Semiconductor materials supplier Entegris (NASDAQ: ENTG) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 9.1% year on year to $807.7 million. Next quarter’s revenue guidance of $825 million underwhelmed, coming in 6.1% below analysts’ estimates. Its non-GAAP profit of $0.77 per share was also 1.5% below analysts’ consensus estimates.

Is now the time to buy Entegris? Find out by accessing our full research report, it’s free.

Entegris (ENTG) Q3 CY2024 Highlights:

- Revenue: $807.7 million vs analyst estimates of $832.4 million (3% miss)

- Adjusted EPS: $0.77 vs analyst expectations of $0.78 (1.5% miss)

- EBITDA: $233 million vs analyst estimates of $239.8 million (2.9% miss)

- Revenue Guidance for Q4 CY2024 is $825 million at the midpoint, below analyst estimates of $878.8 million

- Adjusted EPS guidance for Q4 CY2024 is $0.78 at the midpoint, below analyst estimates of $0.95

- Gross Margin (GAAP): 46%, up from 41.3% in the same quarter last year

- Inventory Days Outstanding: 134, up from 132 in the previous quarter

- Operating Margin: 16.9%, up from 13.2% in the same quarter last year

- EBITDA Margin: 28.8%, up from 26.5% in the same quarter last year

- Free Cash Flow Margin: 14.2%, similar to the same quarter last year

- Market Capitalization: $16.16 billion

Bertrand Loy, Entegris’ president and chief executive officer, said: “The team delivered margins and non-GAAP EPS within our guidance range, despite third quarter sales coming in below expectations, with revenue growth excluding divestitures of 7 percent year-on-year.”

Company Overview

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

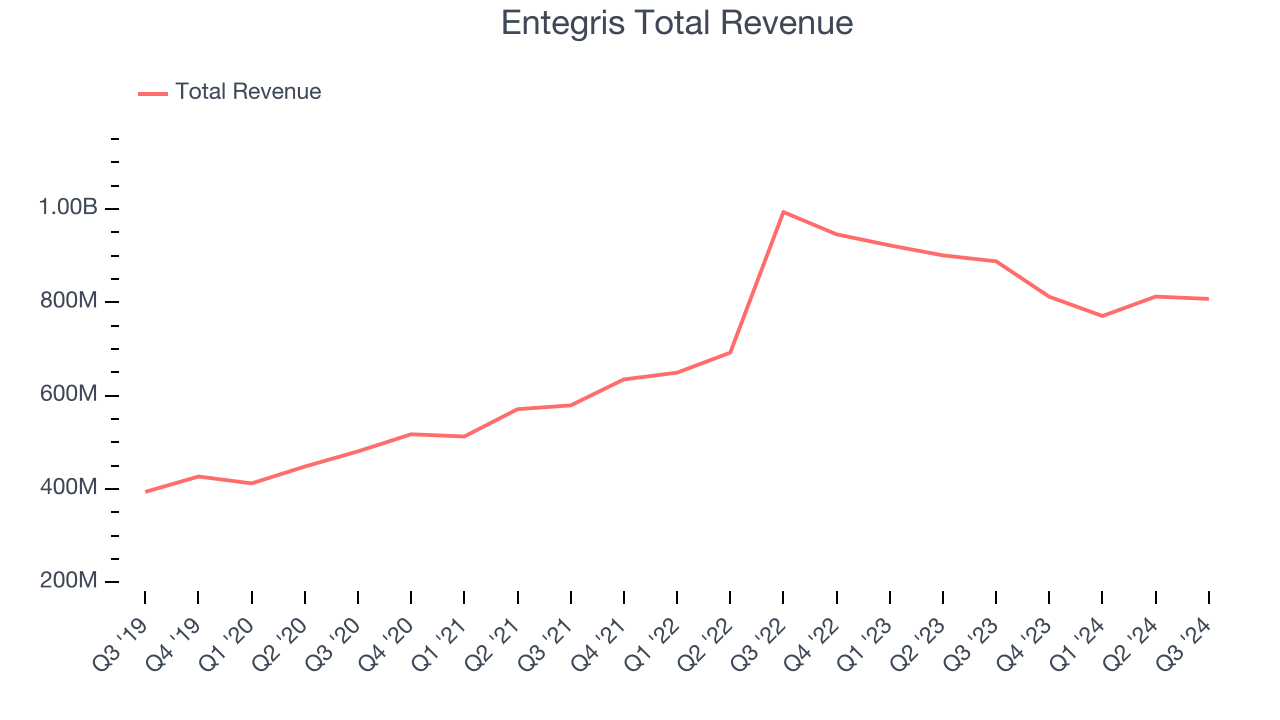

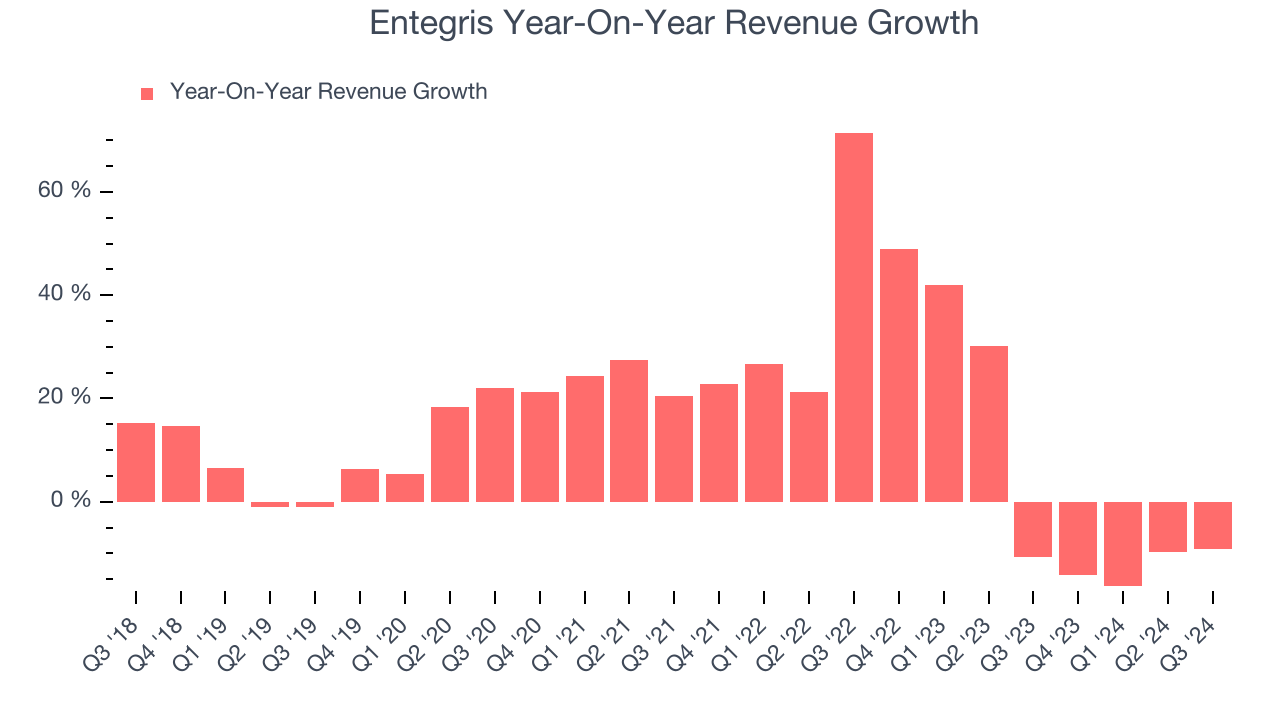

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Entegris’s 15.4% annualized revenue growth over the last five years was excellent. This is a useful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Entegris’s recent history shows its demand slowed significantly as its annualized revenue growth of 3.8% over the last two years is well below its five-year trend.

This quarter, Entegris missed Wall Street’s estimates and reported a rather uninspiring 9.1% year-on-year revenue decline, generating $807.7 million of revenue. Management is currently guiding for a 1.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.8% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates the market thinks its newer products and services will fuel higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

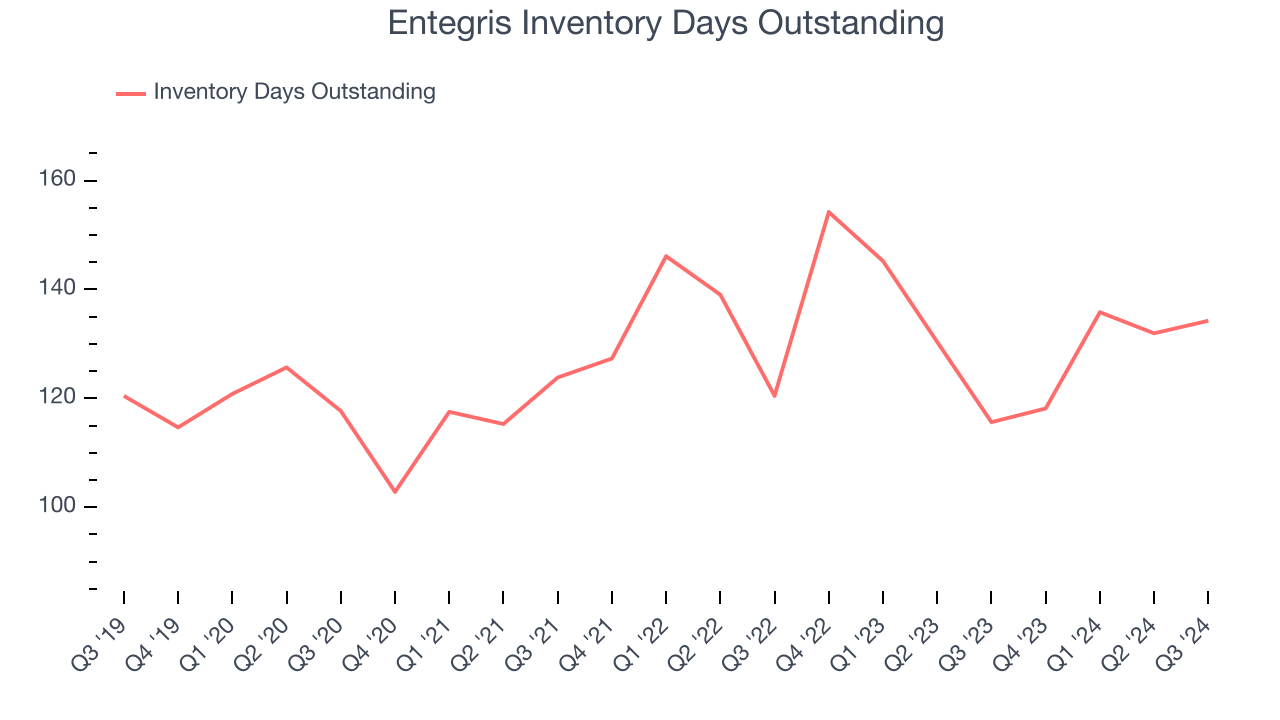

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Entegris’s DIO came in at 134, which is 7 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Entegris’s Q3 Results

We were impressed by Entegris’s strong gross margin improvement this quarter. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its revenue missed Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 10.5% to $96 immediately after reporting.

Entegris didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.