With a market cap of $28.8 billion, Cboe Global Markets, Inc. (CBOE) is a global exchange operator providing trading, clearing, and market data services across options, equities, futures, FX, and digital assets in the United States and internationally. It operates a diversified platform spanning North America, Europe, and Asia Pacific, with strategic partnerships with leading index providers such as S&P Dow Jones Indices, FTSE Russell, and MSCI.

The holding company's shares have outperformed the broader market over the past 52 weeks. CBOE stock has increased 32.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. Moreover, shares of the company are up 9.6% on a YTD basis, compared to SPX’s marginal decline.

Looking closer, shares of the Chicago, Illinois-based company have also outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) slight rise over the past 52 weeks.

Cboe Global Markets reported better-than-expected Q4 2025 adjusted EPS of $3.06, and net revenue of $671.1 million on Feb. 6. The company delivered strong profitability, with operating income up 35% to $403.8 million, net income rising 60% to $312.2 million, and standout performance in the Options segment, where revenue climbed 34% to $433.1 million driven by higher trading volumes. However, the stock fell marginally on that day.

For the fiscal year ending in December 2026, analysts expect CBOE’s adjusted EPS to grow 6.5% year-over-year to $11.36. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

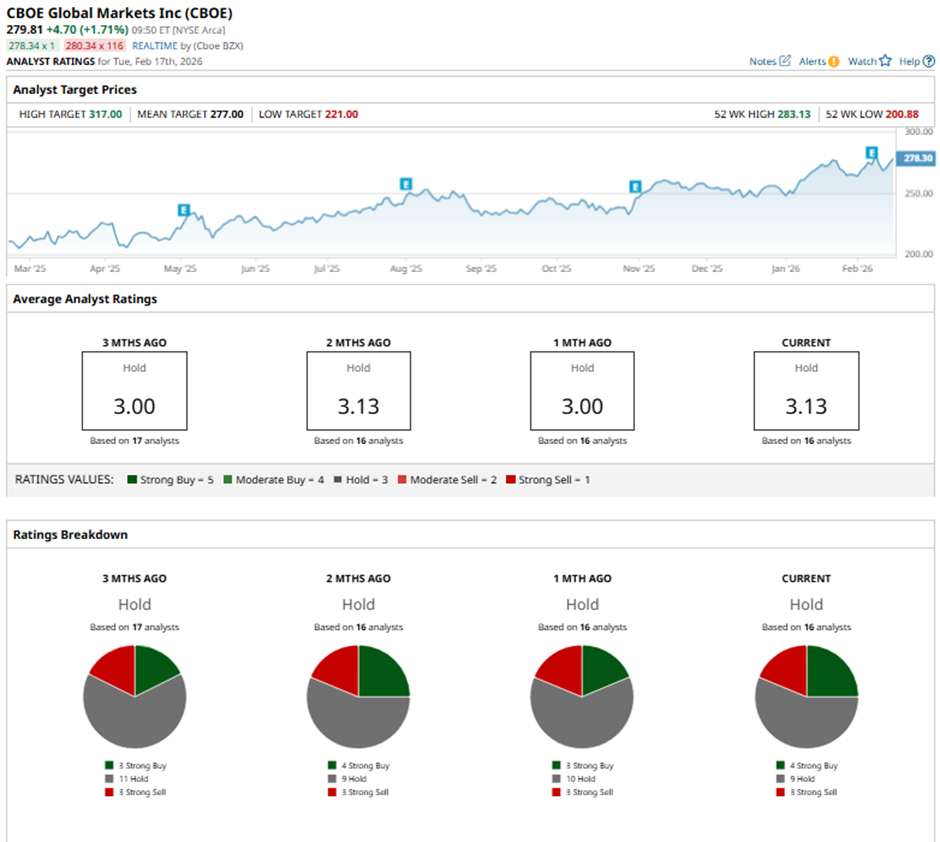

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, nine “Holds,” and three “Strong Sell.”

On Feb. 9, Barclays analyst Benjamin Budish raised the price target on Cboe Global Markets to $317 and reiterated an “Overweight” rating.

As of writing, the stock is trading above the mean price target of $277. The Street-high price target of $317 implies a potential upside of 13.3% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart