- As more gigawatt-scale data centers come online, developers are taking power into their own hands; one-third of data centers to be fully off-grid by 2030

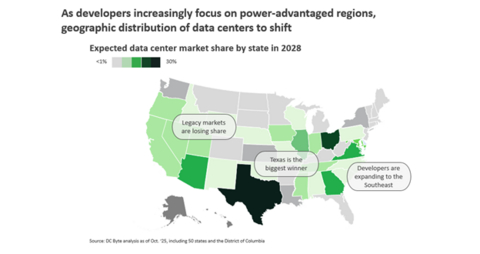

- Data centers are shifting to power-advantaged regions: Texas’ data center load is poised to more than double to 30% of total U.S. demand by 2028; Georgia leads growing boom in Southeast

- Legacy players like California and Oregon stand to lose half their relative market share

Bloom Energy (NYSE: BE), a global leader in power solutions, released its latest Data Center Power Report, which surveyed decision-makers across the data center power ecosystem. The survey found that more data center leaders are reducing their reliance on utility grids by investing in onsite power for rapidly scaling data centers. The report also revealed that power availability is driving data center development decisions as the industry moves into a new set of power-friendly regions. Together, these findings suggest a significant structural market shift for “AI factories” and other high-density data centers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260120114782/en/

The report’s findings indicate that:

- Power availability is creating new geographic winners and losers: Texas is poised to capture nearly 30% of U.S. data center market share by 2028 and Georgia's market share is expected to grow by 75% (from 4% of the total data center market to 7%) as developers expand deeper into the Southeast. In contrast, California, Oregon, Iowa, and Nebraska’s respective relative market shares are expected to drop by more than 50%.

- More data centers are approaching gigawatt scale: Over 50% of new data center campuses are predicted to exceed 500 MW by 2035 and nearly one-third of new data center campuses to exceed 1 GW, with each 1 GW campus consuming roughly as much electricity as the entirety of San Francisco.

- The power expectation gap is widening in key hubs: Utilities project delivery timelines are approximately 1.5-2 years longer than hyperscalers and colocation providers expect. Over the past six months, the expectation gap has widened in three critical hubs – Northern Virginia, the Bay Area, and Atlanta.

- Data center developers plan to make big bets in off-grid power: Hyperscalers and colocation providers expect that roughly one-third of data centers in 2030 will use 100% onsite power, a 22% increase from the previous report six months ago. Developers surveyed believe that, by 2030, onsite power will be a leading solution to minimizing development timelines and costs.

- Higher‑voltage and DC electrical architectures are moving from roadmap to reality. As AI campuses scale to gigawatts, operators are redesigning power systems to handle denser loads and faster build schedules. 45% of respondents expect to adopt direct‑current (DC) distribution architectures in their new data centers by 2028. These designs are likely to be incorporated into data centers entering development this year.

“Data center and AI factory developers can’t afford delays. Our analysis and survey results show that they’re moving into power‑advantaged regions where capacity can be secured faster—and increasingly designing campuses to operate independently of the grid,” said Natalie Sunderland, Bloom Energy’s Chief Marketing Officer. “The surge in AI demand creates a clear opportunity for states that can adapt to support large-scale AI deployments at speed.”

The 2026 Bloom Energy Data Center Power report is based on surveys commissioned via a double-blind process between Bloom Energy and respondents. Surveys were conducted in November 2025 with 152 decision-makers across the data center power ecosystem, reflecting perspectives from hyperscalers, colocation developers, utilities, and GPU service providers. Interviews were also conducted with industry leaders to pressure test findings and assess real-world implications. Download a copy of the report here.

About Bloom Energy

Bloom Energy empowers enterprises to meet soaring energy demands and responsibly take charge of their power needs. The company’s fuel cell system provides ultra-resilient, highly scalable onsite electricity generation for Fortune 500 companies around the world, including data centers, semiconductor manufacturing, large utilities, and other commercial and industrial sectors. Headquartered in Silicon Valley, Bloom Energy has deployed 1.5 GW of low-carbon power across more than 1,200 installations globally. For more information, visit www.BloomEnergy.com.

Forward Looking Statements

This press release contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or the negative of these words or similar terms or expressions that concern Bloom’s expectations, strategy, priorities, plans, or intentions. These forward-looking statements include, but are not limited to, the intentions of developers with respect to their plans to power data centers, the percentage of sites expected to be off-grid, the potential of regional shifts in data centers based upon power availability and the magnitude of such shifts, the role of “AI factories” and data center density in these trends, potential changes in percentage of market share in various data center markets, expectations with respect to size of new data center campuses and the power requirements of such campuses, expectations of utilities as well as hyperscalers and colocation providers with respect to timeline to provide power for new data center campuses, potential advantages of onsite-powered campuses, the percentage of sites expected to implement DC distribution architectures, and the role of AI in driving demand. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including, but not limited to, risks and uncertainties detailed in Bloom’s SEC filings. More information on potential risks and uncertainties that may impact Bloom’s business are set forth in Bloom’s periodic reports filed with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 27, 2025, its Quarterly Report on Form 10-Q for the quarters ended March 31, 2025, June 30, 2025, and September 30, 2025, filed with the SEC on April 30, 2025, July 31, 2025, and October 28, 2025, respectively, as well as subsequent reports filed with or furnished to the SEC. Bloom assumes no obligation to, and does not intend to, update any such forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260120114782/en/

Contacts

Media

Bloom Energy – Katja Gagen (press@bloomenergy.com)

Investors

Bloom Energy – Michael Tierney (investor@bloomenergy.com)