As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the engineered components and systems industry, including Mayville Engineering (NYSE: MEC) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.4% below.

Luckily, engineered components and systems stocks have performed well with share prices up 17.5% on average since the latest earnings results.

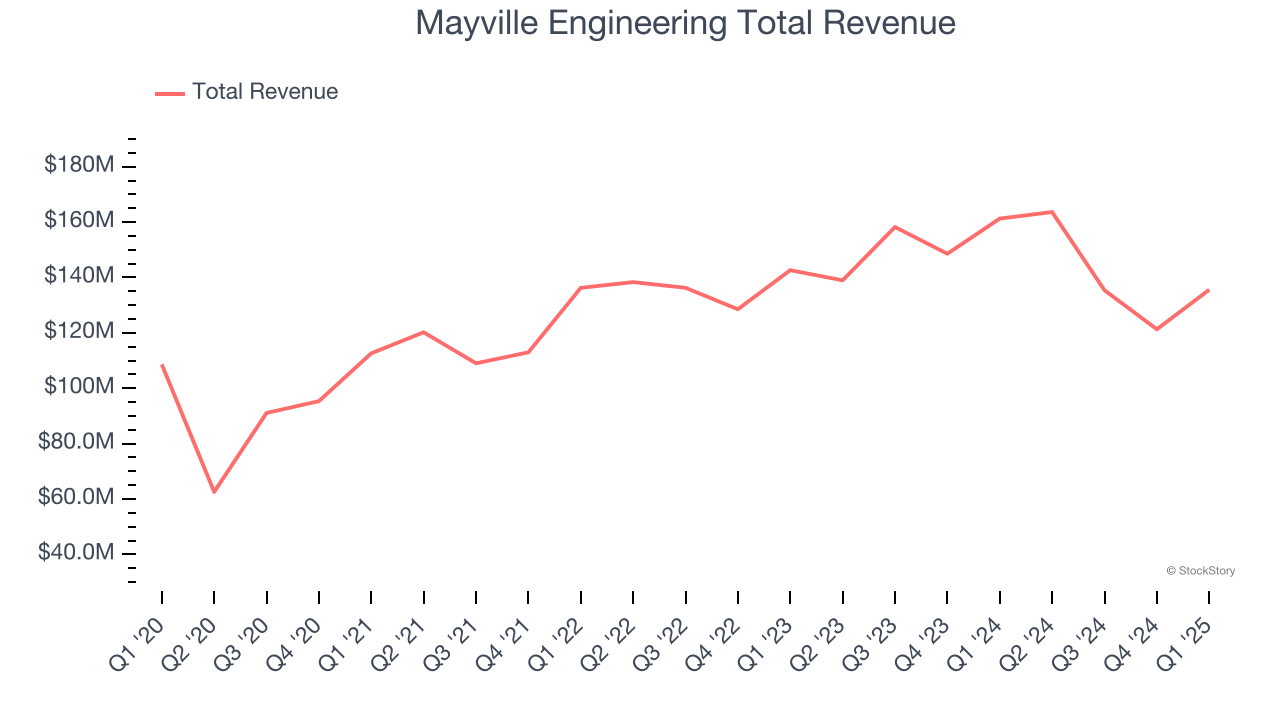

Mayville Engineering (NYSE: MEC)

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE: MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Mayville Engineering reported revenues of $135.6 million, down 15.9% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Mayville Engineering delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 19% since reporting and currently trades at $15.76.

Is now the time to buy Mayville Engineering? Access our full analysis of the earnings results here, it’s free.

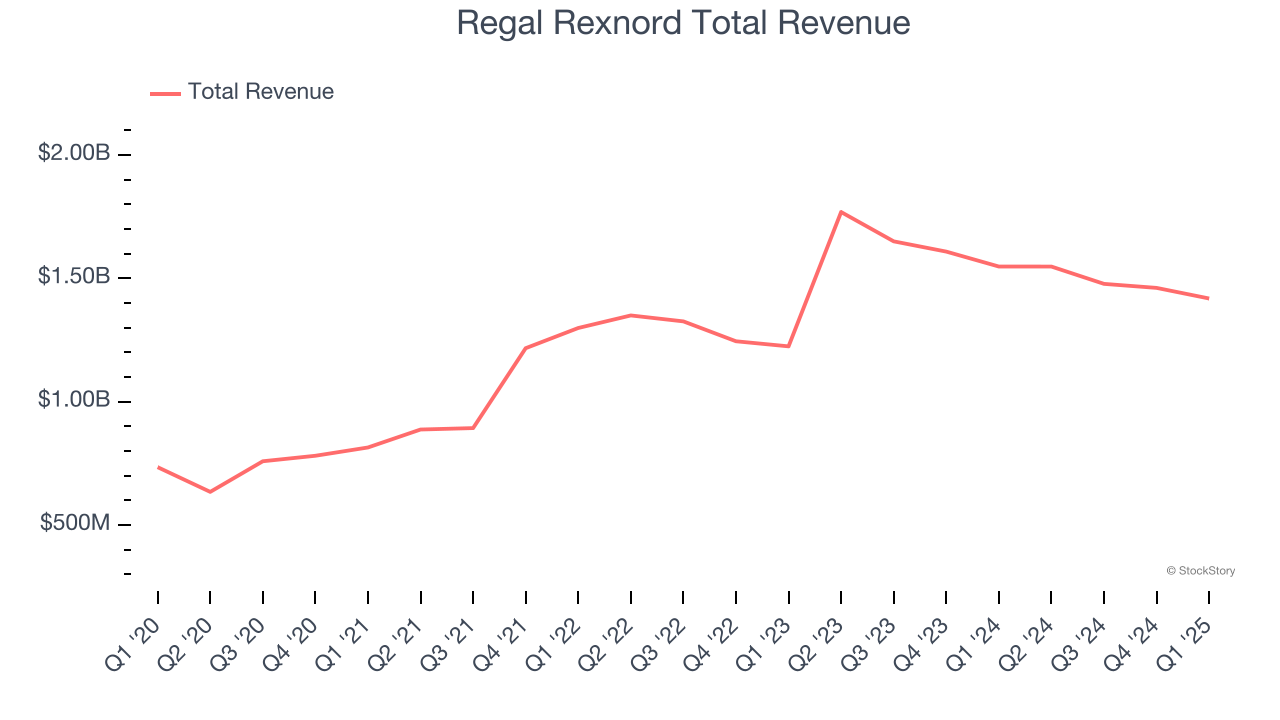

Best Q1: Regal Rexnord (NYSE: RRX)

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Regal Rexnord reported revenues of $1.42 billion, down 8.4% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with a solid beat of analysts’ organic revenue and EBITDA estimates.

The market seems happy with the results as the stock is up 40.2% since reporting. It currently trades at $154.44.

Is now the time to buy Regal Rexnord? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $405.4 million, down 2.9% year on year, falling short of analysts’ expectations by 4.7%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Park-Ohio delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 18.7% since the results and currently trades at $17.35.

Read our full analysis of Park-Ohio’s results here.

Worthington (NYSE: WOR)

Founded by a steel salesman, Worthington (NYSE: WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Worthington reported revenues of $317.9 million, flat year on year. This number beat analysts’ expectations by 5.6%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 3.4% since reporting and currently trades at $62.21.

Read our full, actionable report on Worthington here, it’s free.

Arrow Electronics (NYSE: ARW)

Founded as a single retail store, Arrow Electronics (NYSE: ARW) provides electronic components and enterprise computing solutions to businesses globally.

Arrow Electronics reported revenues of $6.81 billion, down 1.6% year on year. This result surpassed analysts’ expectations by 7.2%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Arrow Electronics scored the biggest analyst estimates beat among its peers. The stock is up 14.4% since reporting and currently trades at $127.15.

Read our full, actionable report on Arrow Electronics here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.