Investment banks, hedge funds, equities and derivatives traders can benefit from options pricing methodology of dividend estimates in forecasting trading, portfolio strategies

OptionMetrics, an options database and analytics provider for institutional investors and academic researchers worldwide, is announcing its new IvyDB Implied Dividend dataset that uses options pricing data to provide forward-looking dividend projections for optionable single-name securities in the US, two years into the future.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241002247226/en/

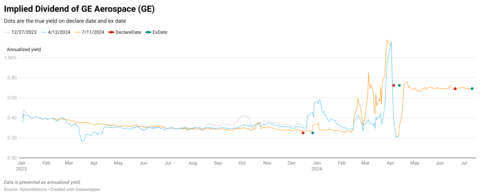

This chart shows the implied dividend distributions and projections for GE Aerospace stock (Ticker: GE) from January 2023 through July 2024, using OptionMetrics’ new IvyDB Implied Dividend dataset. IvyDB Implied Dividend uses options pricing data to provide forward-looking dividend projections for optionable single-name securities in the US, for up to two years into the future. As can be seen from the chart, GE implied yields began indicating an increase in expected dividends in mid-February. The predictive power of IvyDB Implied Dividend was on the mark, as GE publicly declared an increase of its dividend in April. The chart illustrates how IvyDB Implied Dividend data can be used to give financial professionals and portfolio managers important insights on dividend forecasts for stock selection, trading strategies, and portfolio construction. (Graphic: Business Wire)

OptionMetrics IvyDB Implied Dividend gives investment banks, quant strategists, hedge funds, exchanges, and equities and derivatives traders new insights on dividend projections based on the options market’s perception of future dividend payments. This forward looking dividend data is a powerful tool for use in creating trading strategies, constructing investment portfolios, and comparing securities and their potential future yields.

IvyDB Implied Dividend uses a superior methodology and model to predict dividend yields, using the options market valuation of future dividends over time, versus historical, backward-looking data, used by some to calculate dividend projections. Its numerical approach, incorporating binomial tree models to price risk-neutral dividend yields, can offer greater accuracy in determining dividends for US options, over put-call parity, which can be prone to systematic bias because of the American-style exercise feature.

The annualized term structure in IvyDB Implied Dividend also gives traders and financial professionals estimates of embedded risk premiums at future horizons. This can give them greater predictive power to assess timing of strategies, and cross-sectional and time-series comparisons versus receiving a single cumulative yield per option expiration. The dataset does not require a specialized knowledge of options trading and is designed to be intuitive and easy to use.

OptionMetrics IvyDB Implied Dividend can be used in:

- Making predictions on future dividend actions

- Assessing dividend risk premium trades and pricing dividends into the future

- Proxying for dividend uncertainty in the market against analyst and other dividend forecast expectations

- Gauging signals in portfolio selection, such as in identifying stocks with a positive implied dividend yield relative to payments

- Assessing cross-sectional comparisons across groups (sectors, market cap, etc.)

- Backtesting investment strategies

“The options market holds a wealth of information, including on potential dividend signal changes, cuts and suspensions, risk premium, and market sentiment on dividend yields,” said OptionMetrics Founder and CEO David Hait, Ph.D. “With its advanced methodology and forward looking approach, our new IvyDB Implied Dividend can give financial professionals and portfolio managers important insights on dividend forecasts for stock selection, trading strategies, and portfolio construction. And, with its easy-to-use format, users don’t have to be options experts to gain the benefits of the data.”

IvyDB Implied Dividend includes ex-dividend dates, projected amounts, security IDs going back to 2018, provided end of day. The data can be used standalone or as a complement to real-time Woodseer Dividend Forecast Data with GenAI, leveraging algorithm+analyst+ai methodology, and others.

Contact info@optionmetrics.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241002247226/en/

Contacts

Hilary McCarthy

774.364.1440

Hilary@clearpointagency.com