Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at TransUnion (NYSE: TRU) and its peers.

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

The 9 data & business process services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

While some data & business process services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.5% since the latest earnings results.

TransUnion (NYSE: TRU)

One of the three major credit bureaus in the United States alongside Equifax and Experian, TransUnion (NYSE: TRU) is a global information and insights company that provides credit reports, fraud prevention tools, and data analytics to help businesses make decisions and consumers manage their financial health.

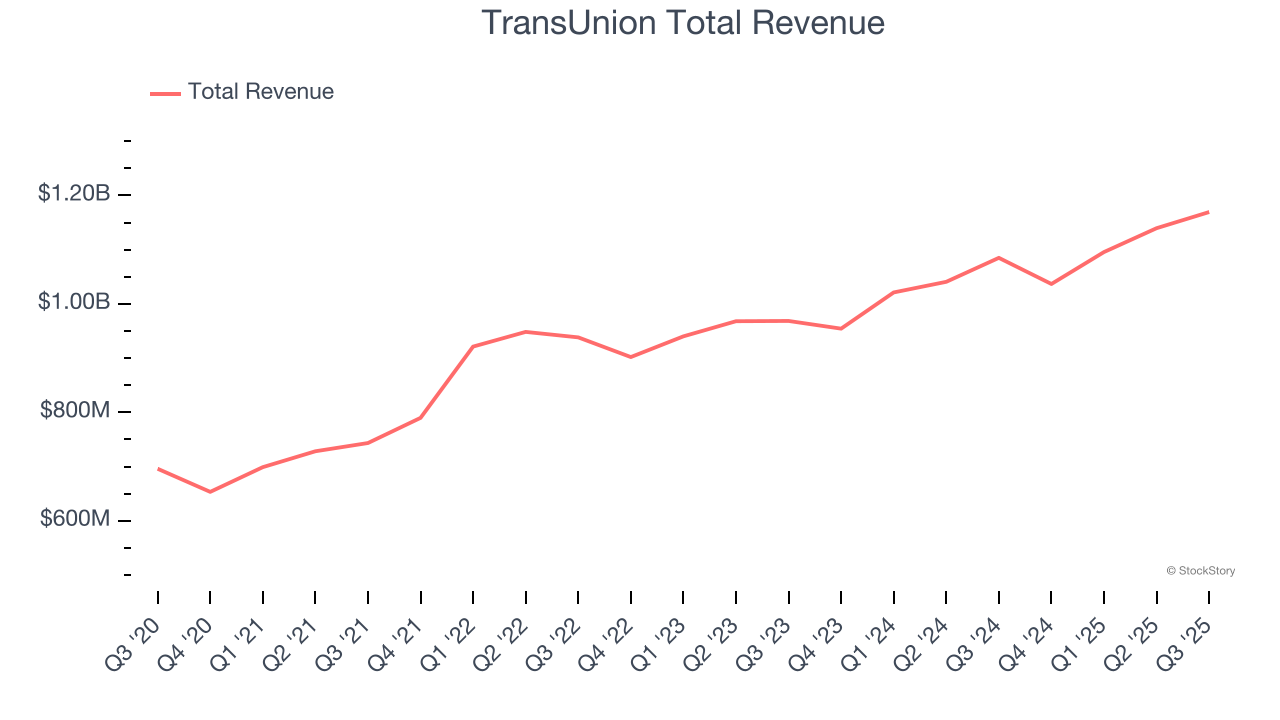

TransUnion reported revenues of $1.17 billion, up 7.8% year on year. This print exceeded analysts’ expectations by 3.2%. Overall, it was a strong quarter for the company with revenue guidance for next quarter beating analysts’ expectations and an impressive beat of analysts’ revenue estimates.

“In the third quarter, TransUnion delivered strong results that again exceeded financial guidance,” said Chris Cartwright, President and CEO.

TransUnion achieved the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 1.8% since reporting and currently trades at $82.13.

Is now the time to buy TransUnion? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Broadridge (NYSE: BR)

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE: BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

Broadridge reported revenues of $1.59 billion, up 11.7% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Broadridge scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.7% since reporting. It currently trades at $229.46.

Is now the time to buy Broadridge? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Verisk (NASDAQ: VRSK)

Processing over 2.8 billion insurance transaction records annually through one of the world's largest private databases, Verisk Analytics (NASDAQ: VRSK) provides data, analytics, and technology solutions that help insurance companies assess risk, detect fraud, and make better business decisions.

Verisk reported revenues of $768.3 million, up 5.9% year on year, falling short of analysts’ expectations by 1.1%. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations and a slight miss of analysts’ revenue estimates.

Verisk delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.7% since the results and currently trades at $219.07.

Read our full analysis of Verisk’s results here.

CSG (NASDAQ: CSGS)

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ: CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

CSG reported revenues of $303.6 million, up 2.9% year on year. This number met analysts’ expectations. It was a very strong quarter as it also recorded a beat of analysts’ EPS estimates.

CSG had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $78.47.

Read our full, actionable report on CSG here, it’s free for active Edge members.

CoStar (NASDAQ: CSGP)

With a research department that makes over 10,000 property updates daily to its 35-year-old database, CoStar Group (NASDAQ: CSGP) provides comprehensive real estate data, analytics, and online marketplaces for commercial and residential properties in the U.S. and U.K.

CoStar reported revenues of $833.6 million, up 20.4% year on year. This result beat analysts’ expectations by 2.4%. Overall, it was a strong quarter as it also produced a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

CoStar achieved the fastest revenue growth among its peers. The stock is down 12.3% since reporting and currently trades at $68.64.

Read our full, actionable report on CoStar here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.