Lease return inspections aren’t moral judgments, and they’re not a “did you take care of it” vibe check.

They’re a resale-readiness check.

Most lessors publish a wear-and-use guide that spells out what they’ll treat as normal aging versus what they’ll bill as excess wear, and the first rule is boring but powerful: your contract and your lessor’s published standards are the reference point.

Here’s the mental model that helps:

- Wear is what happens when you use the car normally.

- Damage is what happens when something needs repair to restore condition, safety, or resale value.

And yes, those two can feel maddeningly close when you’re staring at a scratch that’s “not that bad” until you see it in direct sunlight on your lease end options and the fine print.

The 3 Questions Inspectors Ask

When something looks questionable, most condition reports boil down to three questions (even if nobody says them out loud):

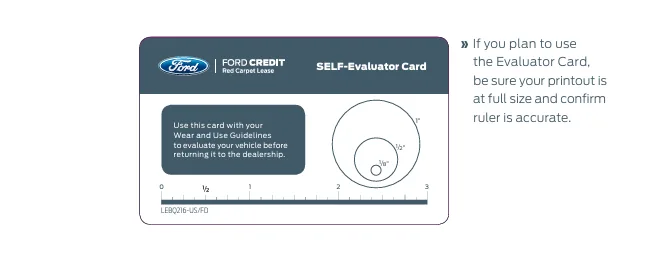

- Size: Is it small enough to be considered incidental? (Many lessors use simple measuring tools or “evaluator cards.”)

- Location: Is it on a high-visibility, high-cost area (bumper corners, wheel faces, windshield line of sight)?

- Severity: Does it break the surface, expose material underneath, crack glass, or look like a failed repair?

If you answer “yes” to location and severity, it’s usually no longer “wear,” even if it’s small.

The Sneaky Stuff that Racks up Fees

Wheels, Glass, and Tires

Lessors routinely call out wheels/tires and glass because they’re expensive to recondition and easy to spot.

- Wheels: Curb rash that looks like “a little kiss” to you can read as “refinishing required” to the next buyer. Ford and many other lessors specifically separate normal scuffs from chargeable wheel damage in their wear-and-use materials.

- Glass: Chips, cracks, and anything that creates a safety or visibility issue tends to move fast into chargeable territory. Autotrader flags windshield cracks as a classic lease-end charge trigger.

- Tires: Legal minimum tread varies by country and sometimes by vehicle class, but the lease reality is simpler: if your tires are at or near the limit, you’re basically donating money to the end-of-lease invoice. Some lessors publish explicit minimums for “acceptable wear” (for example, Ally’s guide uses a minimum tread depth standard).

Interior: Stains, Smells and Missing Bits

Interior charges often come from two buckets: permanent marks and missing equipment.

Multiple lessors explicitly call out upholstery tears/burns/stains and missing keys/accessories as chargeable.

And please don’t underestimate odors. An inspector can’t un-smell a car. If your vehicle has a persistent smoke/pet/mildew scent (or hair), that can translate into “professional remediation,” which is not the cheap kind of cleaning, and be treated as excess wear.

Repairs: Smart vs. Anxious Spending

Use Pre-inspections Like a Cheat Code

Several lessors offer a courtesy pre-inspection or early condition report so you can see likely charges while you still have choices. Toyota Financial and Lexus Financial both explicitly highlight the value of getting a detailed condition report before turn-in.

Once you have that report, make repair decisions like an adult, not like a panicked perfectionist:

- Fix items that are safety-related or clearly chargeable (cracked glass, tire issues, broken lights).

- Be cautious with cosmetic fixes that are borderline; a bad repair can be worse than the original problem (mismatched paint is the classic self-own). Autotrader specifically warns that poor-quality repairs can lead to charges.

Follow the Market

If you want a genuinely practical angle, keep an eye on the financial content market daily, even casually, so you understand your car’s current demand and value swing.

When used-car values are strong, condition standards can feel stricter because the resale upside is bigger.

When the market softens, paying top dollar to perfect a minor blemish can be pure emotional spending.

This is not about becoming a used-car analyst. It’s about avoiding the classic mistake: spending $400 to prevent a $150 charge because you didn’t have context.

Disputes and Legal Basics: How to Push Back Without Turning It into a Saga

You typically have the right to understand fees and challenge what you believe is wrong, but the way you do it matters.

Start With your Paperwork

The Federal Reserve’s consumer leasing resources note that, depending on your lease and local law, you may have a right to dispute the condition report, and some lessors may allow a third-party assessment acceptable to both sides.

Also, consumer leasing rules in many jurisdictions emphasize clear disclosure of lease costs and terms. In the U.S., for example, Regulation M and the Consumer Leasing Act framework cover disclosure requirements for consumer leases.

A Clean, Effective Dispute Checklist

- Ask for the itemized breakdown and photos.

- Reply in writing with specific line-item objections (not “this is unfair,” but “this scratch is within your guide’s normal-use examples”).

- Attach your own time-stamped photos and any repair receipts.

- If your agreement allows it, request a reinspection or an independent assessment pathway.

Witty but true: the fastest way to lose a dispute is to argue feelings. The fastest way to win one is to argue measurements and documentation.