Valued at a market cap of $9.4 billion, Alexandria Real Estate Equities, Inc. (ARE) is a leading life science REIT company that pioneered the life science real estate niche and develops premier Mega campus ecosystems in top U.S. innovation hubs. It combines Class A/A+ properties with strategic venture capital to support life science innovation and deliver long-term value.

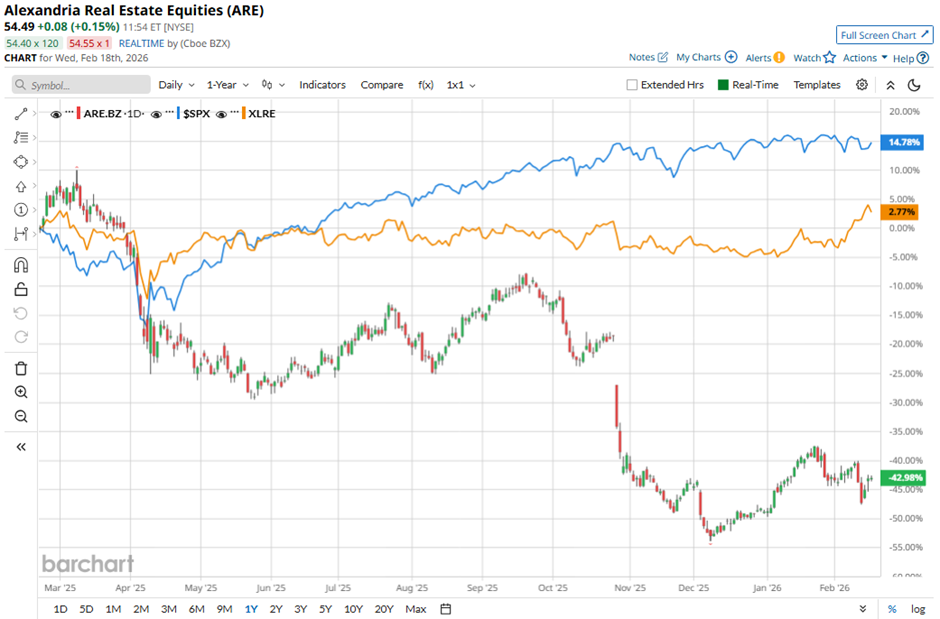

Shares of the Pasadena, California-based company have underperformed the broader market over the past 52 weeks. ARE stock has decreased 43.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.6%. However, shares of ARE are up 11.4% on a YTD basis, outpacing SPX’s marginal gain.

Focusing more closely, shares of the REIT have lagged behind the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 2.9% return over the past 52 weeks.

Shares of Alexandria Real Estate Equities rose 1.7% following its Q4 2025 results on Jan. 26, with stronger-than-expected AFFO per share of $2.16 and revenue of $754.4 million. Investor sentiment was further supported by solid leasing volume of 1.2 million RSF, a slight uptick in North America occupancy to 90.9%, and lower expenses of $322.1 million.

For the fiscal year ending in December 2026, ARE is expected to report an AFFO per share of $6.38, reflecting a 29.2% year-over-year decline. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

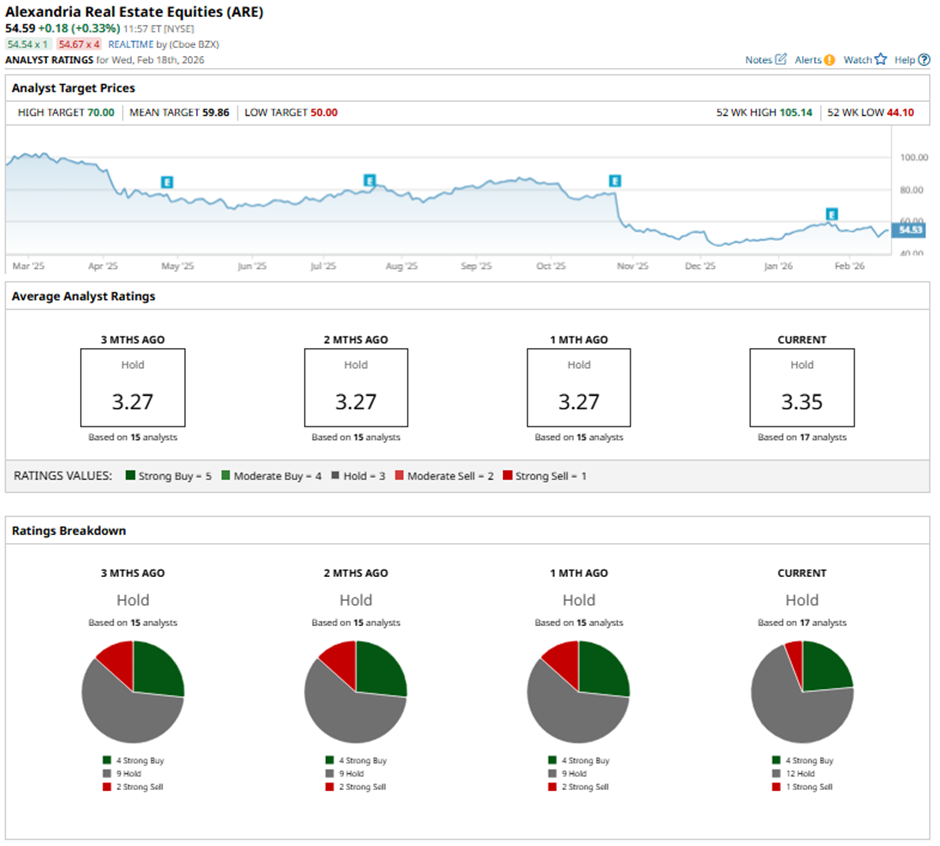

Among the 17 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, 12 “Holds,” and one “Strong Sell.”

On Feb. 10, Morgan Stanley lowered its price target on Alexandria Real Estate Equities to $54 and maintained an “Equal Weight rating.

The mean price target of $59.86 represents a premium of 9.7% to ARE’s current levels. The Street-high price target of $70 implies a potential upside of 28.2% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Can an Activist Investor Rescue Marooned Norwegian Cruise Lines?

- Has Palantir Bottomed? Probably, Based on Huge, Unusual Put Options Activity in PLTR

- Rackspace Stock Is Soaring on a Palantir Partnership. Should You Chase RXT Shares Here?

- Ford Recalibrates EV Strategy While Tesla Pivots To AI: Would the Bet Pay Off?