RESTON, Va., Oct. 28, 2025 (GLOBE NEWSWIRE) -- As deepfakes and other impersonation attacks already hit one in three businesses worldwide, companies are resetting their defenses around biometrics. A new survey by Regula, a global developer of identity verification (IDV) solutions and forensic devices, shows that while biometrics currently ranks third in adoption, it is seen as the #1 must-have tool in the ideal future stack.

Based on the survey responses, biometrics stands out for both adoption and staying power, unlike other IDV methods: on a global level, it has the lowest drop-off rate among users and the highest growth potential, with 21% of non-users planning to add it soon.

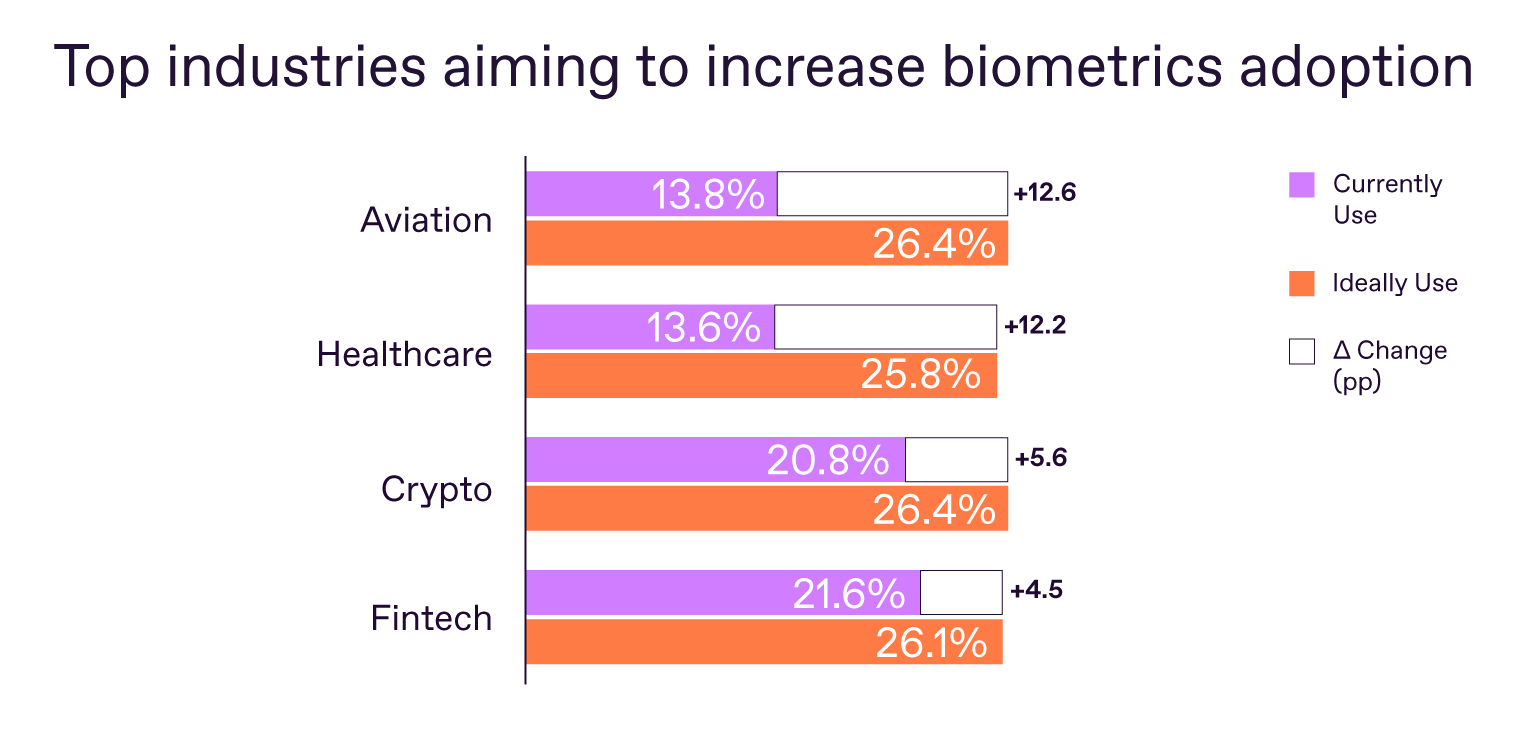

Except for the telecom and banking sectors, which are already leveraging biometrics in full, other industries are aiming to increase their adoption of biometric verification tools.

What’s happening now

Today, most companies still rely on familiar tools for fraud prevention:

- MFA (SMS codes, OTPs, app confirmations) – used by 40% globally.

- Behavioral biometrics (typing, swiping patterns) – 23%.

- Basic biometrics (fingerprints, face scans) – 22%.

These methods became popular because they were easy to deploy, and they still block most simple everyday fraud—but the threat landscape has changed. With deepfakes and synthetic identities targeting organizations as often as basic fraud methods, these tools are no longer enough.

What the ideal IDV stack looks like

When asked to design their ideal future tech stack, companies chose a clear anchor: biometric verification. It is simple for users, scalable for businesses, and trusted by regulators. Once deployed, it almost never gets abandoned. For industries like aviation (29%), crypto (26%), and healthcare (26%), biometric verification is the top fraud-prevention tool.

At the same time, some sectors are rebalancing their priorities. Banking and telecom, for example, are shifting focus toward fraud analytics, dark web intelligence, and compliance-driven tools like watchlists, alerts, and liveness checks. But even here, biometrics remains part of the picture—just embedded in a broader, hybrid approach to counter evolving threats and meet regulatory demands.

Human review ranks second, mainly because of compliance-heavy markets like Germany and Singapore, where regulators require a person to sign off on sensitive decisions. Banking and crypto follow this model to ensure accountability and customer rights.

MFA remains widespread, particularly in banking, healthcare, and telecom. In fintech, adoption is set to rise from 23% to 31%. However, the role of MFA is shifting: no longer the main defense, it is increasingly treated as a supporting safeguard that works best when paired with stronger biometric checks.

“The fraud landscape has changed dramatically, with sophisticated impersonation attacks becoming mainstream. The future of fraud prevention isn’t about relying on easy-to-deploy solutions in isolation. It’s about building resilient, layered defenses with advanced biometric verification as a backbone and orchestration tying it all together,” says Ihar Kliashchou, Chief Technology Officer at Regula.

Download the full report

These findings are part of Regula’s new study, Identity Verification 2025: 5 Threats and 5 Opportunities. Download it now from Regula’s website.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been recognized in the 2025 Gartner® Magic Quadrant™ for Identity Verification.

Learn more at www.regulaforensics.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/edc35b6b-51ae-49da-b057-5b1b051d6bac

Contact: Kristina – ks@regula.us