The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how ResMed (NYSE: RMD) and the rest of the patient monitoring stocks fared in Q4.

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

The 5 patient monitoring stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.2% since the latest earnings results.

ResMed (NYSE: RMD)

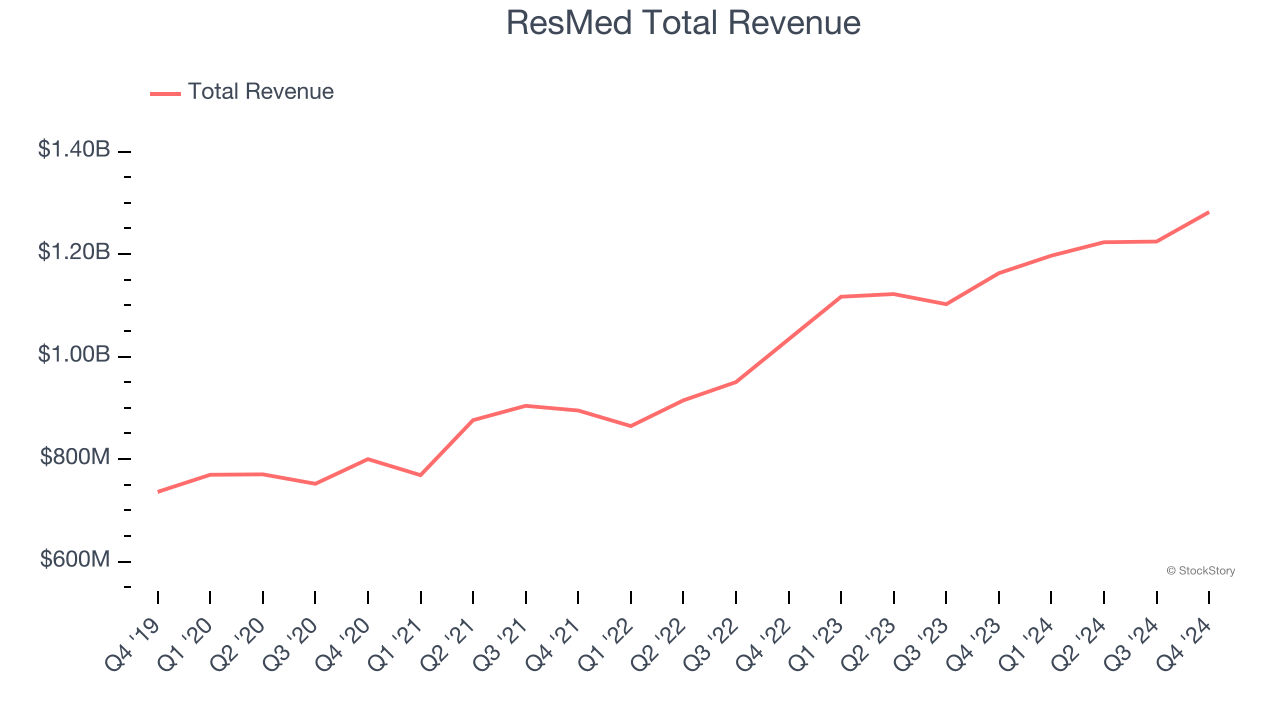

Founded in 1989 in Australia, ResMed (NYSE: RMD) is a medical device company specializing in products for chronic health conditions like sleep apnea, asthma, neuromuscular disorders, and others.

ResMed reported revenues of $1.28 billion, up 10.3% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a strong quarter for the company with a narrow beat of analysts’ constant currency revenue estimates and a decent beat of analysts’ EPS estimates.

“Our second quarter fiscal year 2025 top-line growth, margin expansion, and double-digit EPS growth were the result of increased demand for our sleep health and breathing health products and digital health solutions that people love, as well as our laser-focus on operational excellence,” said ResMed’s Chairman and CEO, Mick Farrell.

The stock is down 8.4% since reporting and currently trades at $236.01.

We think ResMed is a good business, but is it a buy today? Read our full report here, it’s free.

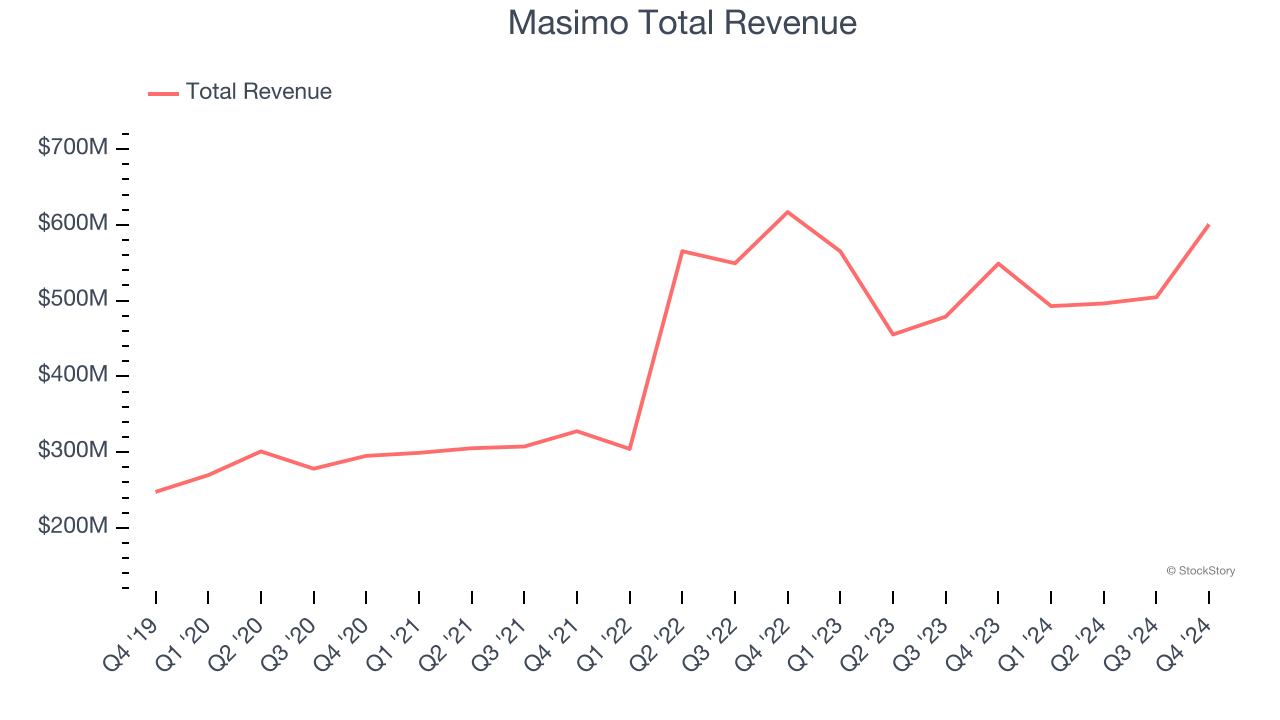

Best Q4: Masimo (NASDAQ: MASI)

Founded in 1989, Masimo Corporation (NASDAQ: MASI) develops and manufactures medical devices, with a focus on noninvasive monitoring technologies.

Masimo reported revenues of $600.7 million, up 9.4% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and full-year operating income guidance exceeding analysts’ expectations.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.1% since reporting. It currently trades at $165.50.

Is now the time to buy Masimo? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: DexCom (NASDAQ: DXCM)

Founded in 1999 to address the demand for non-invasive diabetes treatments, DexCom (NASDAQ: DXCM) is a medical technology company known for its glucose monitoring systems for people with diabetes.

DexCom reported revenues of $1.11 billion, up 7.6% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

DexCom delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 15.3% since the results and currently trades at $71.22.

Read our full analysis of DexCom’s results here.

iRhythm (NASDAQ: IRTC)

Founded in 2006, iRhythm Technologies (NASDAQ: IRTC) develops and markets wearable cardiac monitoring devices, focusing on diagnosing and managing heart arrhythmias (irregular heartbeats).

iRhythm reported revenues of $164.3 million, up 24% year on year. This number beat analysts’ expectations by 3.9%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ EPS estimates.

iRhythm achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 12.8% since reporting and currently trades at $98.01.

Read our full, actionable report on iRhythm here, it’s free.

Insulet (NASDAQ: PODD)

Founded in 2000, Insulet Corporation (NASDAQ: PODD) designs and manufactures insulin delivery systems, with a focus on improving diabetes management through its Omnipod platform.

Insulet reported revenues of $597.5 million, up 17.2% year on year. This result surpassed analysts’ expectations by 2.5%. It was a very strong quarter as it also put up an impressive beat of analysts’ constant currency revenue and EPS estimates.

The stock is down 17.6% since reporting and currently trades at $237.57.

Read our full, actionable report on Insulet here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.