CrowdStrike (CRWD) shares have inched higher in recent sessions on the back of a high-profile analyst upgrade and a strategic expansion into the consumer market (NordVPN deal).

The cybersecurity firm now looks headed to challenge its 20-day moving average (MA) at the $434 level. A decisive break above that price could further accelerate upward momentum in the near term.

While CrowdStrike stock has already gained some 14% since Feb. 5, HSBC sees it pushing higher still through the remainder of 2026.

Why HSBC Recommends Buying CrowdStrike Stock

HSBC analysts upgraded CRWD stock last week, saying the company’s cloud-native architecture makes it a mission-critical leader in artificial intelligence (AI)-driven threat detection.

The investment firm noted multiple paths for continued growth, including CrowdStrike’s ability to continuously ingest signals across its entire customer base to improve its machine learning models.

According to HSBC’s research report, the Austin-headquartered company could more than double its total addressable market (TAM) to roughly $250 billion within four years.

Note that CRWD’s relative strength index (14-day) sits at about 47 only, signaling its recent upward momentum is miles away from exhaustion.

What To Expect From CRWD Shares After Earnings

CrowdStrike shares are worth buying also on its latest landmark agreement with NordVPN, which extends the firm’s reach from enterprise and government clients into the mass consumer market.

Moreover, its Falcon Flex subscription model that reduces procurement friction is growing at an incredible 200% year-over-year, already accounting for more than $1.35 billion ARR.

In the near term, CRWD’s quarterly earnings on Mar. 3, could provide a major boost. Consensus is for the cybersecurity firm to earn $0.20 a share in Q4 — up a whopping 500% versus last year.

Options traders are currently pricing in a 9.99% move after earnings, which means CrowdStrike could be trading at nearly $473 in early March.

Wall Street Remains Bullish on CrowdStrike Holdings

Despite the upgrade, HSBC remains one of the more conservative Wall Street firms on CrowdStrike Holdings.

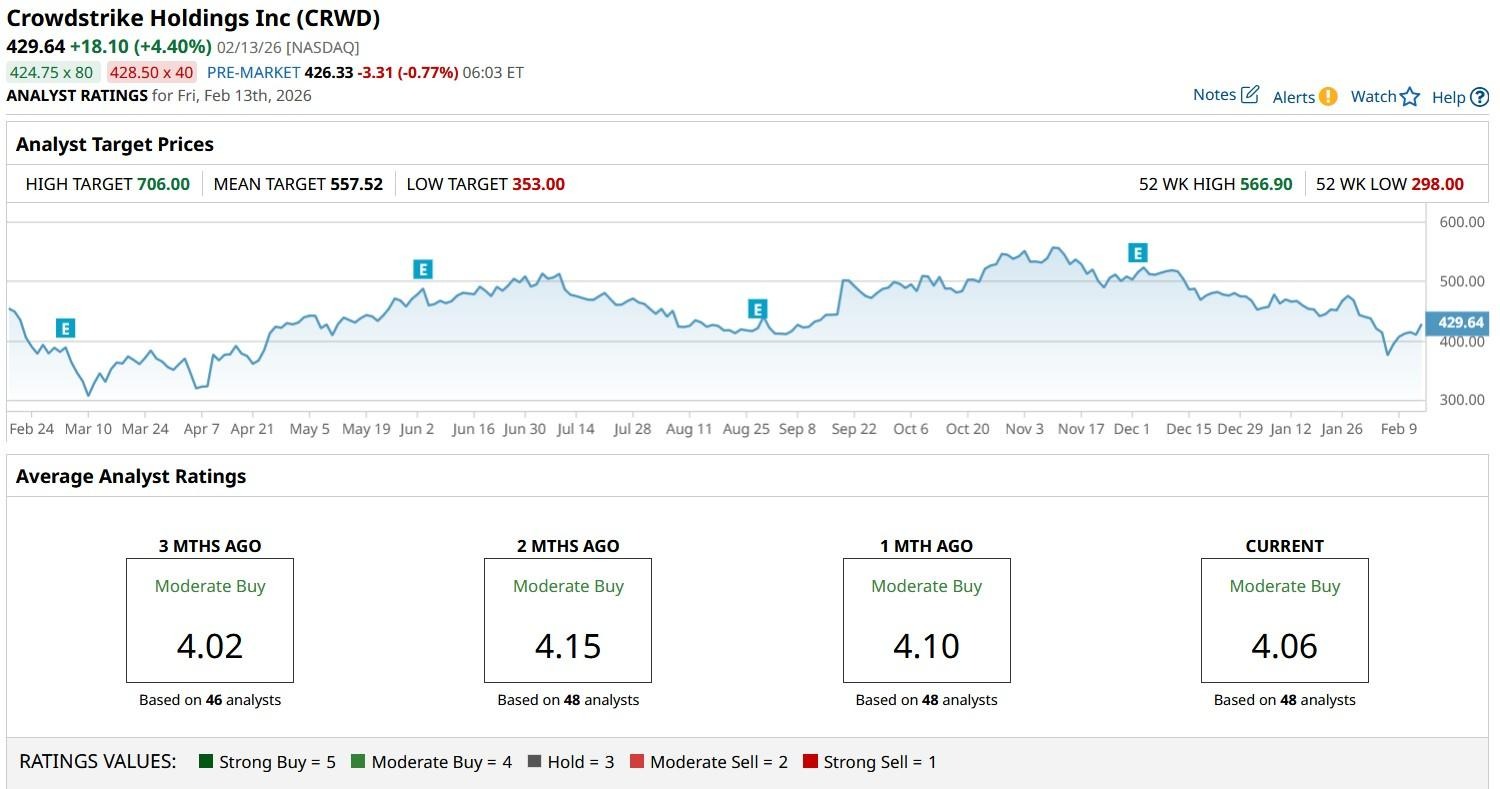

According to Barchart, the consensus rating on CRWD shares sits at “Moderate Buy,” with price targets as high as $706, suggesting potential upside of more than 60% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Chase the Monster Memory Rally in Kioxia Stock?

- AI Stocks Are in Trouble: Is This Just a Pullback or the Start of a Bear Market?

- As This Hedge Fund Sells NVDA , GOOGL, and META, Here Is 1 Blue-Chip Stock It’s Loading Up On

- DraftKings Stock Is Oversold on Earnings Plunge. Should You Buy the Dip?