s 1.9% rise on a YTD basis.

Zooming in further, LUV has also outpaced the U.S. Global Jets ETF (JETS), which has gained about 6.4% over the past year and declined 1.4% this year.

Southwest Airlines’ stock rose and outperformed the broader market largely due to investor optimism around its strategic transformation aimed at boosting profitability, including new revenue initiatives like checked bag fees, basic-economy fares, and premium seating options. These changes, along with strong demand for air travel, improved operational performance and record revenues, helped lift confidence in the company’s turnaround plan.

In Q4 2025, Southwest reported record operating revenues of $7.4 billion, representing about a 7.4% year-over-year increase. For the full year 2025, the airline posted operating revenues of $28.1 billion, an increase of around 2.1% compared to 2024.

For the fiscal year 2026, analysts expect LUV’s EPS to rise 259.6% to $3.38 on a diluted basis. The company has beaten the consensus estimate in three of the last four quarters, while missing on one occasion.

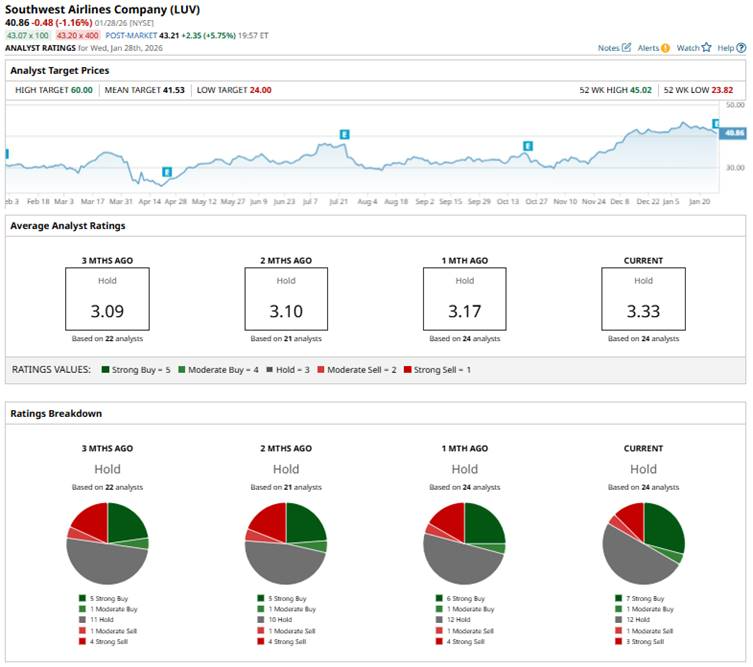

Among the 24 analysts covering LUV, the consensus is a “Hold.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” 12 “Holds,” one “Moderate Sell,” and three “Strong Sells.”

This configuration is more bullish than a month ago, when it had six “Strong Buy” ratings. Also, “Strong Sell” ratings have dropped compared to one month ago, when the count was four.

Recently, Jefferies raised its price target on Southwest Airlines to $45 from $42 while keeping a “Hold” rating. The firm highlighted Southwest’s completed fleet retrofit and the earnings potential from assigned seating and extended legroom.

The mean price target of $41.53 indicates an upside potential of 1.6%. The Street-high price target of $60 suggests an upside potential of as much as 46.8%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart