Hospitality company Travel + Leisure (NYSE: TNL) fell short of the market’s revenue expectations in Q3 CY2024, with sales flat year on year at $993 million. Its GAAP profit of $1.39 per share was also 5.7% below analysts’ consensus estimates.

Is now the time to buy Travel + Leisure? Find out by accessing our full research report, it’s free.

Travel + Leisure (TNL) Q3 CY2024 Highlights:

- Revenue: $993 million vs analyst estimates of $1.01 billion (1.8% miss)

- EPS: $1.39 vs analyst expectations of $1.47 (5.7% miss)

- EBITDA: $242 million vs analyst estimates of $240.2 million (small beat)

- EBITDA guidance for the full year is $925 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 59%, up from 49.3% in the same quarter last year

- EBITDA Margin: 24.4%, in line with the same quarter last year

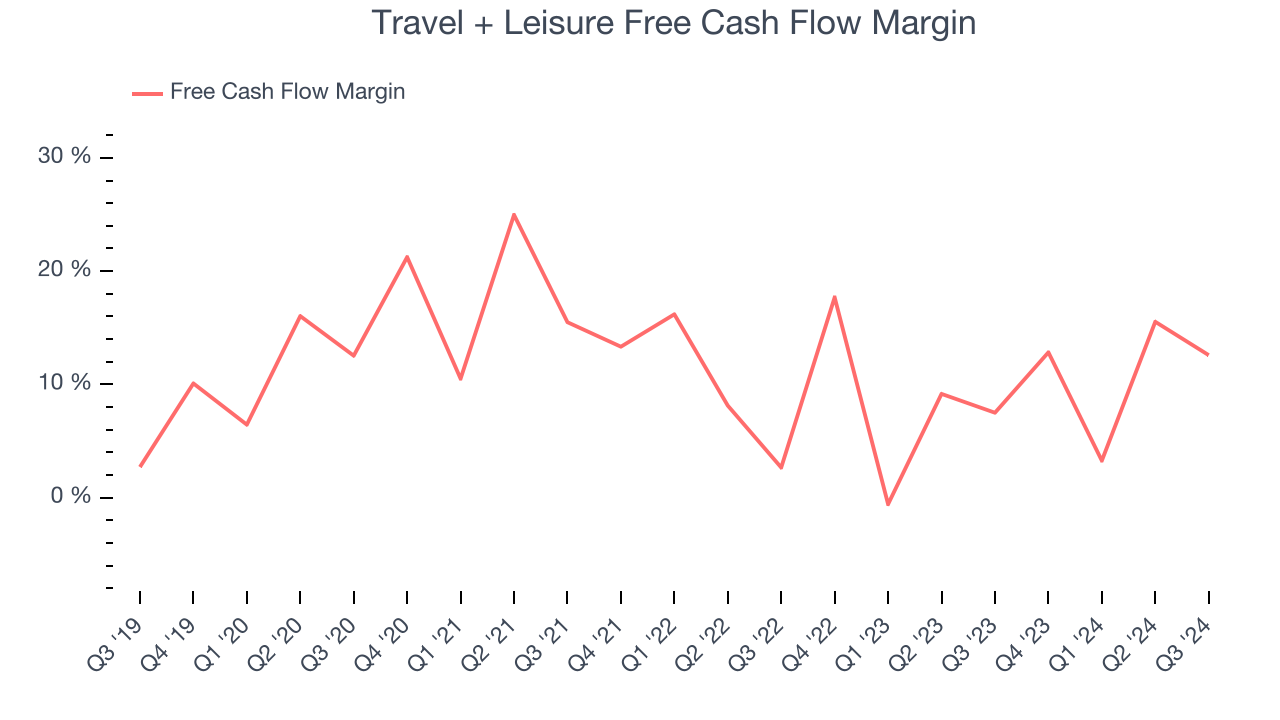

- Free Cash Flow Margin: 12.6%, up from 7.5% in the same quarter last year

- Conducted Tours: 195,000, up 8,000 year on year

- Market Capitalization: $3.18 billion

“Our results this quarter show that we are executing well against our key priorities for the year and that demand for our products remains solid. We have good momentum in our Vacation Ownership business and were especially pleased with our VPG performance, which remains consistently above $3,000, even during our peak new owner mix quarters,” said Michael D. Brown, President and CEO of Travel + Leisure Co.

Company Overview

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE: TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Travel + Leisure struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Travel + Leisure’s annualized revenue growth of 4% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its number of conducted tours, which reached 195,000 in the latest quarter. Over the last two years, Travel + Leisure’s conducted tours averaged 15.2% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Travel + Leisure’s $993 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates the market thinks its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Travel + Leisure has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.9%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Travel + Leisure to make large cash investments in working capital and capital expenditures.

Travel + Leisure’s free cash flow clocked in at $125 million in Q3, equivalent to a 12.6% margin. This result was good as its margin was 5.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Travel + Leisure’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 11.2% for the last 12 months will increase to 12.8%, it options for capital deployment (investments, share buybacks, etc.).

Key Takeaways from Travel + Leisure’s Q3 Results

We enjoyed seeing Travel + Leisure beat analysts’ EBITDA guidance expectations for next quarter. On the other hand, its number of conducted tours unfortunately missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $45.44 immediately following the results.

Is Travel + Leisure an attractive investment opportunity right now?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.