As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the shelf-stable food industry, including Hain Celestial (NASDAQ: HAIN) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 20 shelf-stable food stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.9%.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.4% since the latest earnings results.

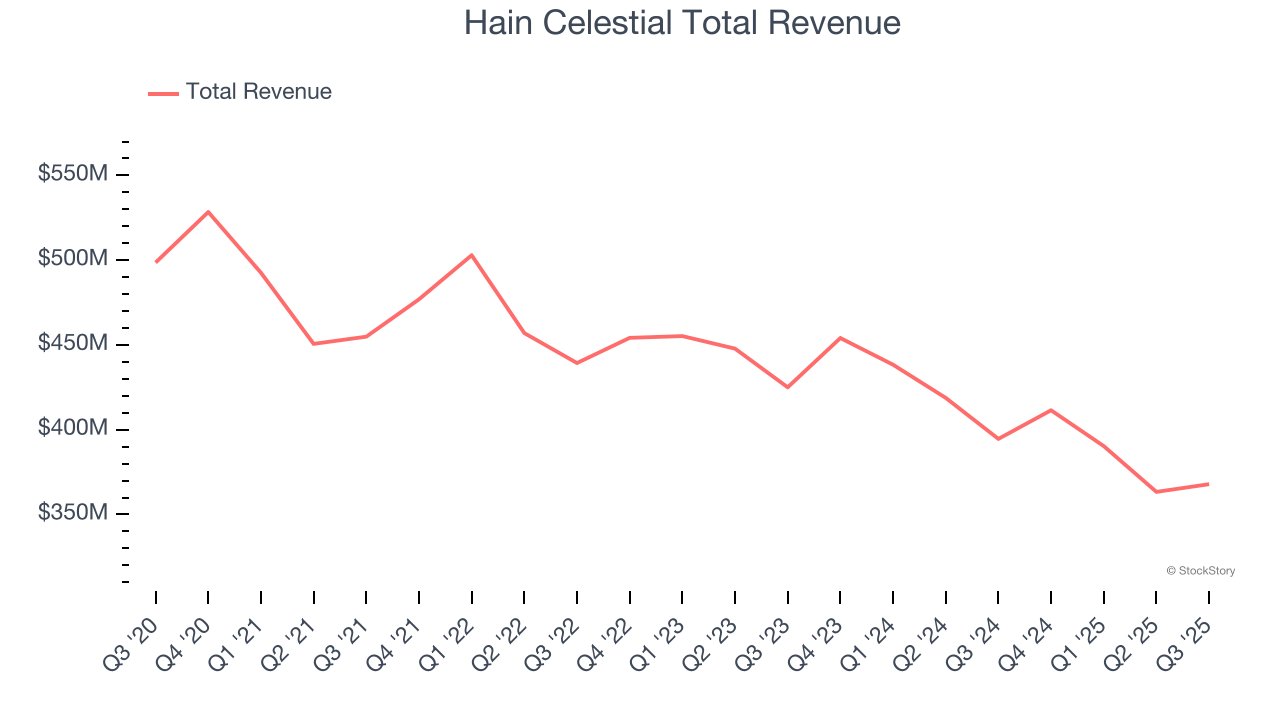

Hain Celestial (NASDAQ: HAIN)

Sold in over 75 countries around the world, Hain Celestial (NASDAQ: HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $367.9 million, down 6.8% year on year. This print exceeded analysts’ expectations by 2.1%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

"First quarter results met our expectations on the top- and bottom-line. During the quarter, organic net sales trends demonstrated sequential improvement in both our North America and International segments. Cost discipline and the decisive actions taken to streamline our cost structure drove a reduction in SG&A, and we are seeing early results from the execution against our ‘5 actions to win’, including benefits from pricing initiatives beginning to build,” said Alison Lewis, interim President and CEO.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $1.08.

Read our full report on Hain Celestial here, it’s free for active Edge members.

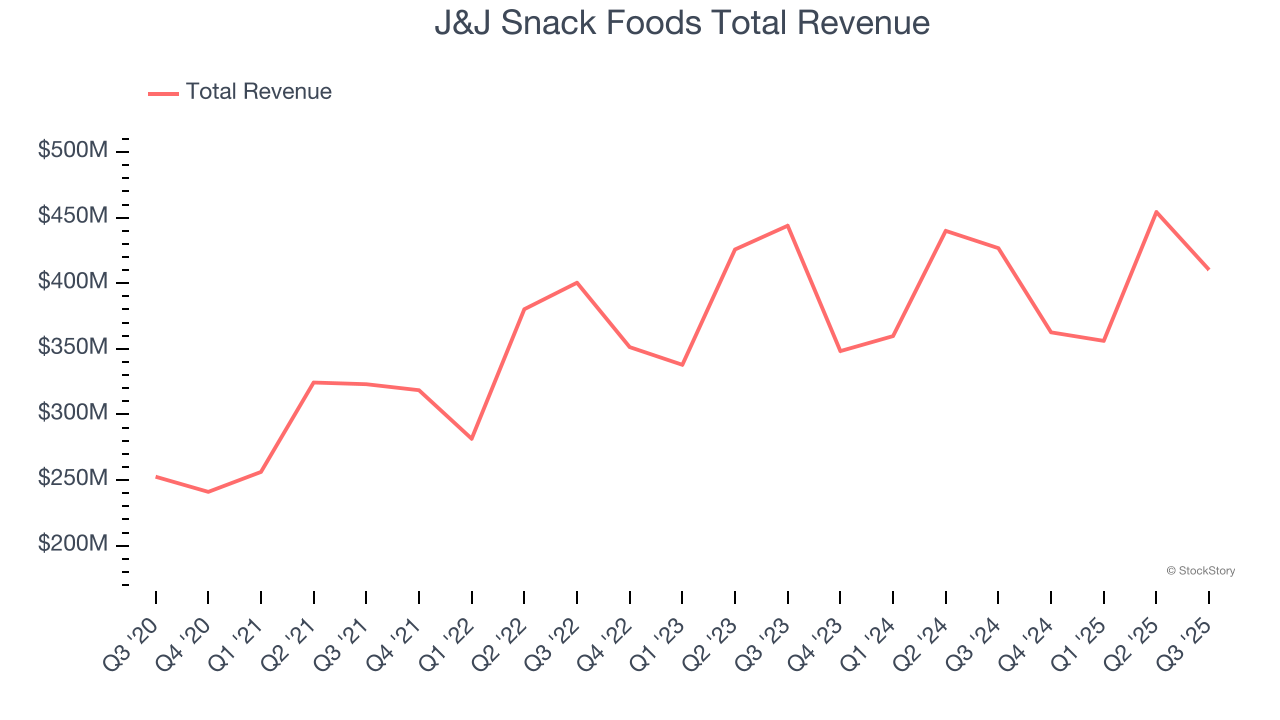

Best Q3: J&J Snack Foods (NASDAQ: JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $410.2 million, down 3.9% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and EPS estimates.

The market seems happy with the results as the stock is up 8.1% since reporting. It currently trades at $89.84.

Is now the time to buy J&J Snack Foods? Access our full analysis of the earnings results here, it’s free for active Edge members.

TreeHouse Foods (NYSE: THS)

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE: THS) produces a wide range of private-label foods for grocery and food service customers.

TreeHouse Foods reported revenues of $841.9 million, down 1.5% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ gross margin estimates.

Interestingly, the stock is up 24.3% since the results and currently trades at $23.69.

Read our full analysis of TreeHouse Foods’s results here.

McCormick (NYSE: MKC)

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE: MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

McCormick reported revenues of $1.72 billion, up 2.7% year on year. This result topped analysts’ expectations by 1.1%. Taking a step back, it was a mixed quarter as it also recorded a narrow beat of analysts’ revenue estimates but a miss of analysts’ gross margin estimates.

The stock is flat since reporting and currently trades at $68.24.

Read our full, actionable report on McCormick here, it’s free for active Edge members.

Simply Good Foods (NASDAQ: SMPL)

Best known for its Atkins brand that was inspired by the popular diet of the same name, Simply Good Foods (NASDAQ: SMPL) is a packaged food company whose offerings help customers achieve their healthy eating or weight loss goals.

Simply Good Foods reported revenues of $369 million, down 1.8% year on year. This number met analysts’ expectations. However, it was a slower quarter as it recorded a miss of analysts’ EBITDA estimates and a miss of analysts’ gross margin estimates.

The stock is down 20.5% since reporting and currently trades at $19.85.

Read our full, actionable report on Simply Good Foods here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.