The Hanover Insurance Group trades at $166.12 and has moved in lockstep with the market. Its shares have returned 6% over the last six months while the S&P 500 has gained 5.4%.

Is there a buying opportunity in The Hanover Insurance Group, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is The Hanover Insurance Group Not Exciting?

We're sitting this one out for now. Here are three reasons why we avoid THG and a stock we'd rather own.

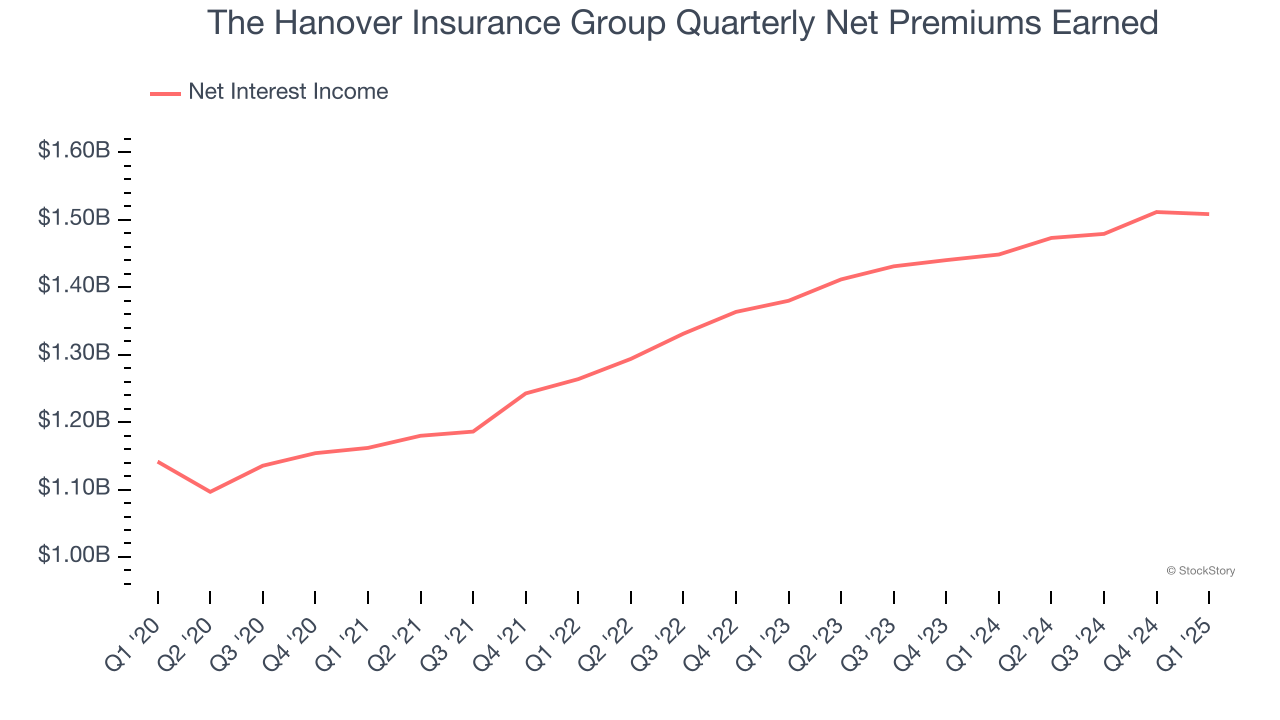

1. Net Premiums Earned Points to Soft Demand

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

The Hanover Insurance Group’s net premiums earned has grown at a 5.5% annualized rate over the last two years, worse than the broader insurance industry and in line with its total revenue.

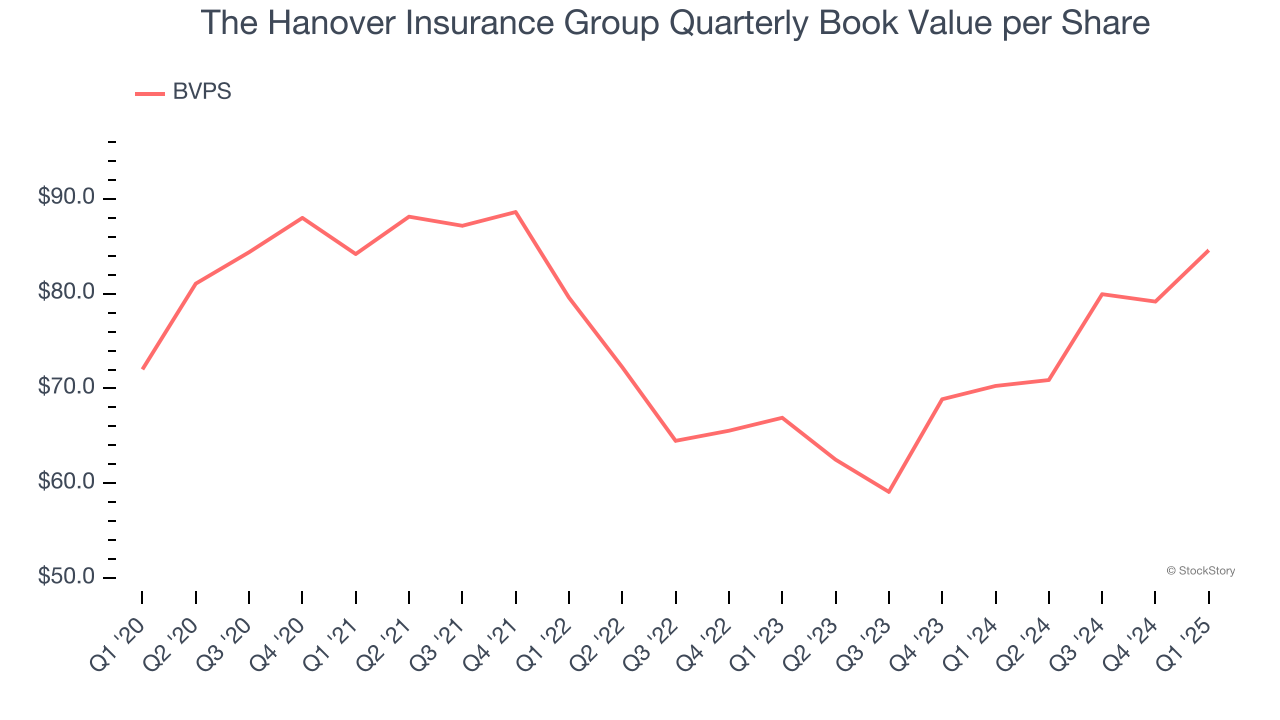

2. Substandard BVPS Growth Indicates Limited Asset Expansion

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Disappointingly for investors, The Hanover Insurance Group’s BVPS grew at a mediocre 12.4% annual clip over the last two years.

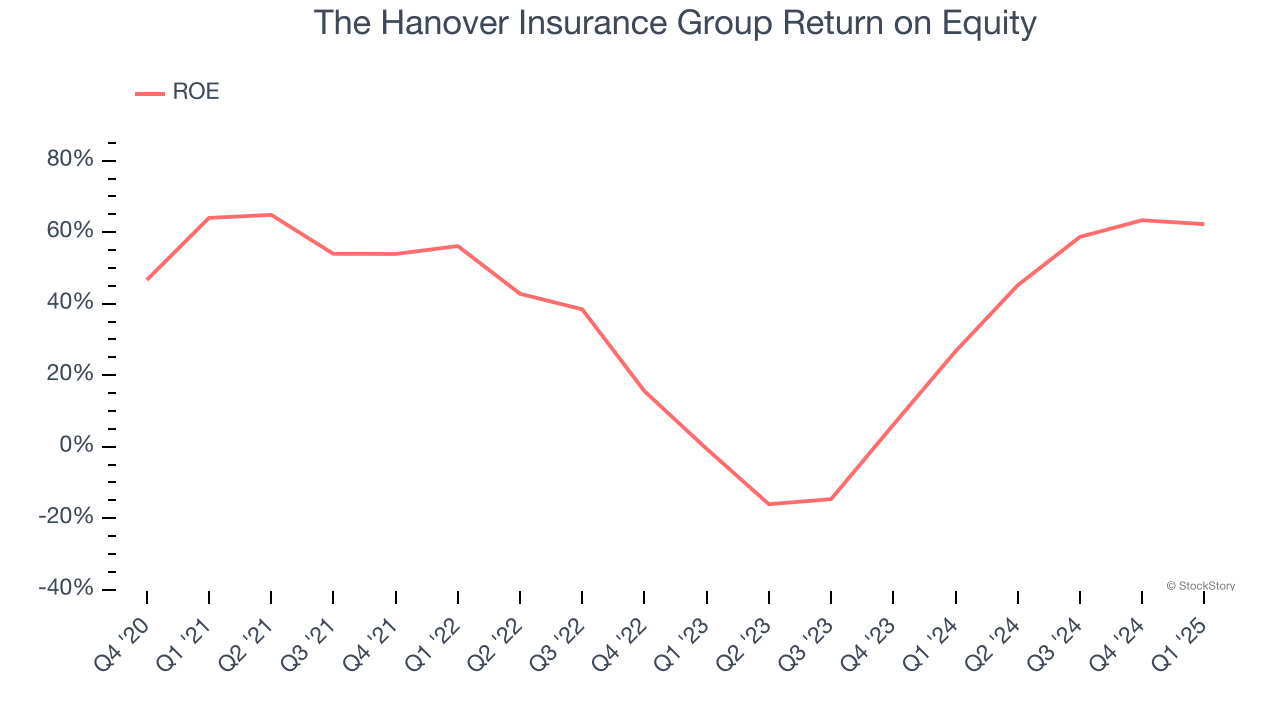

3. Previous Growth Initiatives Haven’t Impressed

Return on Equity, or ROE, ties everything together and is a vital metric. It tells us how much profit the insurer generates for each dollar of shareholder equity entrusted to management. Over a long period, insurers with higher ROEs tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, The Hanover Insurance Group has averaged an ROE of 10.4%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

The Hanover Insurance Group isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 1.9× forward P/B (or $166.12 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than The Hanover Insurance Group

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.