Outdoor equipment company Toro (NYSE: TTC) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 9.4% year on year to $1.08 billion. Its non-GAAP profit of $0.95 per share was in line with analysts’ consensus estimates.

Is now the time to buy The Toro Company? Find out by accessing our full research report, it’s free.

The Toro Company (TTC) Q3 CY2024 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.09 billion (9.4% year-on-year growth, 1.3% miss)

- Adjusted EPS: $0.95 vs analyst estimates of $0.95 (in line)

- Adjusted EBITDA: $114.4 million vs analyst estimates of $167.9 million (10.6% margin, 31.8% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $4.33 at the midpoint, missing analyst estimates by 5.6%

- Operating Margin: 10.1%, in line with the same quarter last year

- Free Cash Flow Margin: 18.6%, up from 11% in the same quarter last year

- Market Capitalization: $8.75 billion

“We delivered our 15th consecutive year of net sales growth in what remained an extremely dynamic environment,” said Richard M. Olson, chairman and chief executive officer.

Company Overview

Ceasing all production to support the war effort during World War II, Toro (NYSE: TTC) offers outdoor equipment for residential, commercial, and agricultural use.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

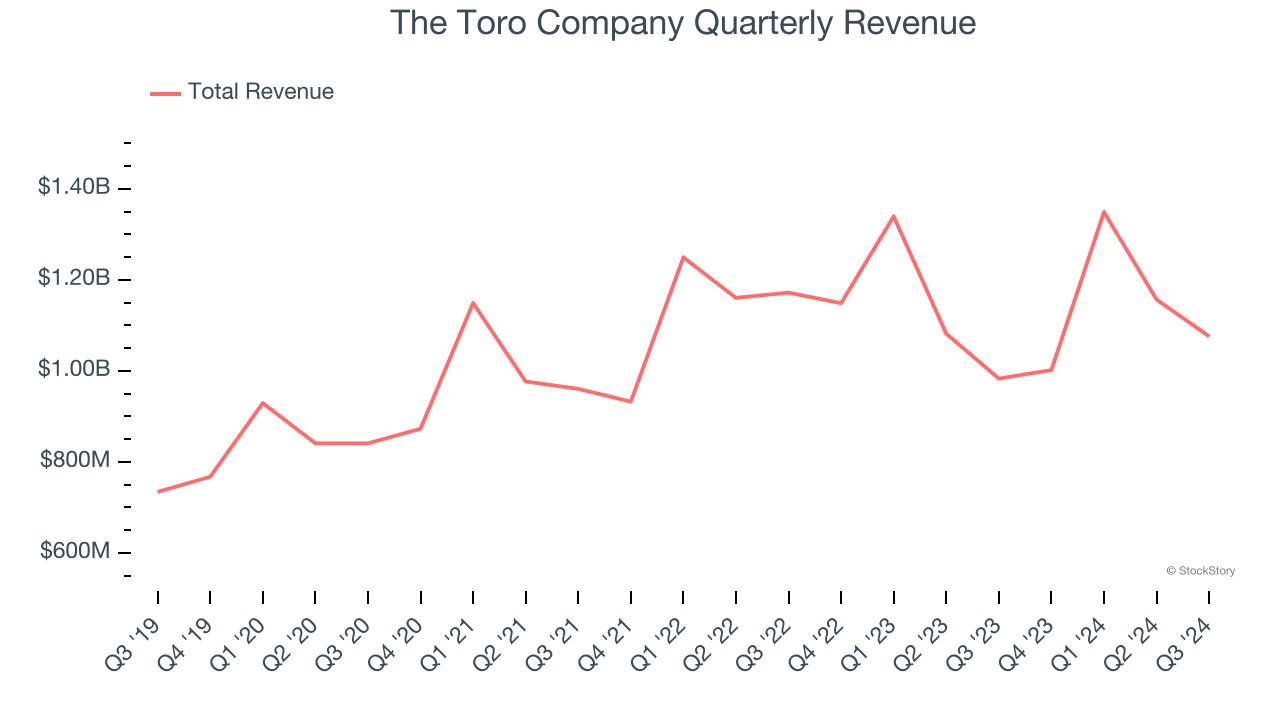

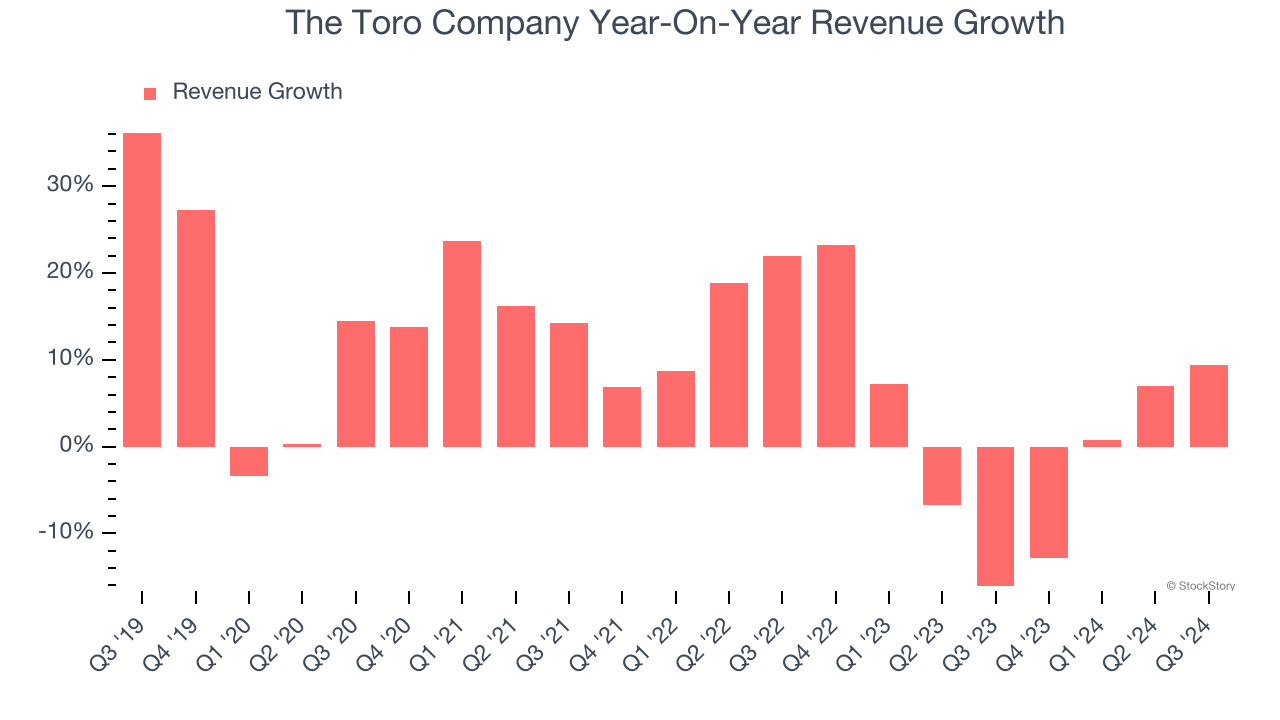

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, The Toro Company grew its sales at a decent 7.9% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. The Toro Company’s recent history shows its demand slowed as its revenue was flat over the last two years.

The Toro Company also breaks out the revenue for its most important segments, Professional and Residential , which are 84.9% and 14.4% of revenue. Over the last two years, The Toro Company’s Professional revenue (sales to contractors) averaged 3% year-on-year growth while its Residential revenue (sales to homeowners) was flat.

This quarter, The Toro Company’s revenue grew by 9.4% year on year to $1.08 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

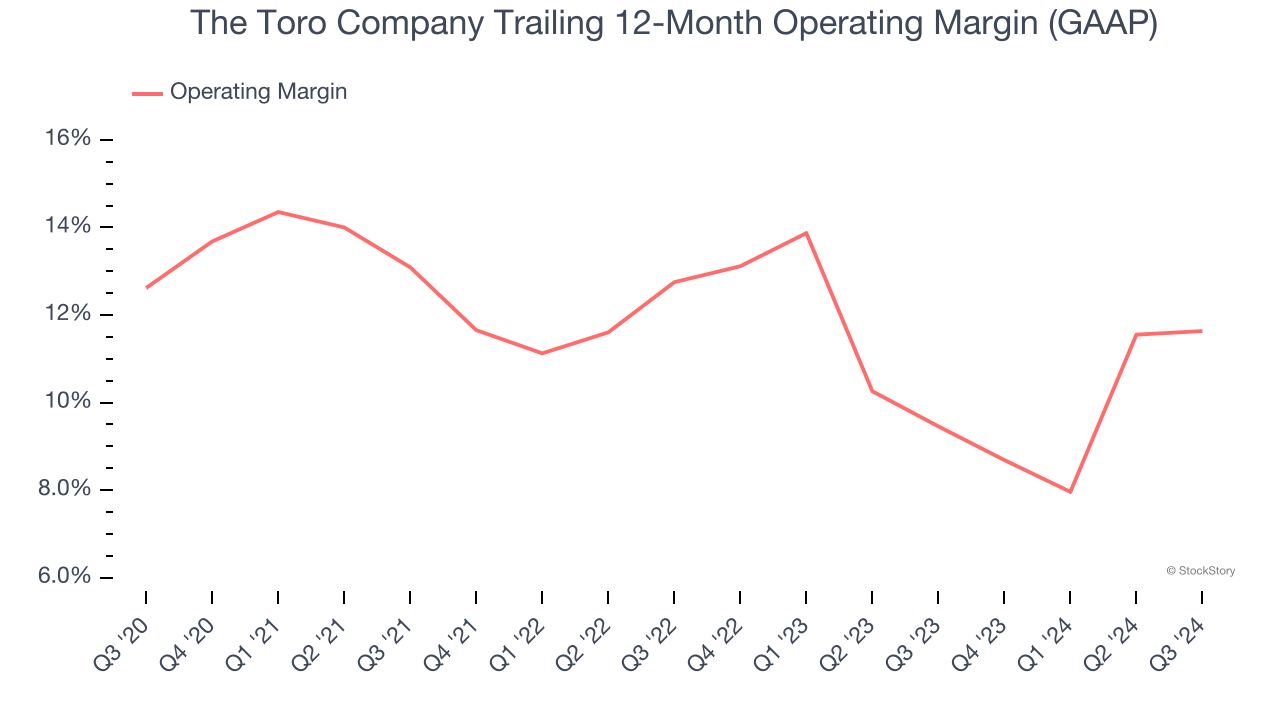

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

The Toro Company has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 11.8%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, The Toro Company’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, The Toro Company generated an operating profit margin of 10.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

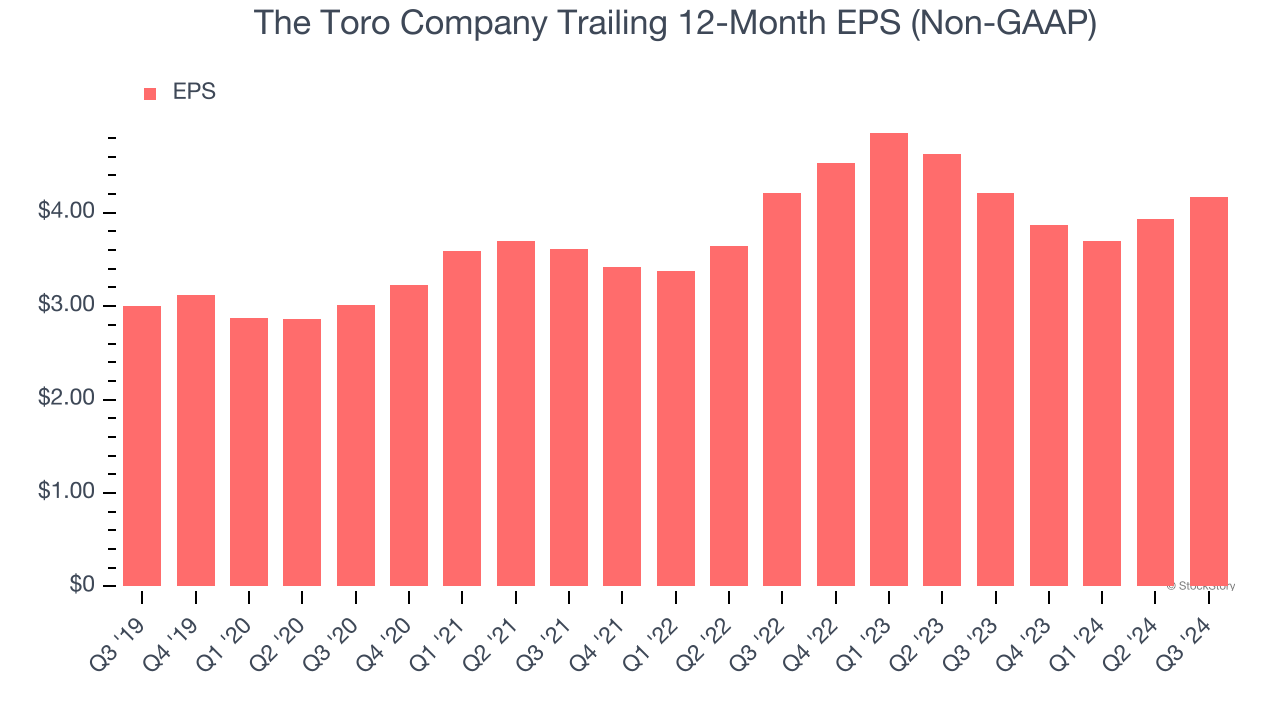

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

The Toro Company’s EPS grew at an unimpressive 6.8% compounded annual growth rate over the last five years, lower than its 7.9% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

The Toro Company’s flat two-year EPS performance was bad and lower than its flat revenue.In Q3, The Toro Company reported EPS at $0.95, up from $0.71 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects The Toro Company’s full-year EPS of $4.17 to grow 11.1%.

Key Takeaways from The Toro Company’s Q3 Results

We struggled to find many resounding positives in these results. Its full-year EPS guidance missed significantly and its revenue in the quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.5% to $78.11 immediately following the results.

The Toro Company’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.