Florida-based Jabil Inc. (JBL) operates as a key manufacturing and engineering partner to many of the world’s leading brands, delivering end-to-end solutions across product design, supply chain management, and advanced manufacturing. With more than 50 years of industry experience and a global network spanning over 100 sites, the company blends international scale with localized expertise to provide both highly customized and scalable solutions.

With a market capitalization of about $27.2 billion, shares of this tech company have performed quite well on Wall Street. Over the past year, the stock has soared roughly 51%, significantly outperforming the S&P 500 Index ($SPX), which climbed 11.8% during the same stretch. The strength hasn’t faded in 2026. Shares are up 11.7% year to date, even as the broader index has slipped modestly.

A closer examination of sector performance makes the outperformance even more pronounced. The stock has comfortably beaten the Technology Select Sector SPDR Fund (XLK), which returned 16.7% over the past year and is down 3.1% so far in 2026, underscoring its leadership within the tech space.

After delivering a solid performance in 2025, Jabil has carried that strength straight into 2026. The momentum peaked on Feb. 12, when the stock surged to a record high of $269.17, a clear sign that investors are increasingly confident in the company’s strategic direction.

One of the key catalysts came on Jan. 20, when Jabil announced a manufacturing partnership and strategic minority investment in Eagle Harbour Technologies (EHT Semi). The alliance blends EHT Semi’s cutting-edge RF and pulsed-power technologies with Jabil’s global manufacturing expertise, aiming to enhance plasma stability, precision, and yields in advanced semiconductor production.

Looking forward to the fiscal year ending in August 2026, analysts expect JBL’s EPS to rise 19.5% year-over-year to $10.62. Encouragingly, Jabil has consistently outperformed expectations. The company has beaten consensus EPS estimates in each of the last four quarters, underscoring its track record of steady performance.

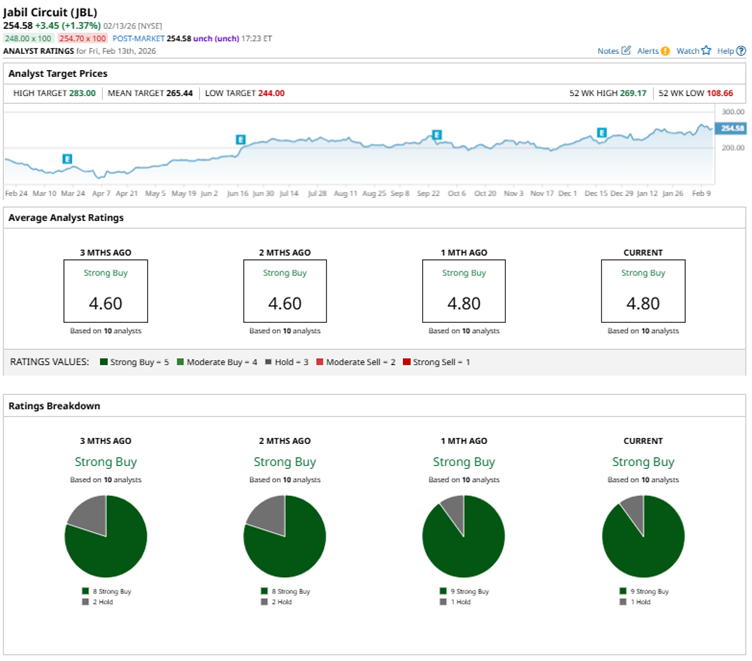

Wall Street’s confidence in Jabil continues to build. The stock currently carries a consensus “Strong Buy” rating, reflecting overwhelming optimism from analysts. Of the 10 covering the name, nine recommend “Strong Buy,” while just one remains on the sidelines with a “Hold.” Notably, sentiment has strengthened in recent months. The tally of “Strong Buy” ratings has climbed to nine from eight just two months ago, a clear sign that analysts are growing even more constructive on JBL’s outlook.

Last month, BofA reiterated its “Buy” rating on Jabil and lifted its price target to $280 from $265, citing strong demand in the company’s Intelligent Infrastructure business. The mean price target of $265.44 represents a premium of 4.3% to JBL’s current levels, while the Street-high price target of $283 implies a potential upside of 11.2% from the current price levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart