Fears of an artificial intelligence bubble are continuing to roil the markets; while AI was one of the biggest drivers in the stock market over the last three years, leading to a long bull market in the S&P 500 ($SPX), AI stocks are struggling in 2026. Meanwhile, energy and consumer stocks are getting more action as investors shift some of their dollars away from AI.

Renaissance Technologies is among those moving money around. The hedge fund reduced its exposure to Nvidia (NVDA) in the fourth quarter from 5.63 million shares to fewer than 900,000. The fund also completely exited its stake in Meta Platforms (META), and cut its Alphabet (GOOG) (GOOGL) shares from 2.61 million to just 296,000.

Among its purchases were Costco Wholesale (COST), the warehouse-style retailer that sells everything from groceries to electronics, according to its 13F filing. Renaissance increased its position from 13,024 shares to 693,000 shares in the fourth quarter.

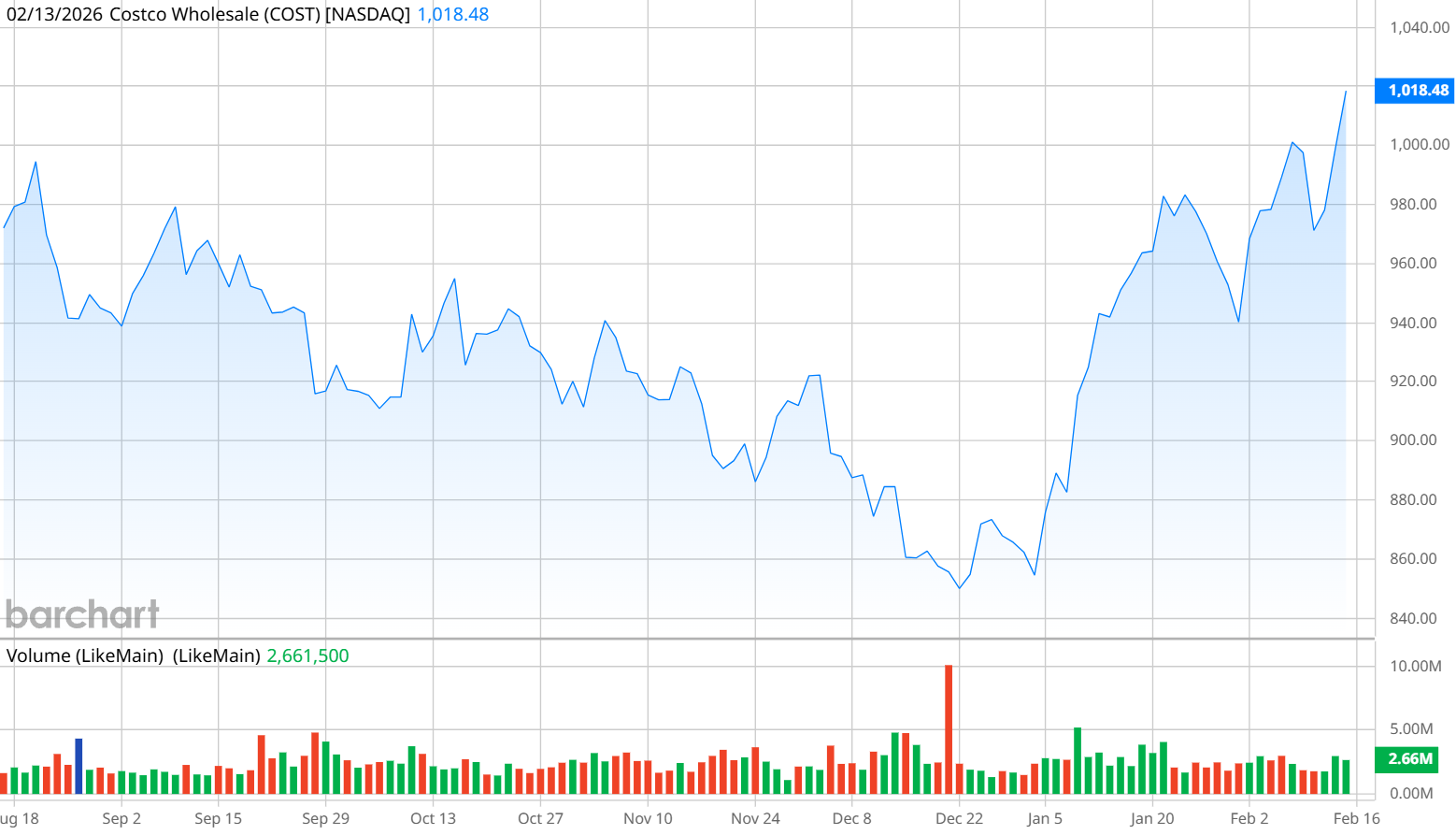

COST stock is off to a strong start in 2026, up more than 18% as it continues to open new locations and drives higher engagement on its website and app. Should investors be giving Costco a second look right now? Let’s dive in.

About Costco Stock

Costco is a warehouse-style retailer based in Washington state. The company’s business model is to utilize the power of bulk purchasing and reduced handling of merchandise to offer lower prices than other retailers. Costco’s no-frills warehouses are open only to members, which promotes exclusivity and provides Costco with an additional revenue stream through membership fees.

Despite the run-up in Costco stock so far this year, shares are still down 5% over the last 12 months, far below the 12% gain of the S&P 500 over the same period. Costco also badly trails its most direct competitor, Walmart (WMT), which operates Sam's Club retail warehouses. WMT stock is up nearly 30% in the last year.

COST stock is also expensive according to its valuation. The forward price-to-earnings ratio of 50.1 is higher than its five-year mean of 44.8. Buying Costco today means you are paying a premium.

The stock pays a quarterly dividend of $1.30, which sounds good on the surface. But considering Costco’s share price is over $1,000, the yield on Costco stock is only 0.5%.

Costco Beats on Earnings

Costco’s earnings for the first quarter of fiscal 2026 (ending Nov. 23, 2025), included revenue of $67.31 billion, up 8.2% from a year ago. Earnings per share were $4.50, versus analysts’ expectations of $4.27 per share.

The company attributed the solid quarter to improved e-commerce performance, with digital sales up 20.5% from a year ago. Costco said that website traffic was up 24% from last year, and users of its app increased by 48%.

Costco saw particular success in its same-day delivery service offered through Instacart (CART) in the U.S., and DoorDash (DASH) and Uber (UBER) in international markets. Management said that sales fulfilled by those partners increased at a rate faster than overall digital sales.

The company announced that it opened eight new warehouses in the quarter, bringing its global count to 921 locations, and has plans to open 30 or more locations per year in the future. “We continue to see improvements in the performance of our new buildings and a reduction in their time to maturity,” CEO Ron Vachris said. “With fiscal year 2025 openings generating an annualized $192 million per warehouse of sales in the year of opening, that is up from $150 million for new warehouses opened just two years earlier.”

Costco did not issue full-year guidance. The company is scheduled to post Q2 earnings on March 5.

What Do Analysts Expect For COST Stock?

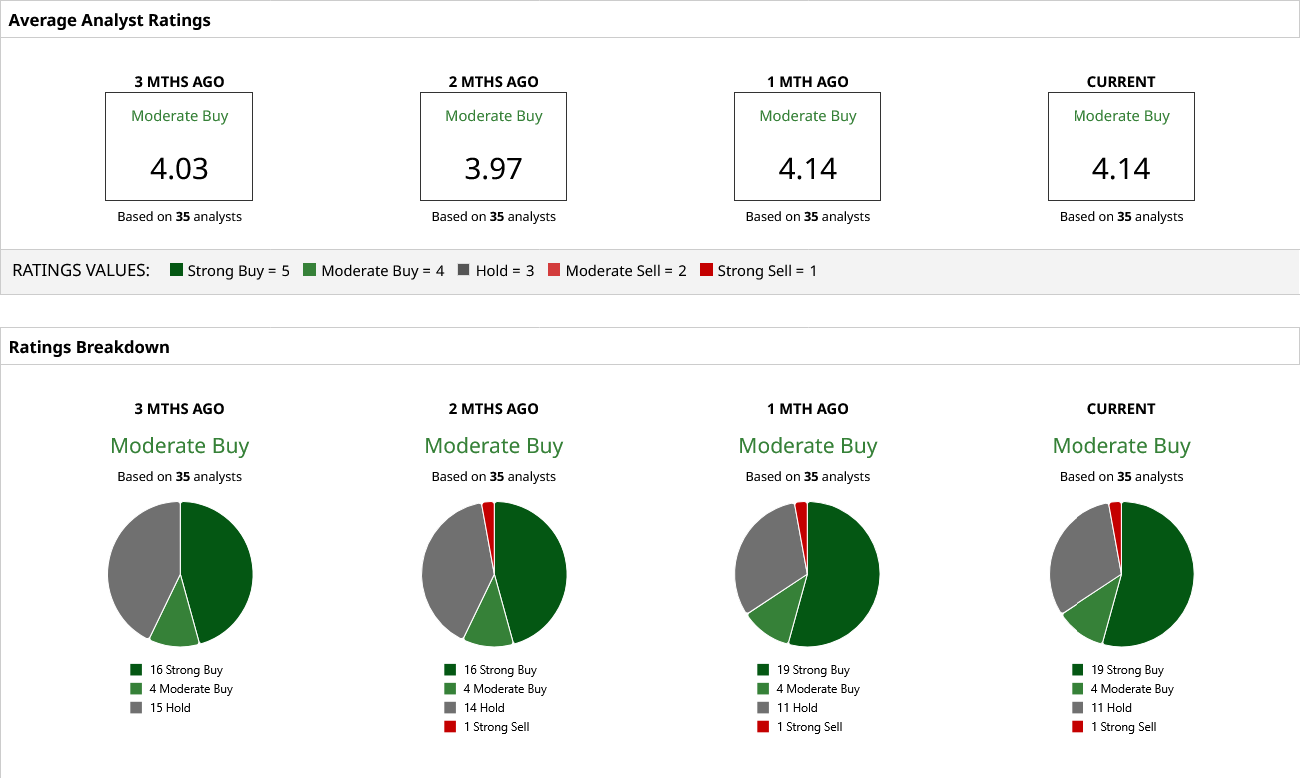

Despite Costco’s one-year stock performance and frothy valuations, analysts are very bullish on the stock right now. Of 35 analysts covering COST stock, only one has a “Sell” rating, while 23 have “Buy” ratings, and the rest suggest holding.

The mean price target of $1,061 suggests only a 4.2% increase in the near future, with the high target of $1,205 hinting toward an 18% gain. The low target of $769 warns of a possible drop of nearly 45%.

While analysts look approvingly at COST stock, the recent run-up in price doesn’t leave much room for gains at Costco’s current value. Should the company manage to continue its strong performance in the Q2 earnings report, investors may see analysts revise their predictions upward. For now, Costco warrants attention, but it may be too highly priced right now for investors to see significant profits.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Microsoft Bets on ‘True Self-Sufficiency,’ Should You Bet on MSFT Stock?

- Don’t Fall for False Buy Signals! How to Find Better Trade Entries

- You May Never Have Heard of Corsair Gaming But Its Stock Just Jumped 50%. Should You Buy Shares Here?

- 1 High-Yield Dividend Stock Riding the Clean Energy Wave