What a fantastic six months it’s been for Robinhood. Shares of the company have skyrocketed 76.8%, hitting $41.40. This performance may have investors wondering how to approach the situation.

Is it too late to buy HOOD? Find out in our full research report, it’s free.

Why Are We Positive On HOOD?

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

1. Eye-Popping Growth in Customer Spending

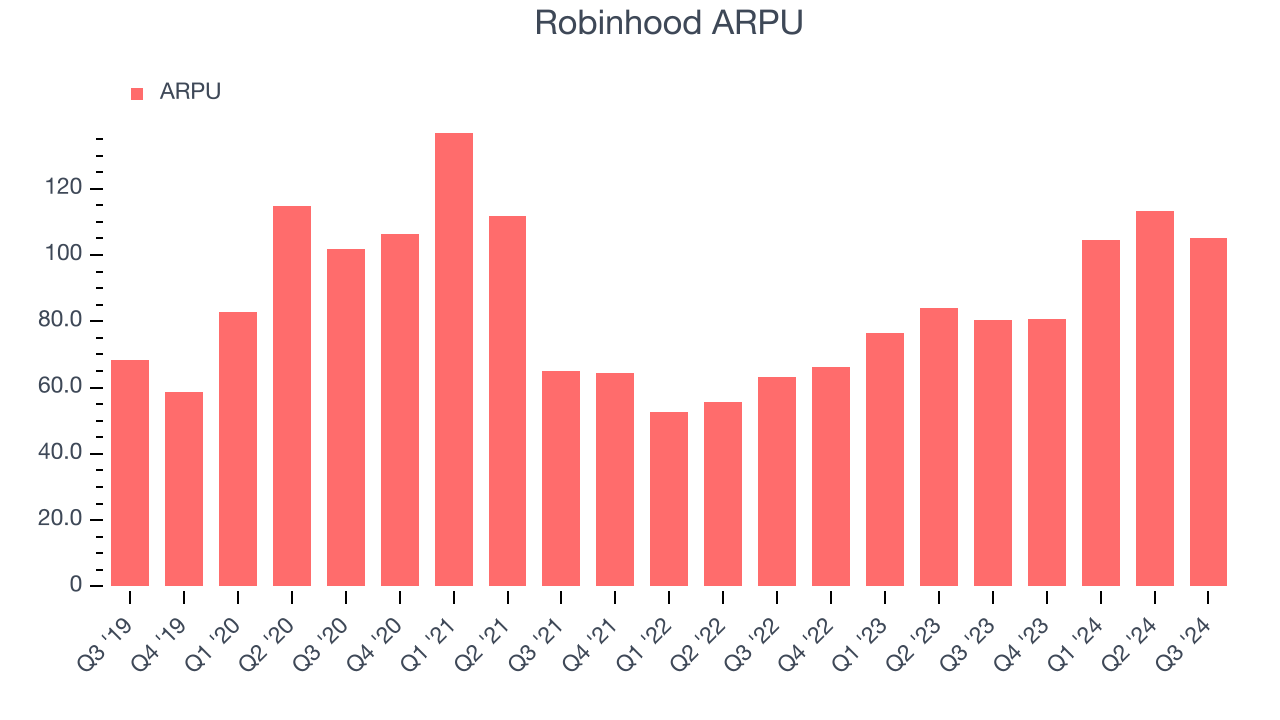

Average revenue per user (ARPU) is a critical metric to track for fintech businesses like Robinhood because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on its platform and Robinhood’s take rate, or "cut", on each transaction.

Robinhood’s ARPU growth has been exceptional over the last two years, averaging 31.4%. Its ability to increase monetization while growing its funded customers demonstrates its platform’s value, as its users are spending significantly more than last year.

2. Elite Brand Reduces Need for Marketing Campaigns

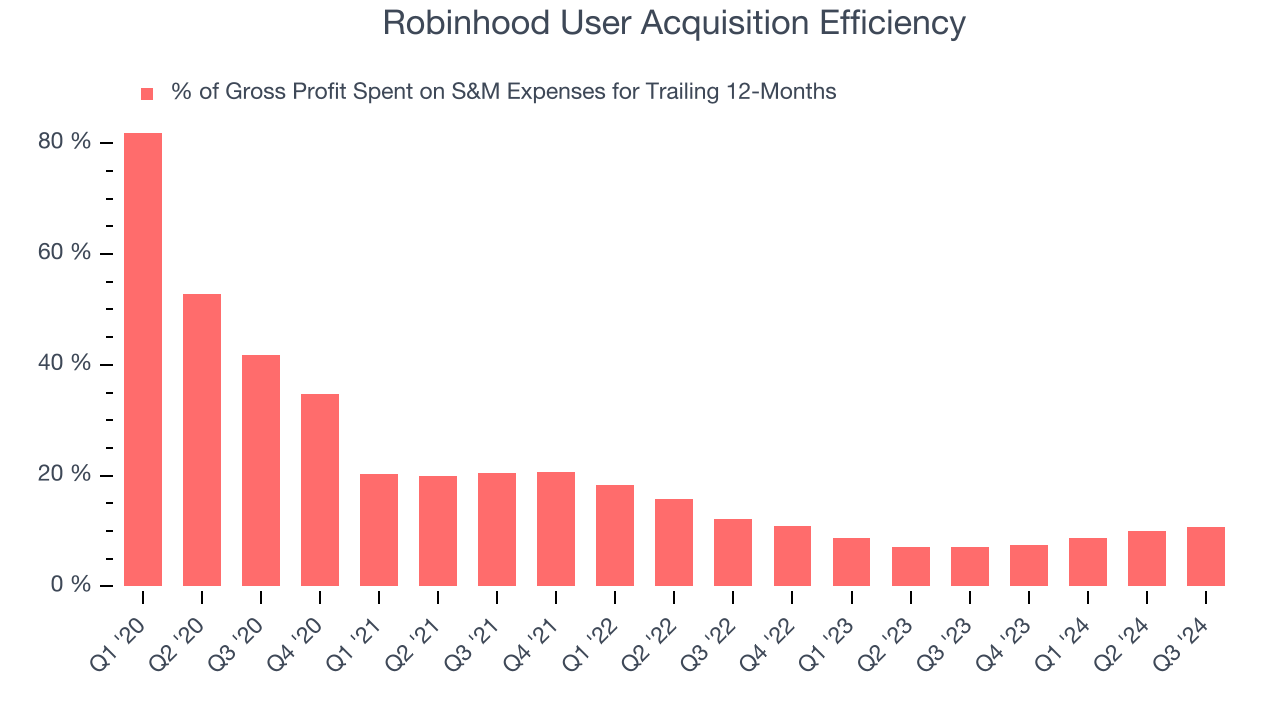

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Robinhood grow from a combination of product virality, paid advertisement, and incentives.

Robinhood is extremely efficient at acquiring new users, spending only 10.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Robinhood the freedom to invest its resources into new growth initiatives while maintaining optionality.

3. Outstanding Long-Term EPS Growth

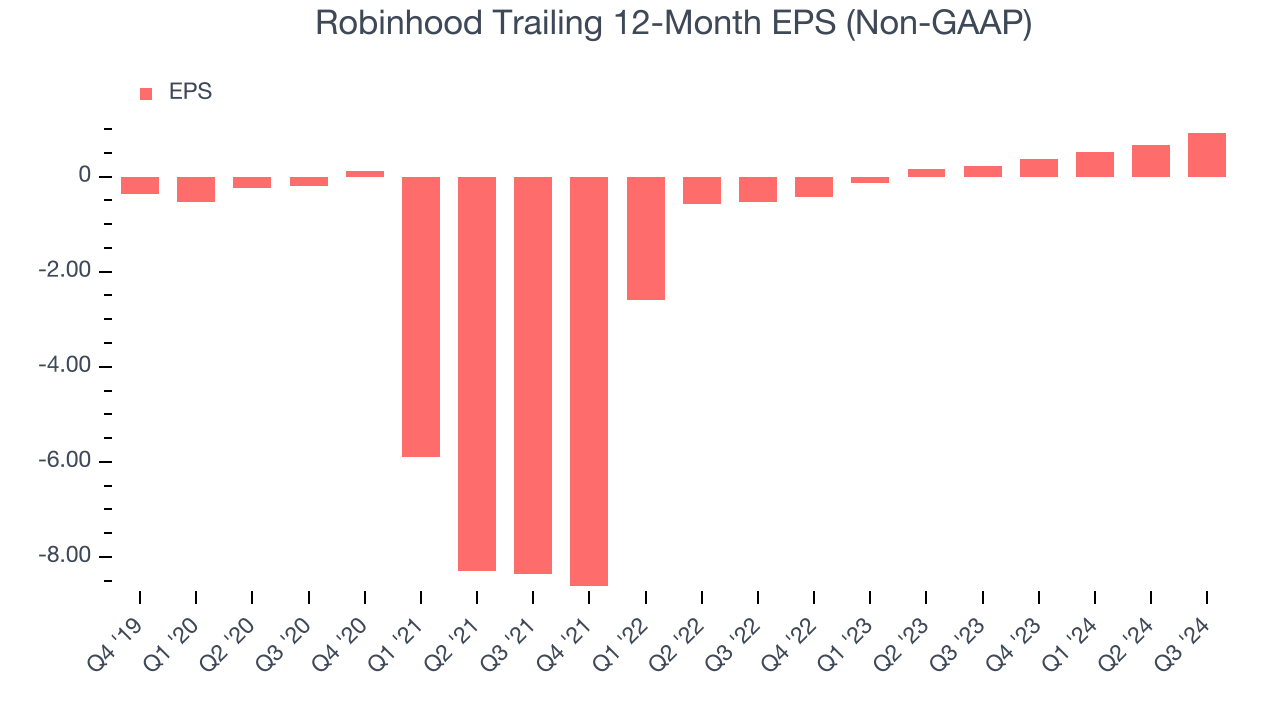

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Robinhood’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons Robinhood is a rock-solid business worth owning, and with the recent rally, the stock trades at 34.3× forward EV-to-EBITDA (or $41.40 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Robinhood

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.