Survey of 969 U.S. restaurant owners highlights diversification, advisory support, and customer retention as key drivers of resilience and long-term growth

MarketStreet today released its second national research report on small businesses, From Survival to Scale: Building Stronger, More Resilient Restaurant Businesses, revealing a widening “capability gap” between independent restaurants that remain stuck in day-to-day survival and those positioned to scale.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260217728317/en/

Based on a September 2025 survey of 969 U.S.-based restaurant owners operating 2–5 locations, the report finds that the difference between stagnation and sustainable growth is less about effort and more about access to capabilities — including diversified revenue channels, operational systems, advisory guidance, and structured customer retention strategies.

“The widening divide among independent restaurants isn’t about ambition,” said Adam Fletcher, CEO at MarketStreet. “It’s about access to the systems and strategic support that allow operators to move from constant firefighting to intentional growth.”

Key Findings

Channel Diversification Signals Operational Maturity

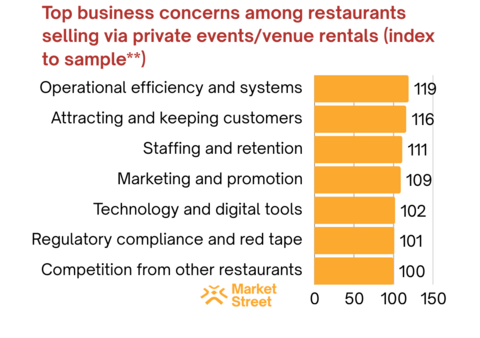

Restaurants operating across multiple revenue channels — such as catering, wholesale, retail products, private events, and delivery — consistently demonstrate higher resilience and sophistication.

Compared to single-channel operators, diversified restaurants are:

- 14% more likely to hold a liquor license

- 12% more likely to offer delivery

- 9% more likely to offer catering

Single-channel operators are significantly more likely to cite rent, cash flow instability, food costs, and owner burnout as top concerns. The data suggests diversification stabilizes revenue and enables proactive growth.

Advisory Support Marks the Shift from Survival to Strategy

Operators who work with business advisors, coaches, or mentors are disproportionately represented in mature, diversified segments such as catering, retail, wholesale, and private events.

These owners are more likely to:

- Focus on financial tracking and margin management

- Invest in customer loyalty and retention

- Engage in structured strategic planning

By contrast, operators without advisory support report being consumed by staffing issues and daily operational pressures.

Customer Retention Remains Underleveraged

Retention-focused operators are 28% more likely to have been in business 10+ years and 18% more likely to employ 40+ staff. They are also significantly more disciplined operationally, with more frequent cost reviews and menu updates.

Yet fast-casual and quick-service operators — despite margin pressure and competition — are 37% less likely to use structured loyalty programs. The report concludes that retention is not simply a marketing tactic, but a measurable driver of financial resilience.

Practical Pathways Forward

The report outlines actionable, low- and no-cost improvements available to independent operators, including accessible advisory programs (such as SBA SCORE and Small Business Development Centers), menu engineering fundamentals, simplified loyalty activators, and structured operational review practices.

The central conclusion: independent restaurants do not lack ambition. They lack accessible, system-level support that translates complexity into execution.

Methodology

The survey was conducted September 3–29, 2025, among 969 U.S.-based restaurant owners operating 2–5 locations. Respondents completed 30 structured questions, with cohort analysis across service models, sales channels, geography, and business challenges. Data was collected via randomized mobile device engagement with fraud detection safeguards.

About MarketStreet

MarketStreet is a Silicon Valley startup building tools and community for small business owners. Its research and platform focus on helping independent operators close the capability gap through community-driven growth, simplified marketing execution, accessible advisory support, and operational intelligence.

For more information or to download the full report, visit marketstreet.com or contact press@marketstreet.com.

From Survival to Scale: Building Stronger, More Resilient Restaurant Businesses is available for free download at https://marketstreet.com/research.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260217728317/en/

“The widening divide among independent restaurants isn’t about ambition,” said Adam Fletcher, CEO at MarketStreet. “It’s about access to the systems and strategic support that allow operators to move from constant firefighting to intentional growth.”

Contacts

Adam Fletcher

CEO, Co-Founder

press@marketstreet.com