Diego, California-based ResMed Inc. (RMD) develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders. It is valued at a market cap of $37.3 billion.

This healthcare company has outperformed the broader market over the past 52 weeks. Shares of RMD have rallied 12.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.9%. Moreover, on a YTD basis, the stock is up 8.3%, compared to SPX’s marginal drop.

Zooming in further, RMD has also outpaced the iShares U.S. Medical Devices ETF (IHI), which declined 8% over the past 52 weeks and 5% on a YTD basis.

On Jan. 29, shares of RMD closed down marginally after its Q2 earnings release, despite posting better-than-expected results. The company’s revenue increased 11% year-over-year to $1.4 billion, surpassing consensus estimates by 2.2%. On the earnings front, its adjusted EPS of $2.81 advanced 15.6% from the year-ago quarter, topping analyst expectations of $2.69.

For fiscal 2026, ending in June, analysts expect RMD’s EPS to grow 14.9% year over year to $10.97. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

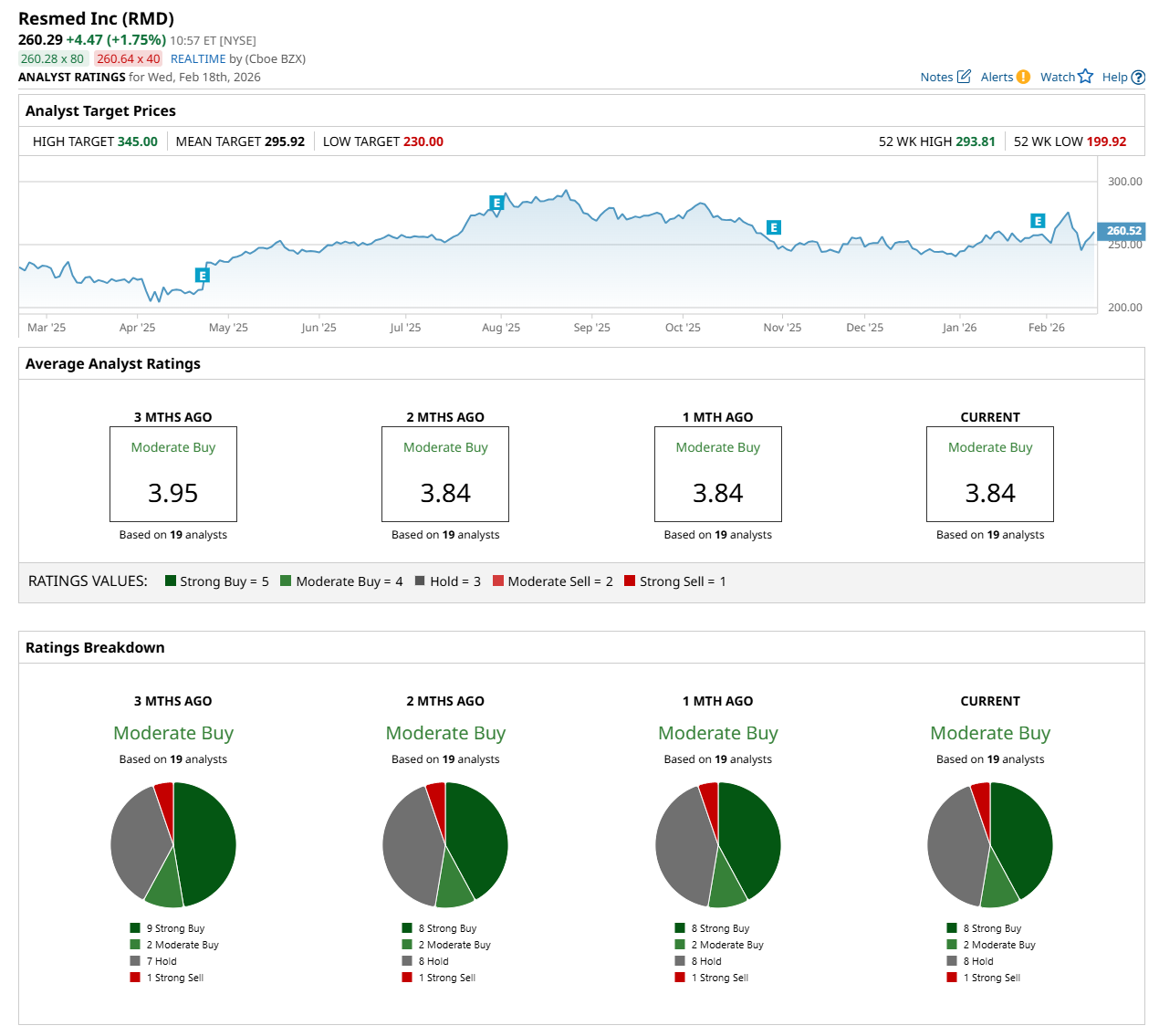

Among the 19 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” two "Moderate Buy,” eight “Hold,” and one “Strong Sell” rating.

The configuration is less bullish than three months ago, with nine analysts suggesting a “Strong Buy” rating.

On Feb. 6, Morgan Stanley (MS) analyst David Bailey maintained a "Buy" rating on RMD and set a price target of $310, indicating a 19.1 potential upside from the current levels.

The mean price target of $295.92 suggests a 13.7% potential upside from the current levels, while its Street-high price target of $345 suggests a 32.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ford Recalibrates EV Strategy While Tesla Pivots To AI: Would the Bet Pay Off?

- Tesla Falters in China Again: How to Play TSLA Stock as Xiaomi Outsells

- It’s ‘Time to Shine’ for Applied Materials Stock, According to Analysts. Should You Buy AMAT Here?

- Up 40% in the Past Year, This Leading Stock Means Business