Discount retailer Dollar General (NYSE: DG) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 5% year on year to $10.18 billion. Its GAAP profit of $0.89 per share was 6.2% below analysts’ consensus estimates.

Is now the time to buy Dollar General? Find out by accessing our full research report, it’s free.

Dollar General (DG) Q3 CY2024 Highlights:

- Revenue: $10.18 billion vs analyst estimates of $10.14 billion (5% year-on-year growth, in line)

- Adjusted EPS: $0.89 vs analyst expectations of $0.95 (6.2% miss)

- Adjusted EBITDA: $619.5 million vs analyst estimates of $576 million (6.1% margin, 7.5% beat)

- EPS (GAAP) guidance for the full year is $5.70 at the midpoint, missing analyst estimates by 2.5%

- Operating Margin: 3.2%, down from 4.5% in the same quarter last year

- Free Cash Flow Margin: 2%, similar to the same quarter last year

- Locations: 20,523 at quarter end, up from 19,726 in the same quarter last year

- Same-Store Sales rose 1.3% year on year (-1.3% in the same quarter last year)

- Market Capitalization: $17.48 billion

“We are pleased with our team’s execution in the third quarter, particularly in light of multiple hurricanes that impacted our business,” said Todd Vasos, Dollar General’s CEO.

Company Overview

Appealing to the budget-conscious consumer, Dollar General (NYSE: DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Discount Grocery Store

Traditional grocery stores are go-tos for many families, but discount grocers serve those who may not have a traditional grocery store nearby or who may have different spending thresholds. Certain rural or lower-income areas simply don’t have a grocery store. Additionally, some lower-income families would prefer to buy in smaller quantities than available at most stores (think one or two paper towel rolls at a time). While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of buying food. Furthermore, those buying small quantities for immediate need are even less likely to leverage e-commerce for these purposes.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Dollar General is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth.

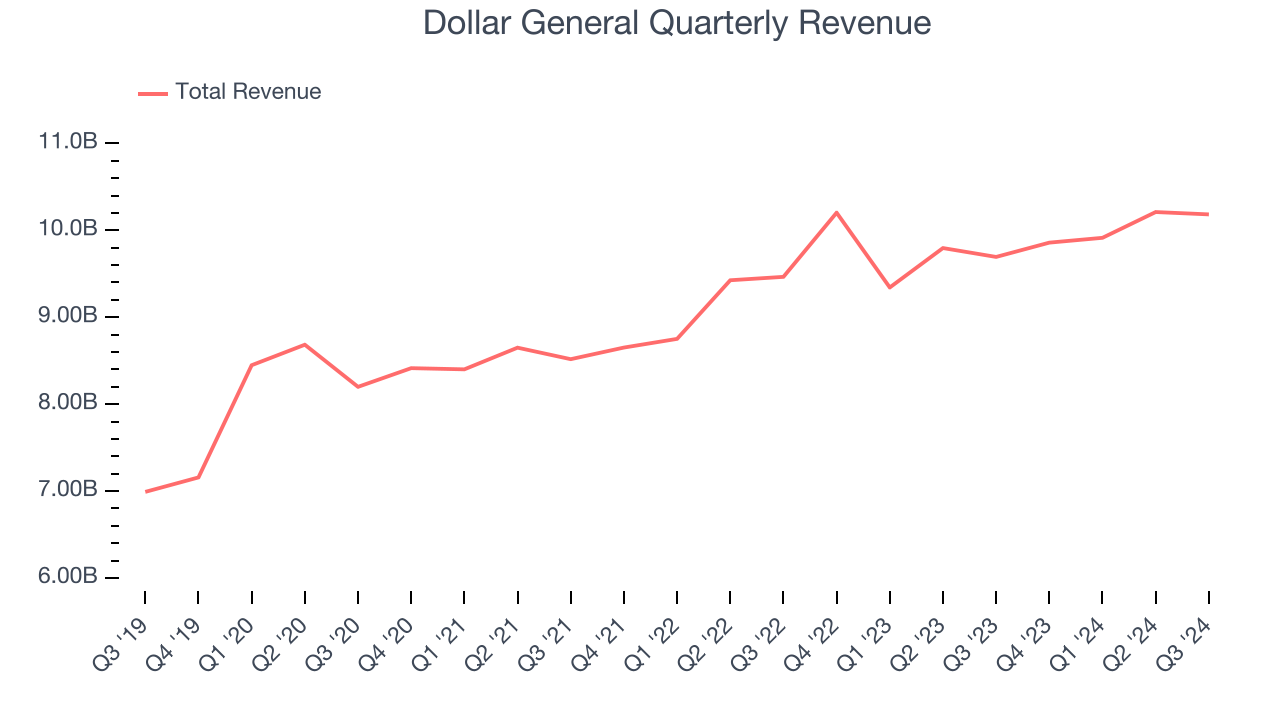

As you can see below, Dollar General’s 8.1% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it barely increased sales at existing, established locations.

This quarter, Dollar General grew its revenue by 5% year on year, and its $10.18 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is satisfactory given its scale and implies the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

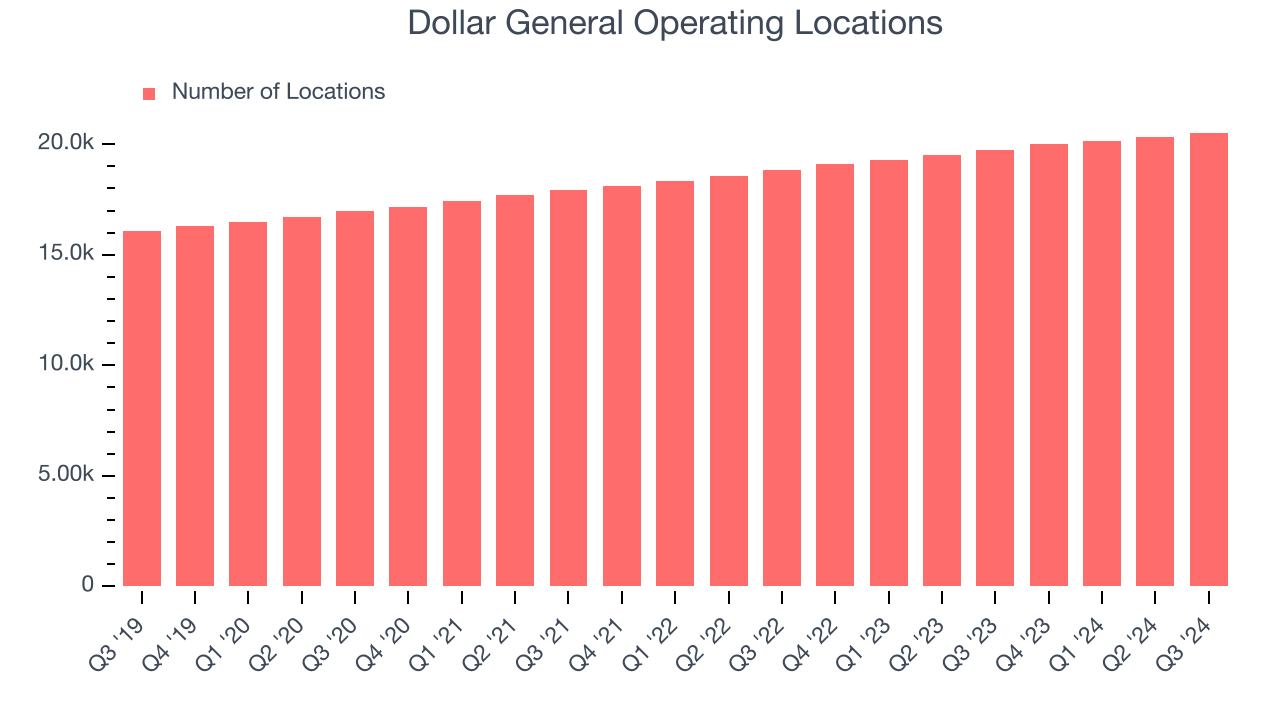

Dollar General operated 20,523 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years and averaged 4.7% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

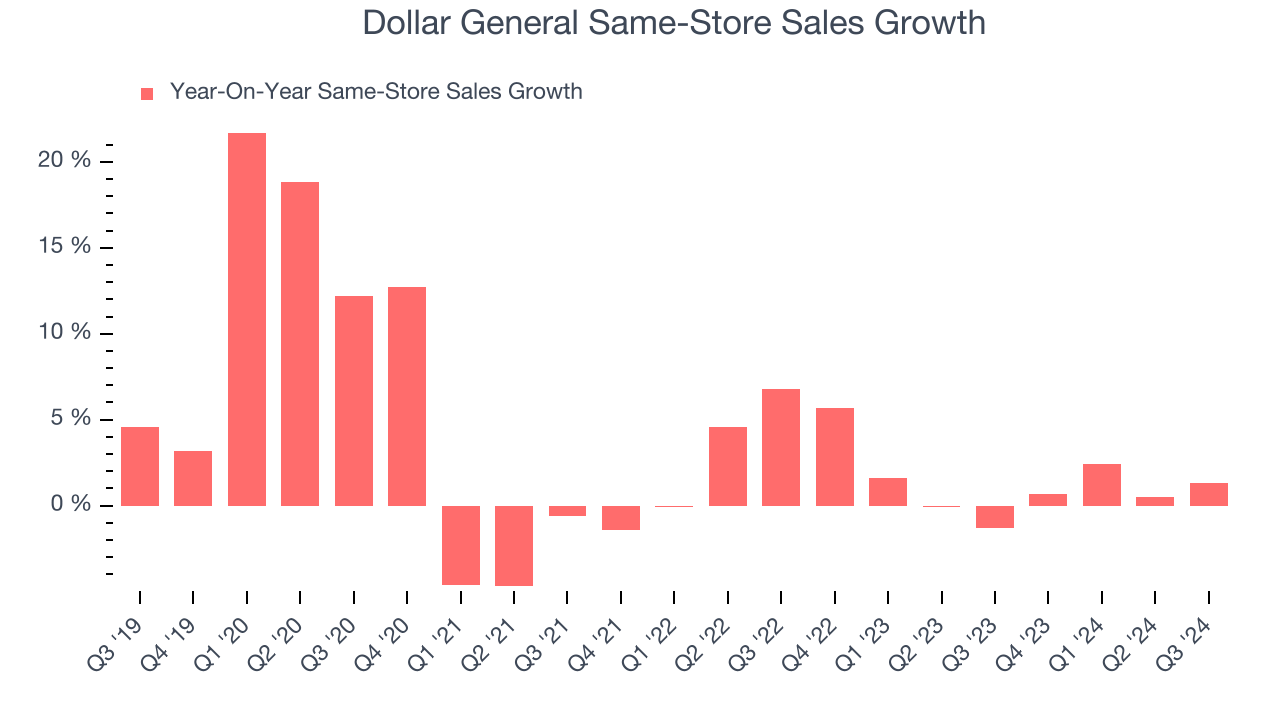

Dollar General’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.4% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Dollar General’s same-store sales rose 1.3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Dollar General’s Q3 Results

We were impressed by how significantly Dollar General blew past analysts’ EBITDA expectations this quarter. We were also happy its gross margin narrowly outperformed Wall Street’s estimates. On the other hand, its EPS and full-year EPS guidance missed Wall Street’s estimates. Overall, this quarter was mixed but still had some key positives. The stock traded up 1.8% to $81.01 immediately after reporting.

Is Dollar General an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.