Gaming and PC hardware stocks don’t usually grab headlines the way AI megacaps do, but every so often, a forgotten name reminds investors how fast sentiment can change. After spending much of last year out of favor amid a choppy PC cycle, some niche tech stocks are suddenly back in play as demand pockets re-emerge and valuations reset to compelling levels.

One such surprise winner is Corsair Gaming (CRSR). The little-known maker of PC gaming components and peripherals shocked the market last Friday when its stock surged roughly 50% in a single session following a blowout fourth-quarter earnings report and the announcement of its first-ever share buyback.

With CRSR rebounding sharply from multi-year lows, investors are now asking an important question: Is this just a short-term momentum spike, or the start of a more durable turnaround worth buying into today?

About CRSR Stock

Corsair Gaming designs and sells PC gaming and streaming hardware. Its “Components and Systems” division covers pre-built gaming PCs, power supplies, cases, liquid coolers, and performance memory, e.g., Vengeance RAM. Its “Peripherals” segment includes gaming keyboards, headsets, controllers, and Elgato streaming devices. Corsair sells to gamers and content creators worldwide.

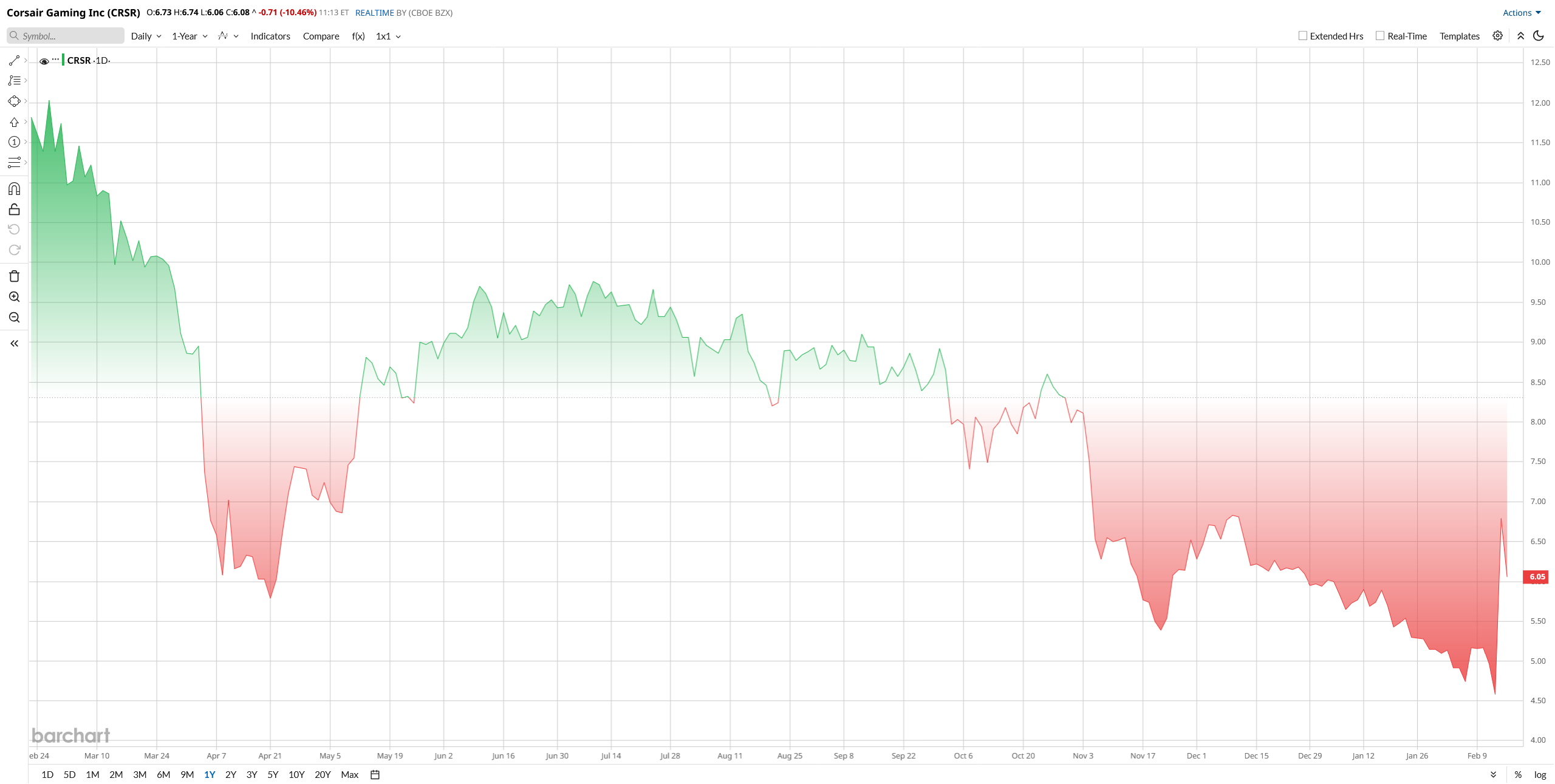

Corsair's shares have been volatile lately. Early last year, the stock climbed as PC hardware demand remained healthy, but it later drifted lower amid broader weakness across the technology sector. Over the past 52 weeks, shares have plunged about 50%. However, after a sharp 50% rally last week, the stock has been able to recover some of those losses and is now up roughly 5% year to date (YTD).

Additionally, CRSR stock has been deeply out of favor with investors. On a trailing basis, the shares trade at roughly 13.9 times earnings and about 1.0 times book value, well below most technology peers, many of which command 20 to 30 times earnings and 2 to 4 times book, which shows Corsair looks inexpensive relative to its long-term growth potential.

Corsair Gaming Q4 Earnings Spark a Violent Rally

The massive rally was sparked by Corsair Gaming’s Feb. 12 fourth-quarter earnings report, which handily beat analyst expectations and triggered aggressive buying. In after-hours trading, the stock jumped about 25% and extended those gains to roughly 48% soon after. The surge pushed Corsair’s market capitalization above $600 million, signaling renewed investor optimism and instantly shifting the stock from laggard to leader, though its higher valuation now faces closer scrutiny. The move followed strong results, including Q4 revenue of approximately $436.9 million, up 6% year-over-year (YoY); earnings of $0.43 per share; and the announcement of Corsair’s first-ever $50 million share-repurchase program.

Beyond the headline numbers, the rally materially strengthened Corsair’s financial flexibility. A higher share price gives management added “dry powder” to invest in growth initiatives, weather industry downturns, and pursue future financing on more favorable terms.

Management also pointed to improving fundamentals. Margins benefited from favorable memory pricing and continued cost reductions, with CEO Thi La citing “significant progress on the strategy.” For full-year 2025, revenue climbed 12% to $1.47 billion, while adjusted EBITDA surged 80% to $100 million.

Cash generation remained strong, with Corsair adding $33 million in Q4, building inventory to meet demand, and paying down more than $50 million of debt during the year. By quarter-end, cash and cash equivalents exceeded $284 million, well above prior-year levels.

Corsair Advances Strategy Amid Challenges

Corsair Gaming has also been executing strategically within its niche. The company recently named Michael Potter as CFO to push recurring revenue, opened its first retail store in Santa Clara, and lifted direct-to-consumer sales to 20% of revenue.

Additionally, new product launches and profitable memory pricing helped results, though management warned of semiconductor constraints and a roughly $12 million tariff headwind in 2026.

What Do Analysts Say About CRSR Stock?

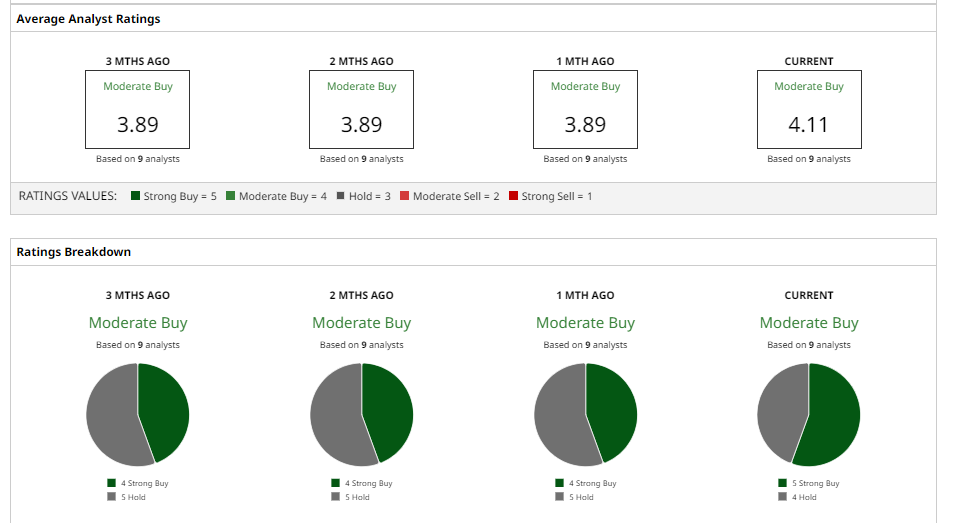

Wall Street’s views on Corsair had been lukewarm entering this quarter. Analysts generally saw Corsair as a turnaround play, with a consensus “Buy” rating with a mean price target of $8.31, which suggests a 37% upside potential.

For example, B. Riley raised its 12-month target to $7 on the Q4 beat. Barclays maintained a “Buy” rating but cut its target to $8.

By contrast, Goldman Sachs and Morgan Stanley have not covered Corsair recently. Before the quarter, analysts expected $423 million in revenue, so the results exceeded those hopes.

In their notes, analysts emphasize the mix: Barclays noted the memory windfall but remains cautious about 2026 supply constraints. B. Riley pointed to the robust margin beat. Piper Sandler (Hold, $7 PT) and Jefferies (Buy, ~$12 PT) have differing views: some see upside if peripherals boom, others worry about cycles.

Overall, the recent upbeat results have led a few to raise their targets and labels; e.g., TipRanks noted a new “Buy” from Craig-Hallum with an $8 price target, but most are still waiting to see if new sales traction continues.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart