Video game retailer GameStop (NYSE: GME) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 20.2% year on year to $860.3 million. Its non-GAAP profit of $0.06 per share was significantly above analysts’ consensus estimates.

Is now the time to buy GameStop? Find out by accessing our full research report, it’s free.

GameStop (GME) Q3 CY2024 Highlights:

- Revenue: $860.3 million vs analyst estimates of $887.7 million (20.2% year-on-year decline, 3.1% miss)

- Adjusted EPS: $0.06 vs analyst estimates of -$0.03 (significant beat)

- Operating Margin: -3.9%, down from -1.4% in the same quarter last year

- Free Cash Flow Margin: 2.3%, up from 1% in the same quarter last year

- Market Capitalization: $12.47 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

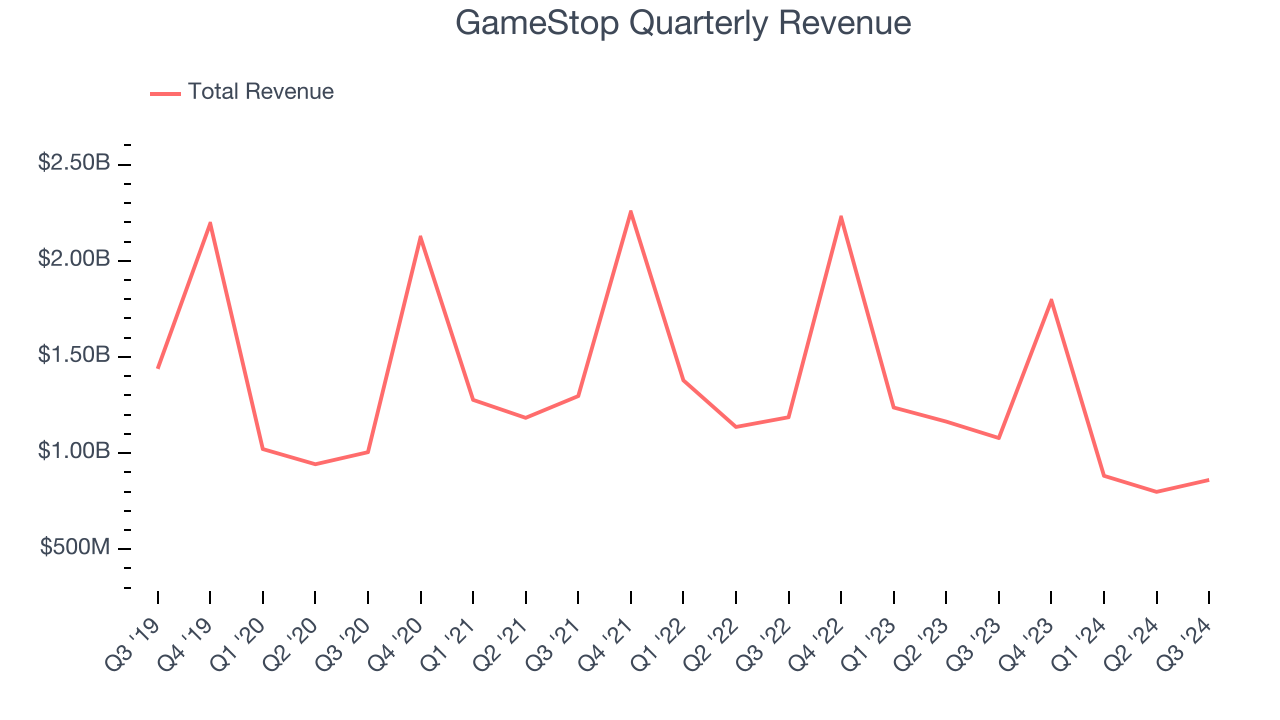

As you can see below, GameStop struggled to generate demand over the last five years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 10% annually as it closed stores and observed lower sales at existing, established locations.

This quarter, GameStop missed Wall Street’s estimates and reported a rather uninspiring 20.2% year-on-year revenue decline, generating $860.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 11.2% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and indicates its products will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

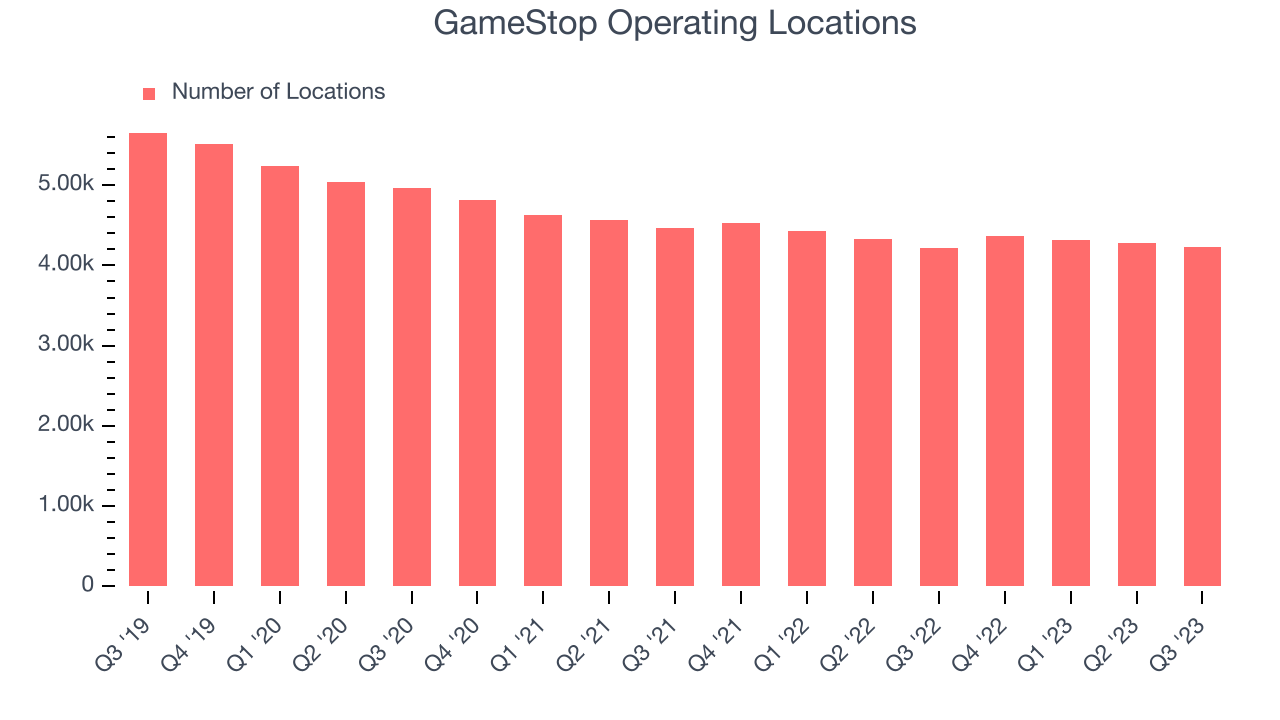

Over the last two years, GameStop has generally closed its stores, averaging 1.6% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Note that GameStop reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

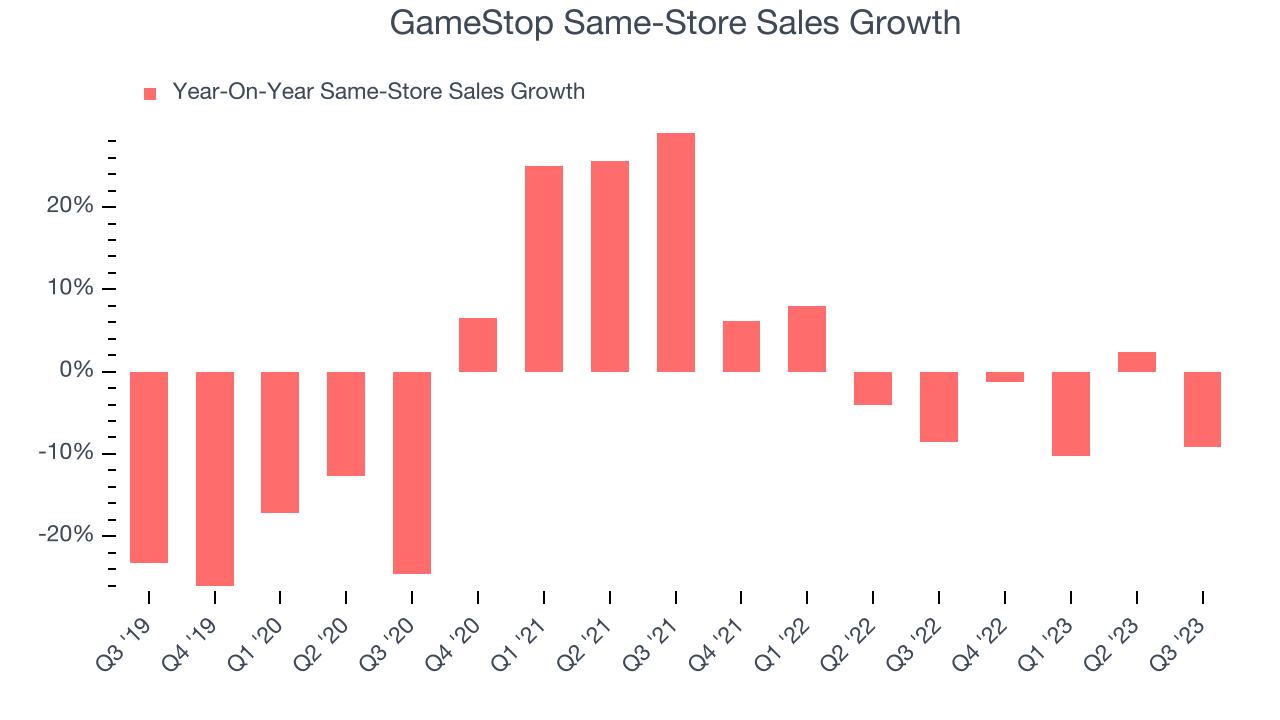

GameStop’s demand has been shrinking over the last two years as its same-store sales have averaged 4.5% annual declines. This performance isn’t ideal, and GameStop is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

Note that GameStop reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from GameStop’s Q3 Results

We were impressed by how significantly GameStop blew past analysts’ EPS expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its revenue fell short. Overall, this quarter had some key positives, but the market seemed to focus on the revenue miss. The stock traded down 1.6% to $26.51 immediately after reporting.

So do we think GameStop is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.