Diversified industrial and facilities services company ABM Industries (NYSE: ABM) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 4% year on year to $2.18 billion. Its non-GAAP profit of $0.90 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy ABM Industries? Find out by accessing our full research report, it’s free.

ABM Industries (ABM) Q3 CY2024 Highlights:

- Revenue: $2.18 billion vs analyst estimates of $2.08 billion (4% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.90 vs analyst estimates of $0.87 (3.3% beat)

- Adjusted EBITDA: $128 million vs analyst estimates of $125 million (5.9% margin, 2.4% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.70 at the midpoint, beating analyst estimates by 1%

- Operating Margin: 0.9%, down from 5.1% in the same quarter last year

- Free Cash Flow Margin: 0.7%, down from 5.8% in the same quarter last year

- Organic Revenue rose 3.2% year on year, in line with the same quarter last year

- Market Capitalization: $3.45 billion

“ABM finished the year well, with double-digit revenue growth in Technical Solutions and Aviation, and our performance also reflected the continued resilience of our Business & Industry segment. These fourth quarter results were highlighted by 3.2% organic revenue growth and adjusted EPS of $0.90 cents, both of which were a little higher than expected,” said Scott Salmirs, President and Chief Executive Officer.

Company Overview

Started with a $4.50 investment to purchase a bucket, sponge, and mop, ABM (NYSE: ABM) offers janitorial, parking, and facility services.

Facility Services

Many facility services are non-discretionary (office building bathrooms need to be cleaned), recurring, and performed through contracts. This makes for more predictable and stickier revenue streams. However, COVID changed the game regarding commercial real estate, and office vacancies remain high as hybrid work seems here to stay. This is a headwind for demand, and facility services companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these companies’ services.

Sales Growth

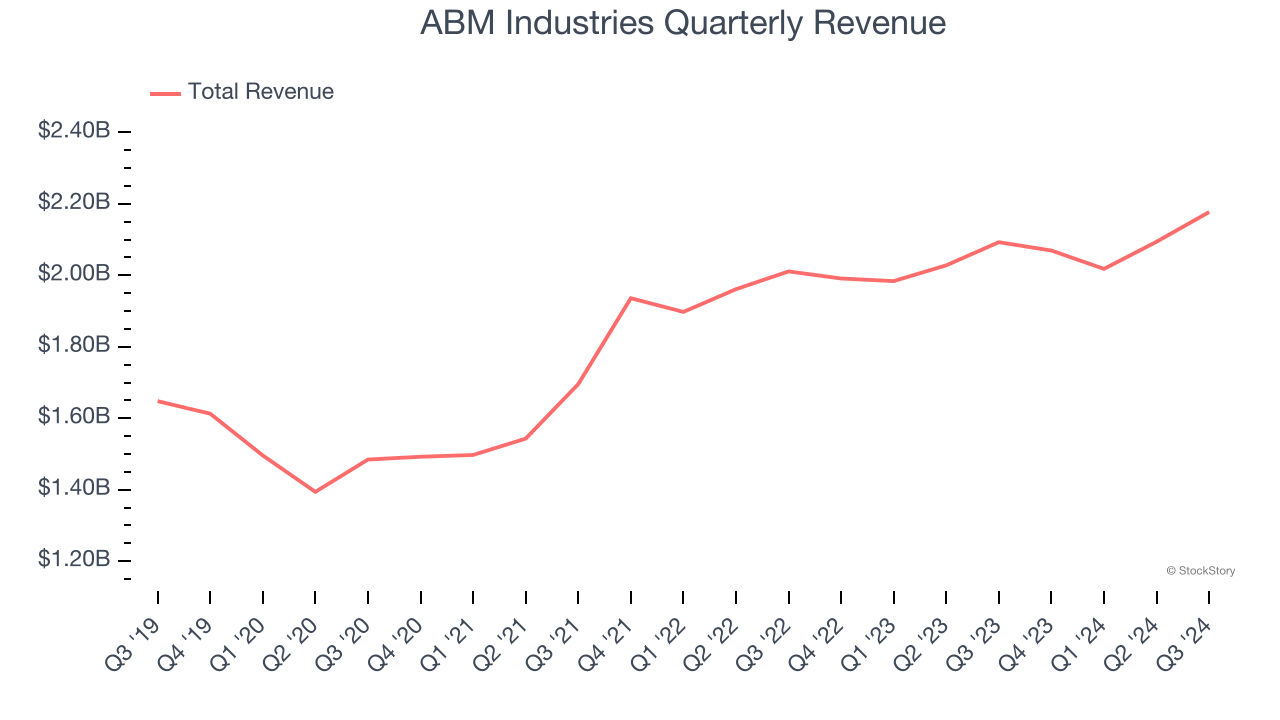

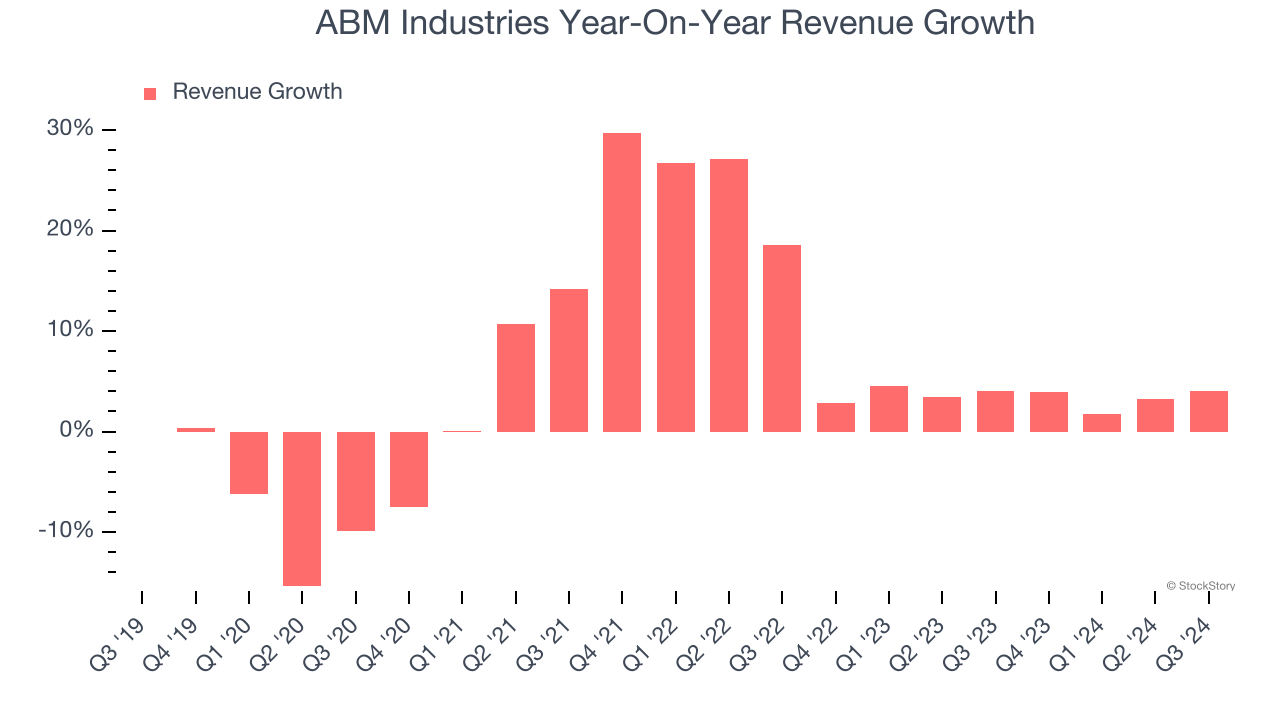

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, ABM Industries’s 5.2% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ABM Industries’s recent history shows its demand slowed as its annualized revenue growth of 3.5% over the last two years is below its five-year trend.

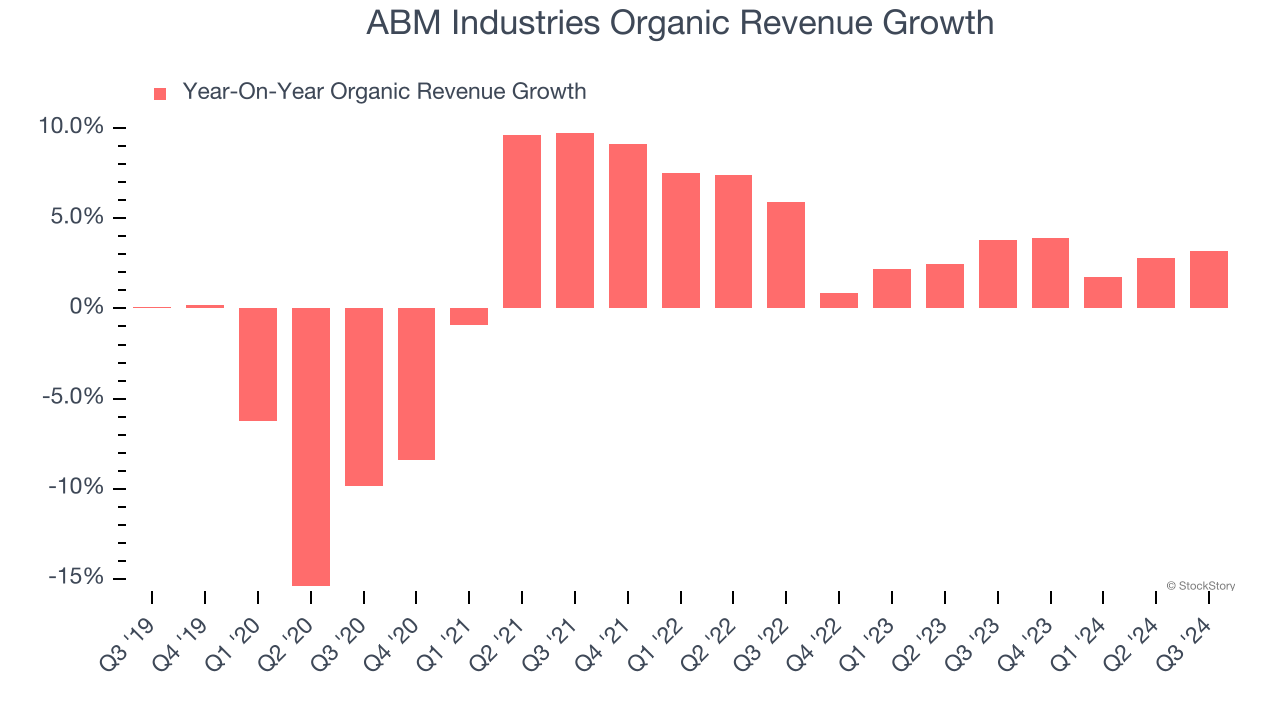

ABM Industries also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, ABM Industries’s organic revenue averaged 2.6% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ABM Industries reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

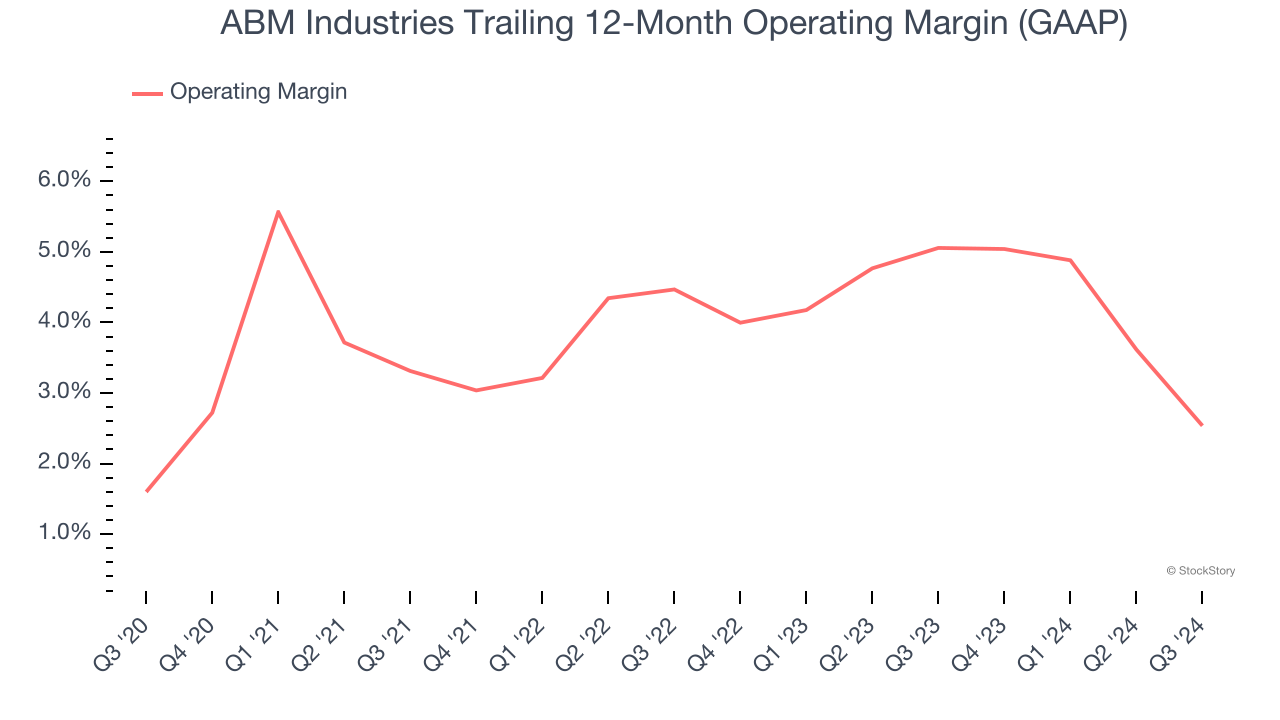

ABM Industries was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, ABM Industries’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q3, ABM Industries’s breakeven margin was down 4.2 percentage points year on year. Since ABM Industries’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

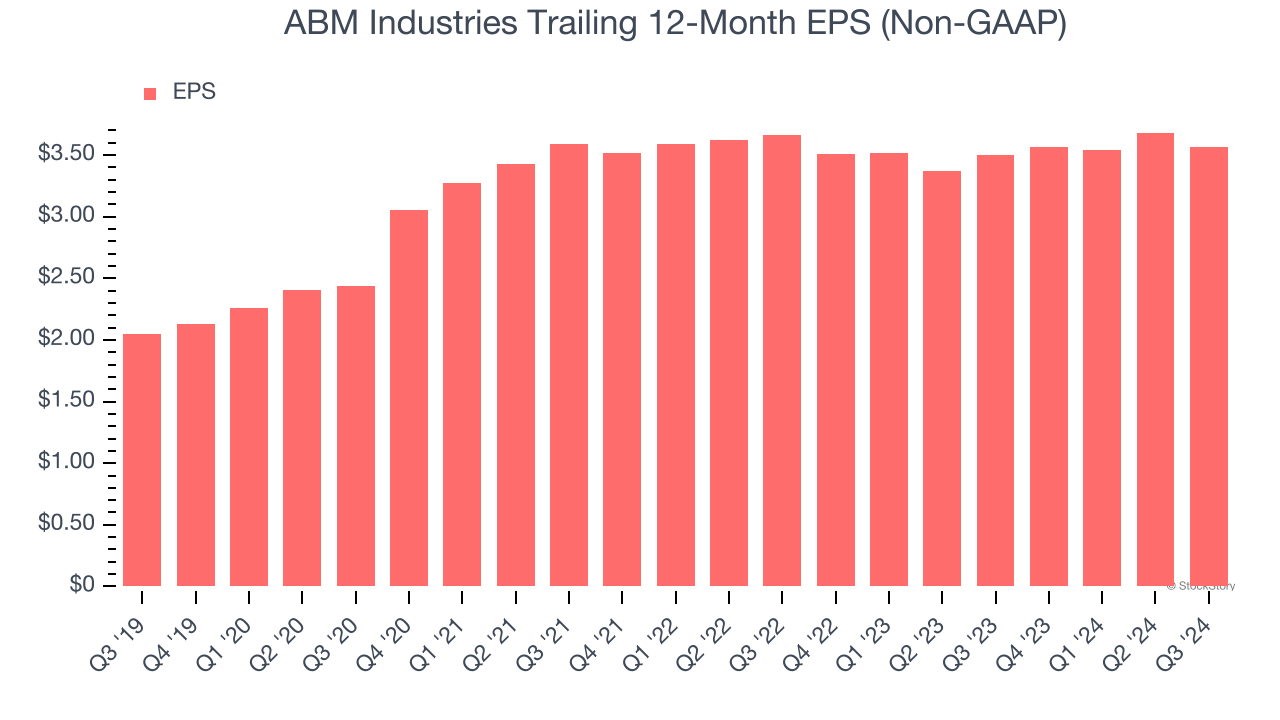

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

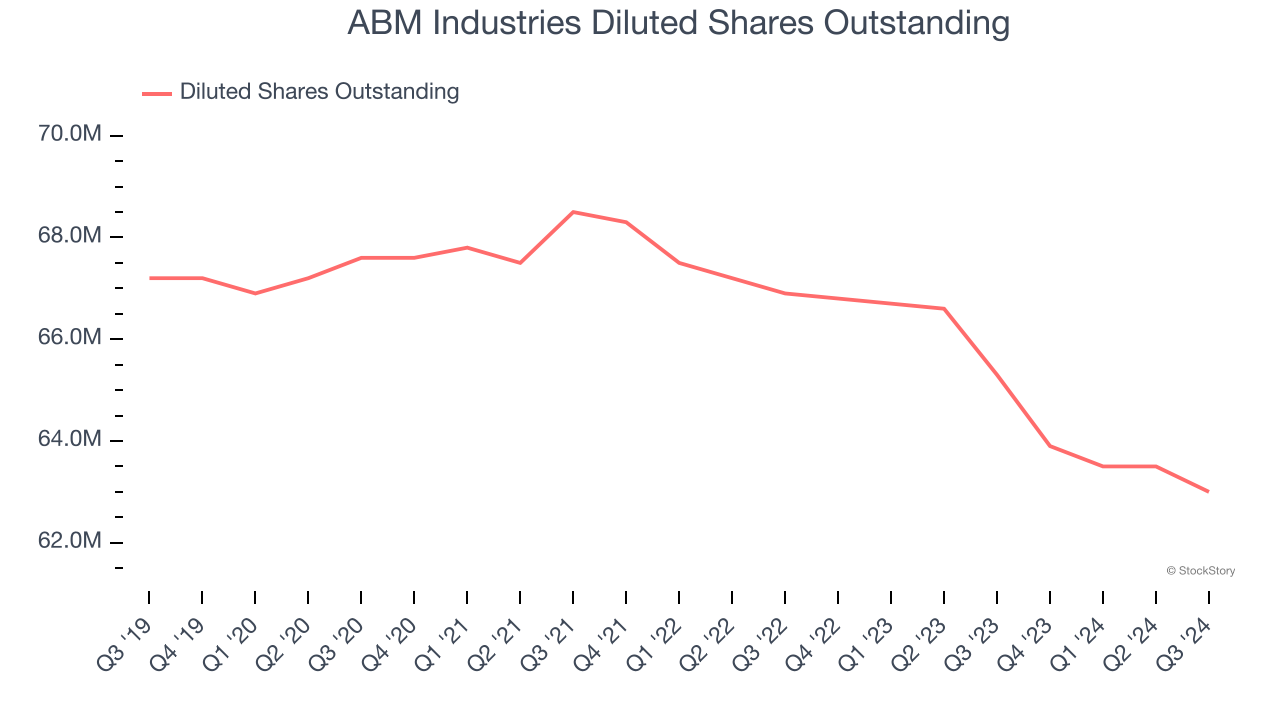

ABM Industries’s EPS grew at a solid 11.7% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into ABM Industries’s earnings quality to better understand the drivers of its performance. A five-year view shows that ABM Industries has repurchased its stock, shrinking its share count by 6.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ABM Industries, its two-year annual EPS declines of 1.3% mark a reversal from its (seemingly) healthy five-year trend. We hope ABM Industries can return to earnings growth in the future.In Q3, ABM Industries reported EPS at $0.90, down from $1.01 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects ABM Industries’s full-year EPS of $3.57 to grow 2.6%.

Key Takeaways from ABM Industries’s Q3 Results

We were impressed by how significantly ABM Industries blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Looking ahead, full year EPS guidance also came in ahead. Zooming out, we think this quarter featured some important positives. The stock remained flat at $55 immediately following the results.

Indeed, ABM Industries had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.