Advanced Micro Devices (AMD) will report fiscal fourth quarter financial results tomorrow, Tuesday, Feb. 3. The company has delivered strong revenue performance through the first three quarters of 2025, and the upcoming quarter could continue that trend.

AMD's Q4 top line is expected to benefit from the solid momentum in its data center business, which remains a major growth engine as demand for high-performance computing and AI-related infrastructure accelerates. At the same time, the embedded segment appears to be regaining strength, supporting AMD’s overall top-line expansion.

That said, investors should also keep an eye on profitability. AMD has been investing heavily to capitalize on the long-term opportunities in artificial intelligence (AI), and those costs could pressure margins in the near term. However, a better product mix and the benefits of operating leverage may help soften the impact and maintain resilient earnings performance.

Heading into the earnings, AMD’s 14-day Relative Strength Index is 59, below the 70 level typically associated with overbought conditions. This suggests the stock may still have room to move higher despite the significant rally over the past year.

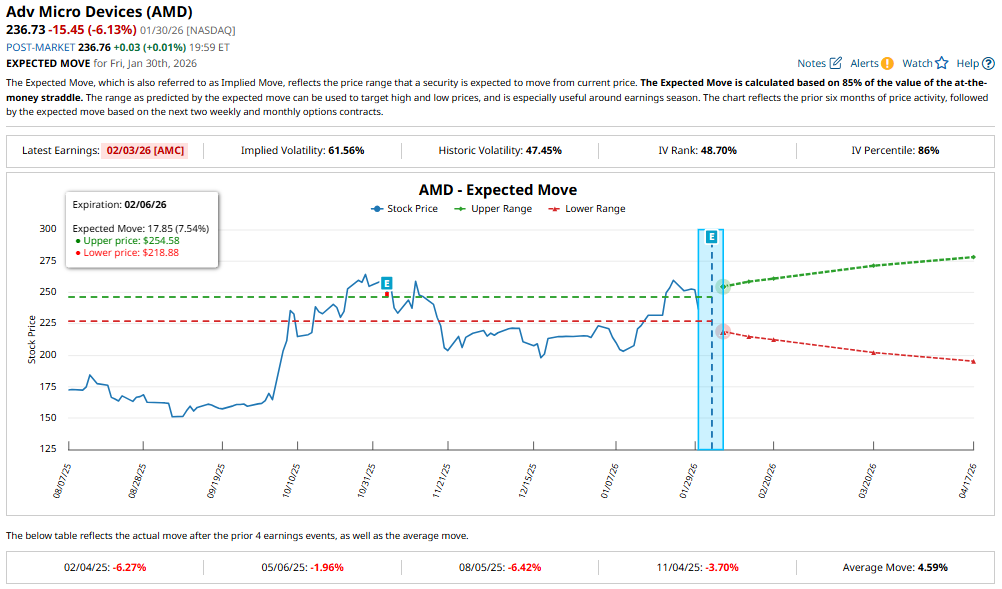

At the same time, options traders are pricing in a post-earnings move of about 7.5% in either direction for contracts expiring Feb. 6. That is higher than AMD’s average move of roughly 4.6% after earnings over the past year. Investors should also be aware of a recent pattern. AMD shares have declined following earnings reports in each of the past four quarters despite solid top-line growth.

AMD Q4: Here’s What to Expect

AMD could impress with its Q4 performance. The company could deliver strong top-line growth driven by continued expansion in its data center AI business. The large total addressable market and accelerating adoption of its Instinct AI platforms will drive its AI business. At the same time, rising server demand and steady gains in EPYC and Ryzen CPU market share will support its revenue in Q4.

For Q4 2025, management has guided revenue to be $9.6 billion, up 25% year-over-year (YoY). This growth is expected to be driven primarily by strong double-digit expansion in the company’s data center segment, along with continued strength in its client and gaming operations. Additionally, AMD anticipates its embedded business returning to growth after recent softness.

On a sequential basis, AMD’s revenue is projected to improve, supported by double-digit gains in the data center segment. Server demand remains robust, and the company is also benefiting from the continued ramp of its new MI350 Series GPUs.

During the Q3 earnings call, management emphasized that its AI business is entering a new phase of expansion, with the potential to deliver billions in annual revenue by 2027. The growth is likely to be supported by AMD’s leadership in rack-scale AI solutions, higher customer adoption, and an increasing number of large global deployments.

Several major MI350 Series deployments are already underway with large cloud and AI providers, and additional large-scale rollouts are expected to ramp up over the coming quarters. These deployments could become a major growth engine as demand for AI compute continues to surge.

Server CPU performance could once again remain a bright spot. Revenue from server processors is expected to stay strong, reflecting high adoption of AMD’s 5th Gen EPYC Turin chips. Enterprise adoption is accelerating, and EPYC server sell-through could rise sharply. In the cloud market, AMD expects hyperscalers to significantly increase general-purpose compute capacity as they scale AI workloads.

With solid revenue growth expected across its core segments, analysts are forecasting AMD to deliver earnings of $1.11 per share, representing 26.1% YoY growth. Overall, AMD’s Q4 financials are likely to remain strong.

Should You Buy AMD Stock or Wait?

AMD could again deliver solid quarterly financials. With data center demand accelerating, MI350 deployments ramping, and EPYC share gains continuing, AMD’s revenue outlook remains compelling heading into earnings. At the same time, margin pressure from heavy AI investment and the stock’s recent history of post-earnings pullbacks suggest investors should approach the report with some caution.

Moreover, market sentiment is already elevated after a strong rally over the past year. Thus, new buyers should wait for a better entry point.

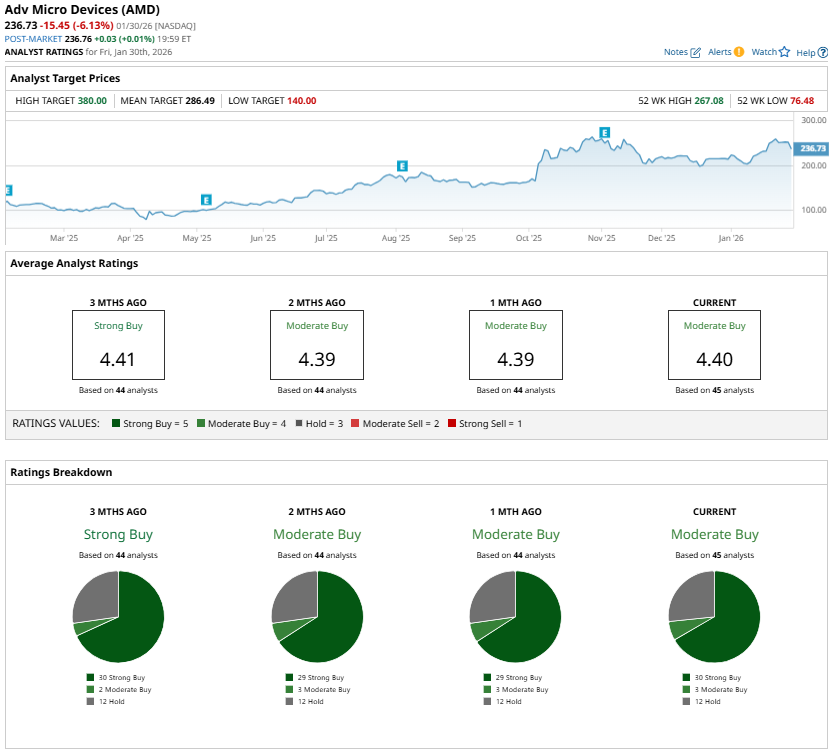

AMD stock carries a “Moderate Buy” consensus rating from Wall Street analysts ahead of Q4 earnings.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart