Popular footwear manufacturer Deckers Outdoor (DECK) has seen shares decline by almost 50% over the past 52 weeks. Just for comparison, the broader S&P 500 Index ($SPX) has gained 17% over the same period.

DECK stock's trajectory has been subdued as the company's famous UGG and HOKA brands face headwinds. There are concerns that UGG’s popularity is peaking after years of strong performance, while HOKA’s dominance in running shoes is approaching saturation. The company is also facing headwinds from tariff imposition as well as competing brands.

However, Deckers continues to report topline growth and a surge in profitability. So, does this pose a dip-buying opportunity for investors?

About Deckers Stock

Deckers Outdoor designs, markets, and distributes footwear, apparel, and accessories through a portfolio of popular brands including UGG, HOKA, and Teva. The company specializes in both lifestyle and performance products, leveraging innovation and consumer research to drive new designs and expand globally.

Its corporate headquarters are located in Goleta, California. In combining technical performance with everyday fashion, Deckers maintains a strong and growing position within the international footwear and lifestyle industry. The company has a market capitalization of $15.6 billion.

Despite falling 48% over the past 52 weeks, DECK stock somewhat recovered in the second half of last year. Over the past six months, it has gained marginally, and gained 4% over the past three months. Shares had reached a 52-week high of $223.98 in January 2025 but are currently down 52% from that level. However, DECK also reached a 52-week low of $78.91 in November and is up 34% from that level.

The selloff in Deckers stock has made it relatively cheap, especially compared to its peers. Its price-to-earnings ratio of 16 times is lower than the industry average.

Deckers’ Q2 Fiscal 2026 Results Were Better Than Expected

On Oct. 23, Deckers reported its second-quarter results for fiscal 2026. The company reported quarterly net sales of $1.43 billion, up 9.1% year-over-year (YOY) and exceeding the $1.41 billion that Wall Street analysts had expected. The company’s topline is primarily driven by the UGG and HOKA brands, which collectively accounted for more than 90% of Deckers’ net sales in the second quarter.

HOKA net sales increased by 11.1% YOY to $634.1 million, while UGG’s topline expanded by 10.1% from the prior-year period to $759.6 million. There was also significant international momentum behind these brands, as Deckers’ international net sales increased 29.3% YOY to $591.3 million.

The topline growth also translated into profitability gains. The company’s income from operations grew 7% YOY to $326.52 million. EPS increased 14.5% YOY to $1.82, surpassing the $1.58 figure that Street analysts had expected.

Despite the top- and bottom-line increases, DECK stock declined by 15% intraday on Oct. 24. This is because investors showed concern about the company’s subdued projections.

For fiscal 2026, net sales are expected to be approximately $5.35 billion, with HOKA increasing by a low-teens percentage YOY and UGG growing in the low-to-mid single-digit range. Deckers also anticipates a gross margin of about 56%, as its operations continue to be affected by tariffs, with the impact becoming material in the back half of the fiscal year.

Wall Street analysts have a mixed view about Deckers’ bottom-line trajectory. For the fiscal third quarter, EPS is expected to drop by 8% YOY to $2.76. On the other hand, for fiscal 2026, EPS is projected to increase by 1.3% annually to $6.41, followed by a 7% increase to $6.82 for fiscal 2027.

What Do Analysts Think About DECK Stock?

Despite the underperformance, Wall Street analysts have not completely turned away from DECK stock. Last month, Guggenheim analyst Simeon Siegel initiated coverage of the stock with a “Neutral” rating. While the retail sector shows signs of sickness, the holiday season has breathed new life into it, and the impact of the tariffs has been manageable so far.

In November, analysts at Stifel upgraded DECK stock from “Hold” to “Buy” while keeping the price target at $117. Stifel cited management’s confidence in the growth prospects of the HOKA brand and a favorable demand-supply environment for UGG.

Following the company’s Q2 earnings report, Barclays analyst Adrienne Yih reduced DECK stock’s price target from $141 to $113. However, the analyst also maintained a bullish “Overweight” rating.

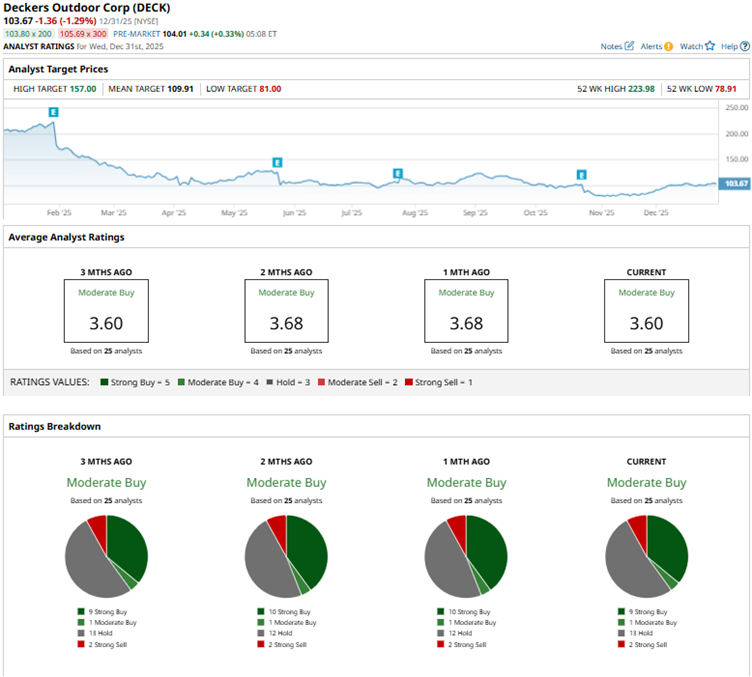

Wall Street analysts remain bullish on DECK stock, assigning it a consensus “Moderate Buy” rating. Of the 25 analysts rating the stock, nine rate it a “Strong Buy,” one has a “Moderate Buy,” 13 have a “Hold,” and two offer a “Strong Sell" rating. The consensus price target of $109.91 represents 3% potential upside from current levels. Meanwhile, the Street-high price target of $157 indicates 48% potential upside from here.

Key Takeaways

Deckers continues to report strong results and sales growth. Moreover, the company appears to be quite popular overseas. As Wall Street analysts remain bullish on the stock and the company continues to mitigate the impact of tariffs, DECK may be worth investing in now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart