Options traders believe Advanced Micro Devices (AMD) shares will 7.04% in either direction this week after the company reports Q4 earnings on Feb. 3.

According to Barchart, consensus is for the chipmaker to record $1.11 per share of earnings for its fourth quarter, up more than 26% on a year-over-year basis.

AMD stock has already ripped higher ahead of the quarterly release. At the time of writing, it’s up some 25% versus its year-to-date low.

Where Options Data Suggests AMD Stock Is Headed

According to Barchart, derivatives contracts are pricing in a 7.04% move in AMD shares through the end of this week. This means they could be trading as high as $267 within days after the Q4 print. Options traders are forecasting a larger-than-average move this week, based on an average 4.59% move after the last four quarterly reports.

What’s also worth mentioning is that the AI stock is trading handily above its key moving averages (MAs) currently, with a 14-day relative strength index pegged at about 60 only, suggesting the upward momentum isn’t near exhaustion yet.

How High Can AMD Shares Fly in 2026?

On Monday, Cantor Fitzgerald analysts also reiterated their “Overweight” rating on AMD stock, saying the chipmaker will beat Q4 estimates and raise its guidance on Feb. 3.

According to them, the company continues to steal share in CPUs while strong server demand positions it strongly to hit $350 a share over the next 12 months.

Cantor Fitzgerald remains bullish on Advanced Micro Devices also because it isn’t wrestling with wafer transition challenges that weighed on Intel’s (INTC) outlook last month.

Note that AMD has a history of gaining nearly 5.5% on average in February, a seasonal trend that makes it all the more attractive to own heading into its quarterly release tomorrow.

How Wall Street Recommends Playing AMD

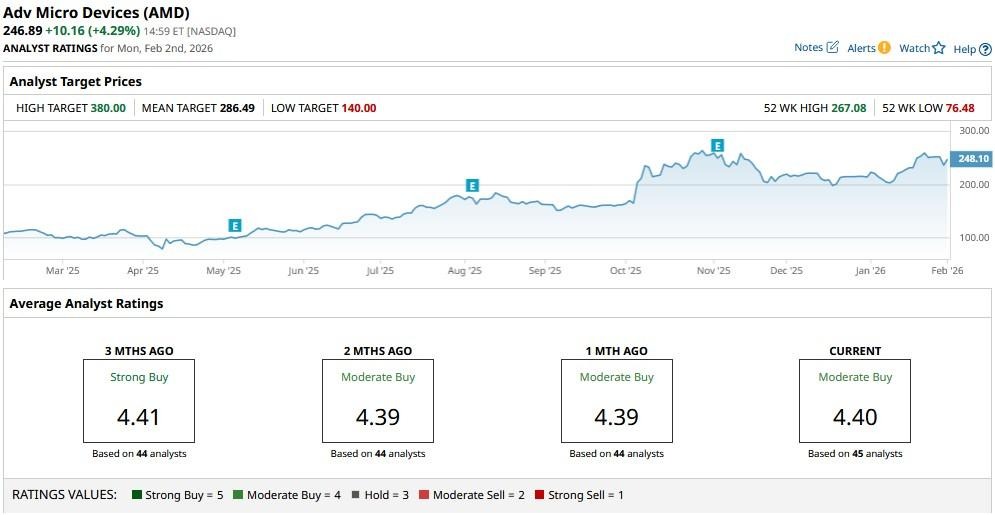

Other Wall Street analysts agree with Cantor Fitzgerald’s bullish view on Advanced Micro Devices

The consensus rating on AMD shares remains at “Moderate Buy” with the mean target of roughly $286 indicating potential upside of more than 15% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Here’s What Options Traders Expect from Advanced Micro Devices Stock After Earnings

- Volatility Skew May Be Pointing to an Earnings Surprise for Sirius XM (SIRI) Stock

- Shorting Microsoft Puts Looks Very Attractive to Value Investors in MSFT Stock

- Option Volatility And Earnings Report For February 2 - 6