Dun & Bradstreet’s stock price has taken a beating over the past six months, shedding 22.3% of its value and falling to $8.94 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Dun & Bradstreet, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on Dun & Bradstreet for now. Here are three reasons why we avoid DNB and a stock we'd rather own.

Why Is Dun & Bradstreet Not Exciting?

Known for its proprietary D-U-N-S Number that serves as a unique identifier for businesses worldwide, Dun & Bradstreet (NYSE: DNB) provides business decisioning data and analytics that help companies evaluate credit risks, verify suppliers, enhance sales productivity, and gain market visibility.

1. Lackluster Revenue Growth

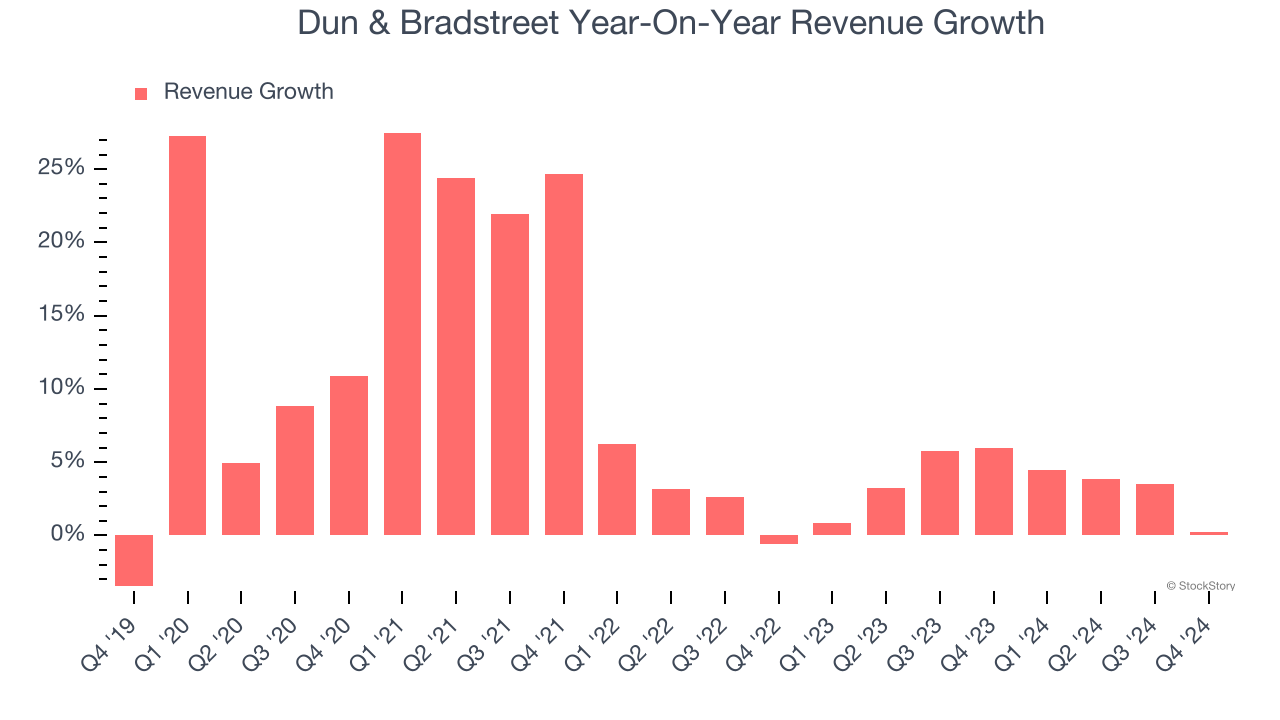

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Dun & Bradstreet’s recent performance shows its demand has slowed as its annualized revenue growth of 3.5% over the last two years was below its five-year trend.

2. EPS Growth Has Stalled Over the Last Two Years

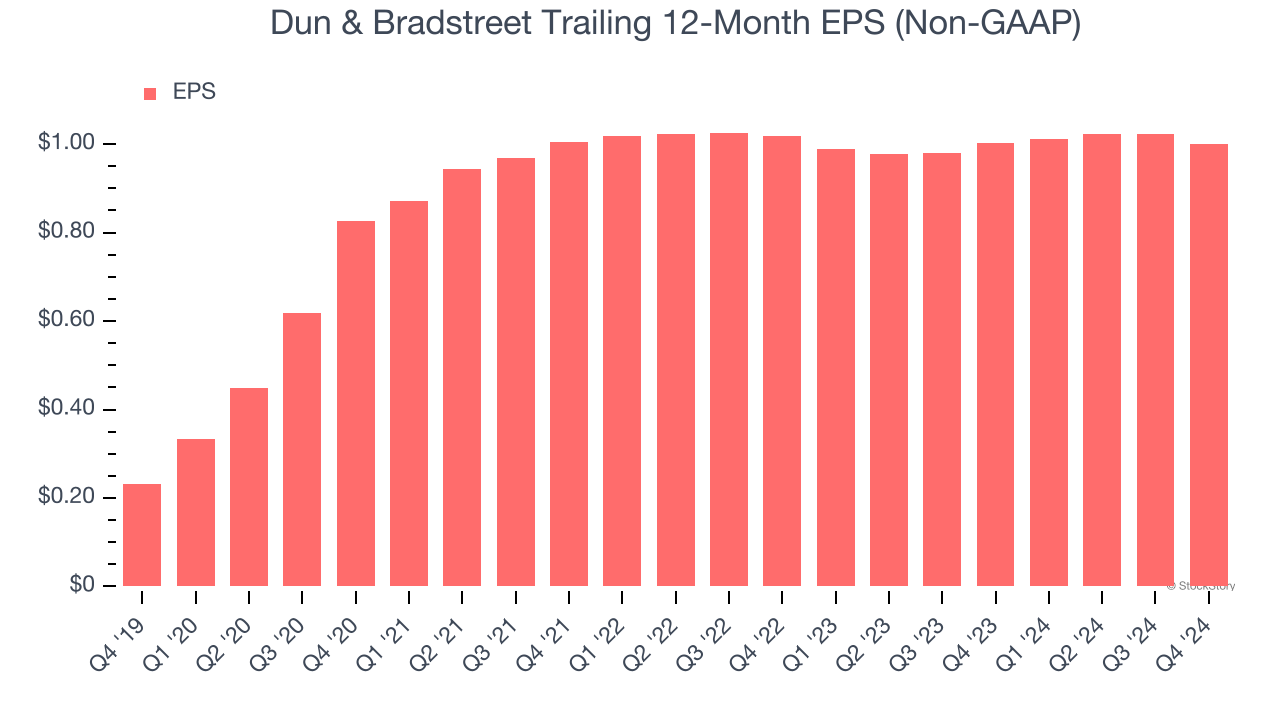

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Dun & Bradstreet’s flat EPS over the last two years was worse than its 3.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Dun & Bradstreet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.2%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

Dun & Bradstreet isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 8.2× forward price-to-earnings (or $8.94 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Dun & Bradstreet

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.