What a time it’s been for AeroVironment. In the past six months alone, the company’s stock price has increased by a massive 106%, reaching $328.82 per share. This run-up might have investors contemplating their next move.

Is now the time to buy AeroVironment, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is AeroVironment Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in AeroVironment. Here are three reasons why AVAV doesn't excite us and a stock we'd rather own.

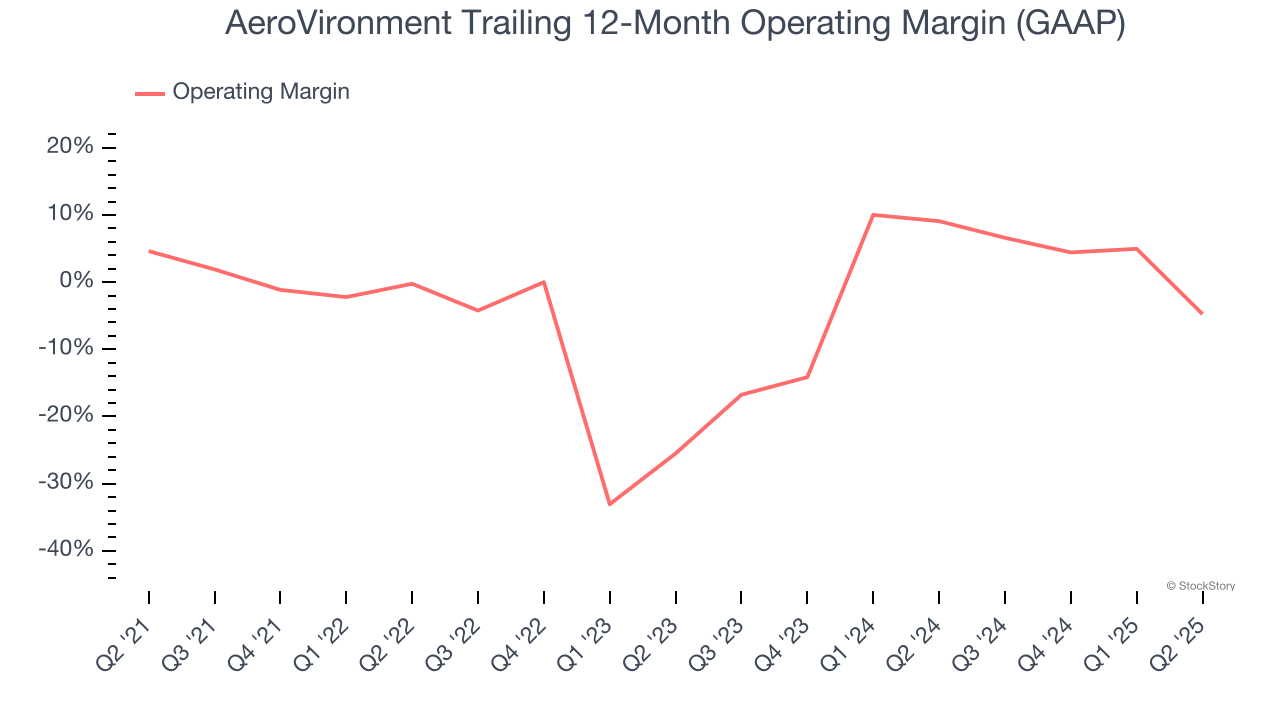

1. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, AeroVironment’s operating margin decreased by 9.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. AeroVironment’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 4.7%.

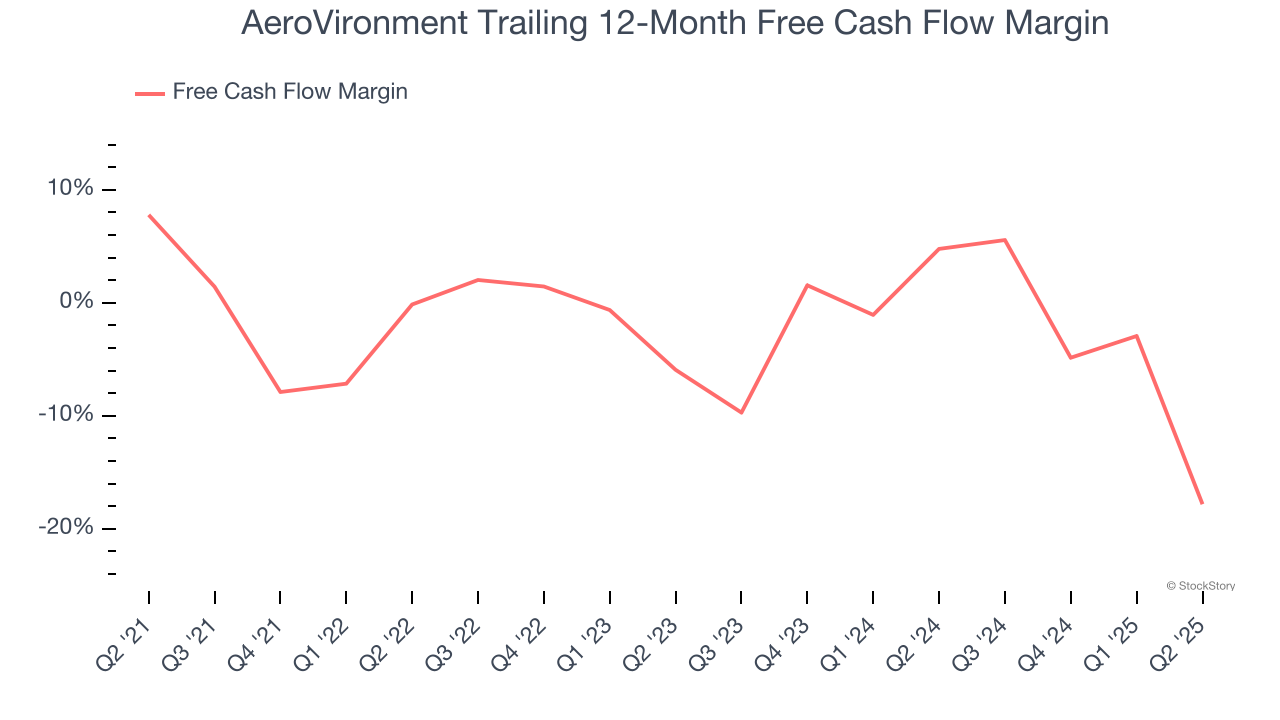

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, AeroVironment’s margin dropped by 25.6 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business. AeroVironment’s free cash flow margin for the trailing 12 months was negative 17.8%.

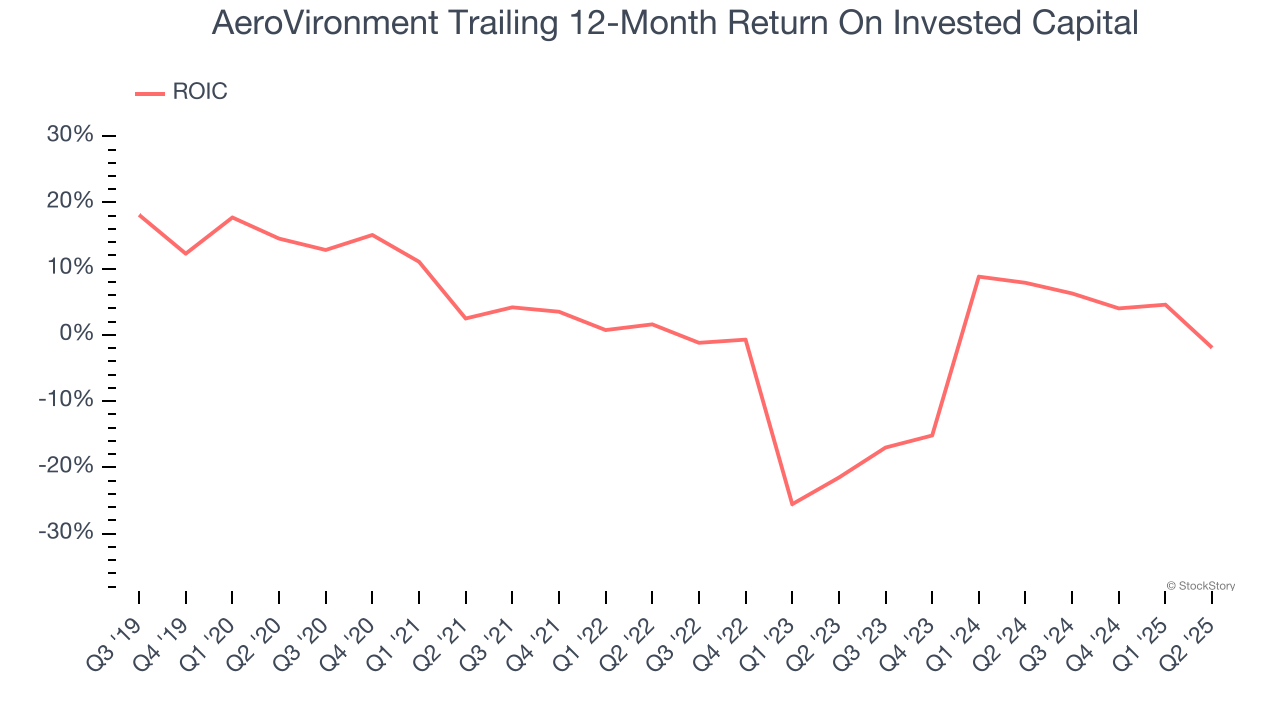

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AeroVironment’s five-year average ROIC was negative 2.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

Final Judgment

AeroVironment isn’t a terrible business, but it doesn’t pass our bar. Following the recent surge, the stock trades at 76.9× forward P/E (or $328.82 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.