Axon currently trades at $792 and has been a dream stock for shareholders. It’s returned 878% since August 2020, blowing past the S&P 500’s 90.8% gain. The company has also beaten the index over the past six months as its stock price is up 33.5% thanks to its solid quarterly results.

Following the strength, is AXON a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On Axon?

Providing body cameras and tasers for first responders, AXON (NASDAQ: AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

1. Elevated Demand Drives Higher Sales Volumes

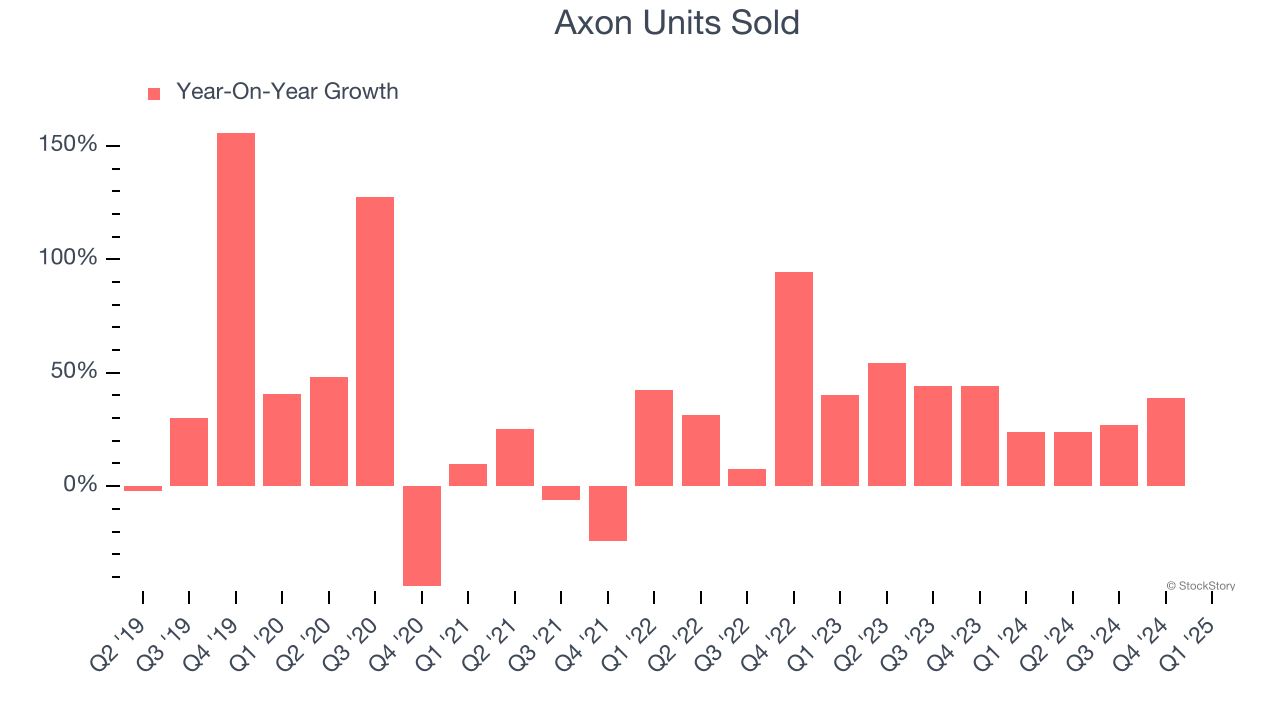

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Law Enforcement Suppliers company because there’s a ceiling to what customers will pay.

Over the last two years, Axon’s units sold averaged 28.8% year-on-year growth. This performance was fantastic and shows its offerings have a unique value proposition (and perhaps some degree of customer loyalty).

2. Outstanding Long-Term EPS Growth

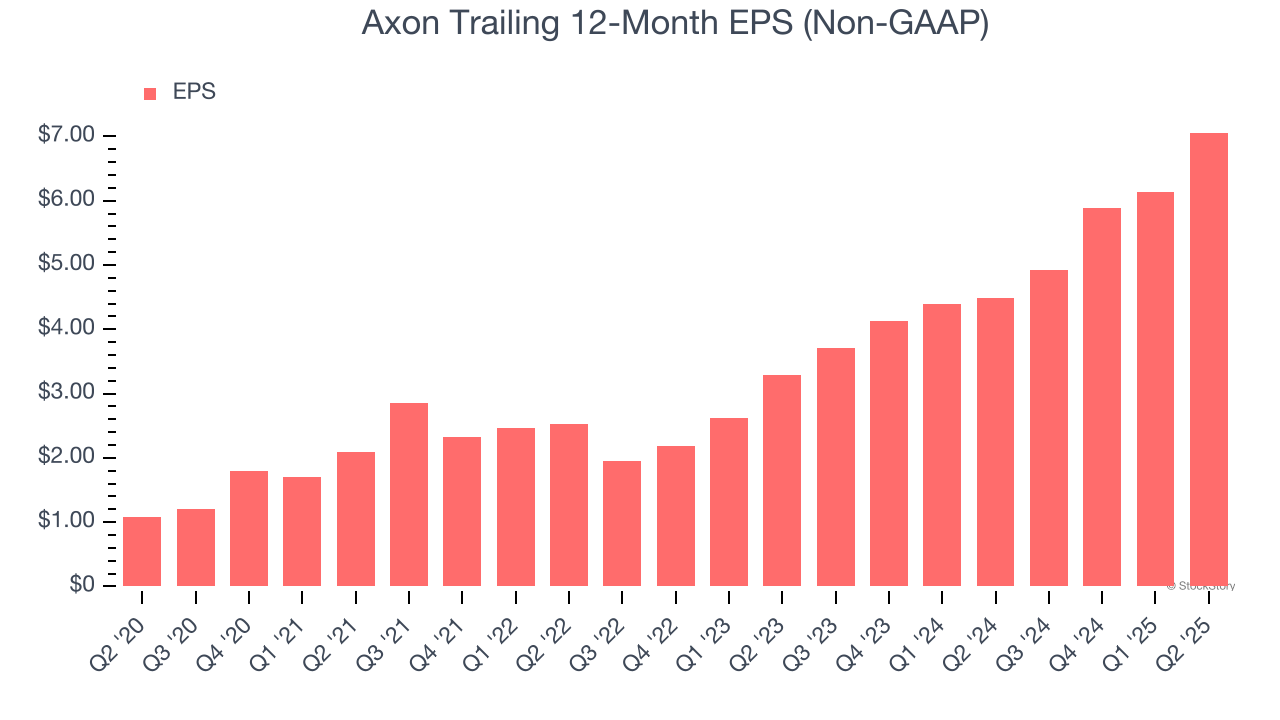

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Axon’s EPS grew at an astounding 45.6% compounded annual growth rate over the last five years, higher than its 32.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. New Investments Bear Fruit as ROIC Jumps

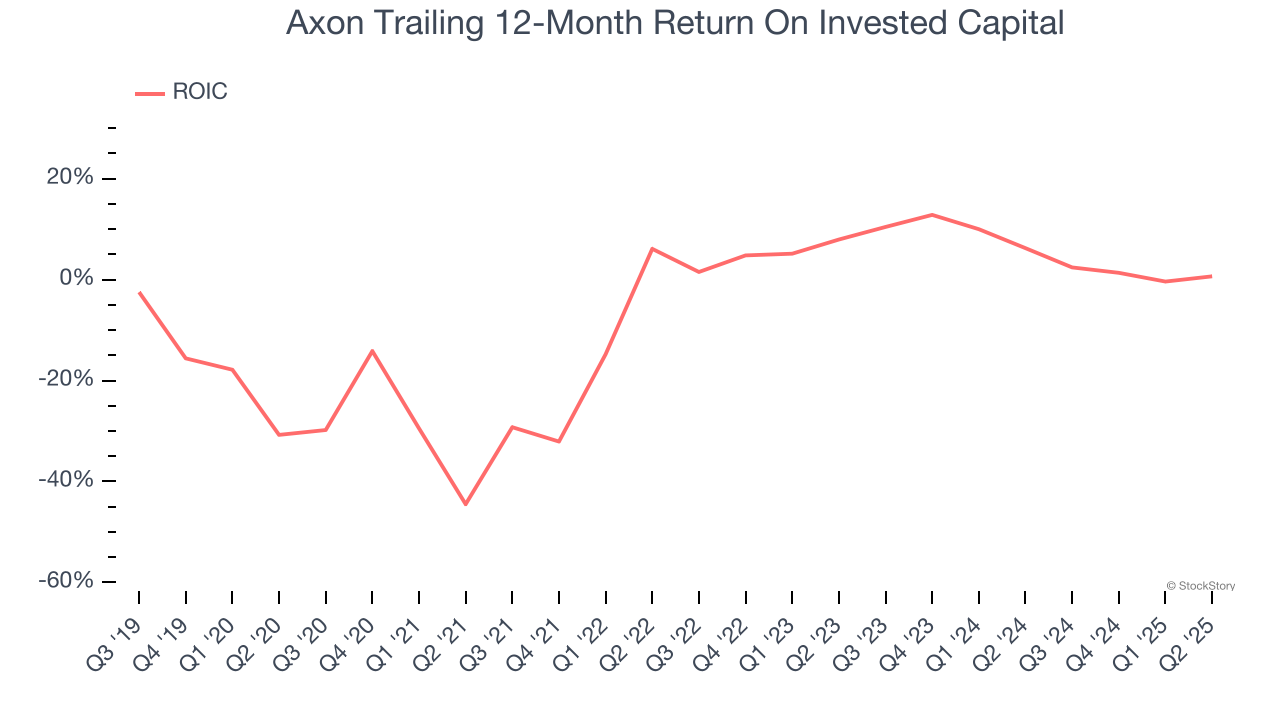

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Axon’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

Final Judgment

These are just a few reasons why we think Axon is a high-quality business, and with its shares topping the market in recent months, the stock trades at 119.5× forward P/E (or $792 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Axon

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.