Atlanta, Georgia-based PulteGroup, Inc. (PHM) engages in the homebuilding business. Valued at $27.4 billion by market cap, the company sells and constructs homes, and purchases, develops, and sells residential land and develops active adult communities. PHM also provides mortgage financing, title insurance, and other services to home buyers.

Shares of this homebuilding giant have outperformed the broader market over the past year. PHM has gained 33.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.8%. In 2026, PHM stock is up 21.6%, surpassing the SPX’s marginal fall on a YTD basis.

Zooming in further, PHM’s outperformance is also apparent compared to the SPDR S&P Homebuilders ETF (XHB). The exchange-traded fund has gained about 14.5% over the past year. Moreover, PHM’s gains on a YTD basis outshine the ETF’s 17.9% returns over the same time frame.

PulteGroup's performance was driven by strong demand in the Midwest, Northeast, and Florida, offsetting weakness in Texas and Western markets. The company's Del Webb communities saw an increase in active adult sign-ups, generating the highest gross margins. To adapt to softer demand, PulteGroup increased sales incentives and is shifting towards built-to-order homes. Management is optimistic about the spring 2026 selling season due to improved affordability and lower mortgage rates.

On Jan. 29, PHM shares closed up more than 3% after reporting its Q4 results. Its adjusted EPS of $2.88 exceeded Wall Street expectations of $2.78. The company’s revenue was $4.6 billion, beating Wall Street forecasts of $4.3 billion.

For the current fiscal year, ending in December, analysts expect PHM’s EPS to decline 11.6% to $10.11 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

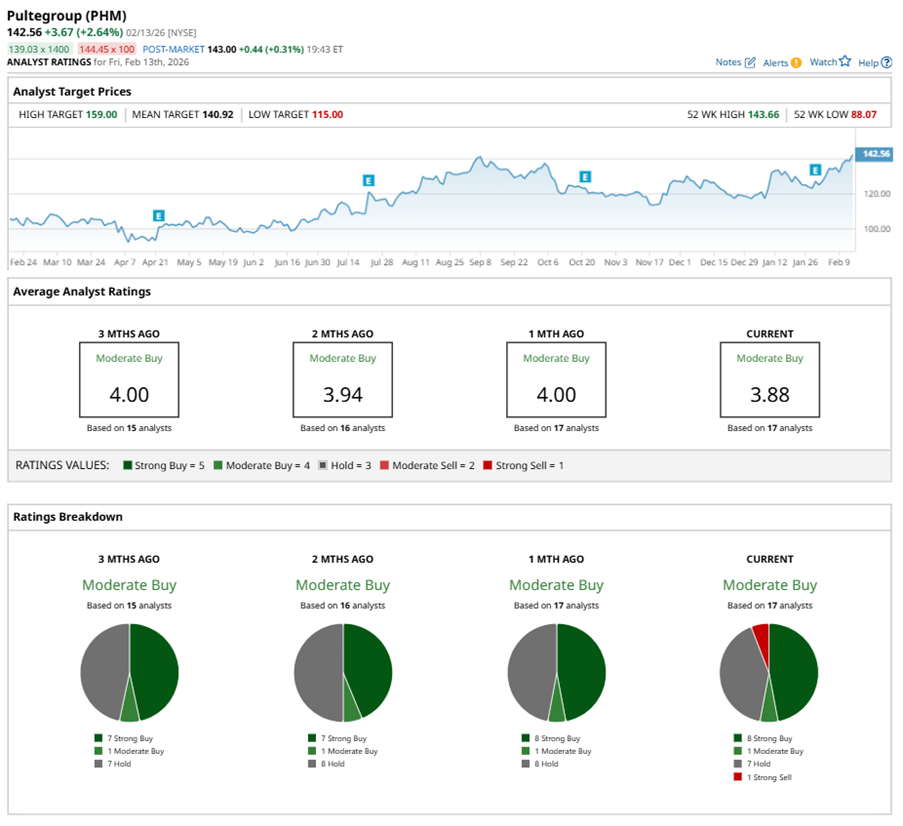

Among the 17 analysts covering PHM stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” seven “Holds,” and one “Strong Sell.”

This configuration is more bullish than two months ago, with seven analysts suggesting a “Strong Buy.”

On Feb. 3, Raymond James Financial, Inc. (RJF) kept an “Outperform” rating on PHM and raised the price target to $145, implying a potential upside of 1.7% from current levels.

While PHM currently trades above its mean price target of $140.92, the Street-high price target of $159 suggests an upside potential of 11.5%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart