The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how El Pollo Loco (NASDAQ: LOCO) and the rest of the traditional fast food stocks fared in Q2.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 13 traditional fast food stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 0.8%.

While some traditional fast food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

El Pollo Loco (NASDAQ: LOCO)

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ: LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

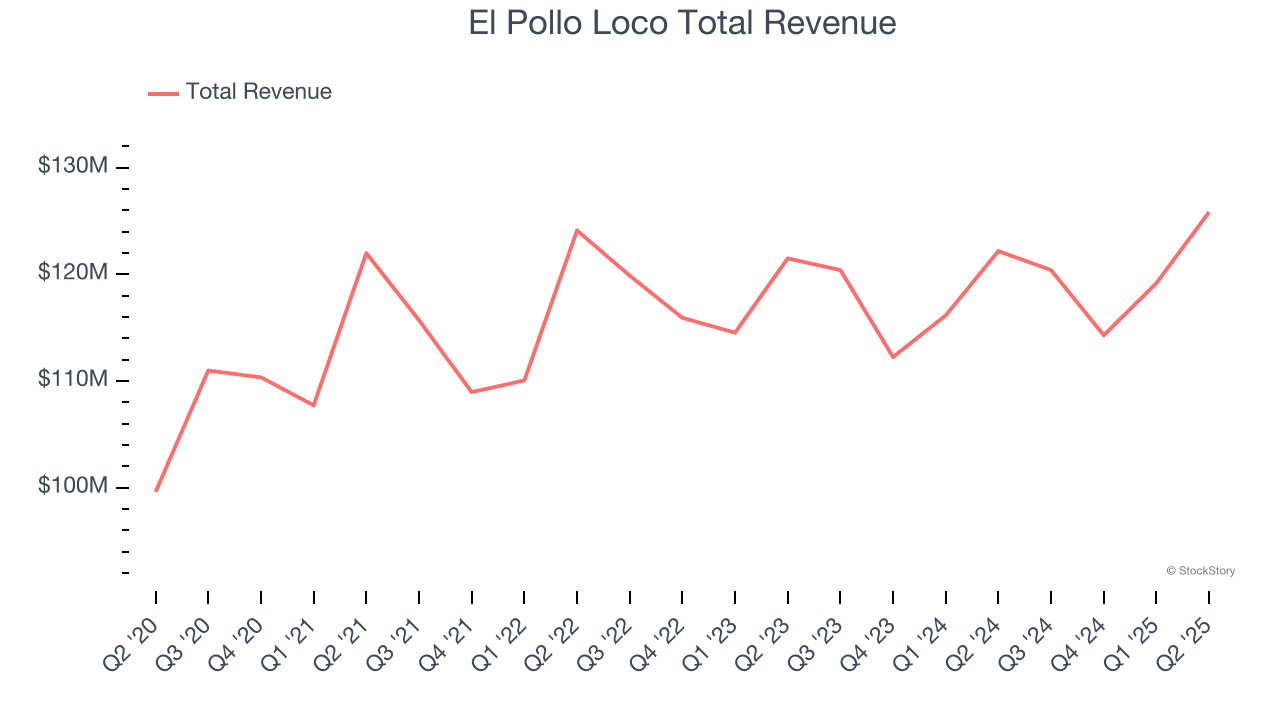

El Pollo Loco reported revenues of $125.8 million, up 3% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA and EPS estimates.

Liz Williams, Chief Executive Officer of El Pollo Loco Holdings, Inc., stated, “During the quarter, we made meaningful progress against our strategy as the investments we’ve made in our brand re-launch and menu innovations are resonating with our customers. Despite ending the quarter with slightly negative sales performance, we saw modest sequential improvement in overall sales and achieved a return to positive system-wide traffic growth. Additionally, we had profitability growth across both the restaurant and corporate-level. With the successful introduction of Fresca Wraps and Salads, followed by premium Quesadillas, we are building a strong foundation for long-term sustainable growth. Our solid unit growth in 2025, combined with a growing development pipeline for further acceleration in 2026 position us well for national expansion as the fire-grilled chicken leader.”

Unsurprisingly, the stock is down 3.1% since reporting and currently trades at $10.01.

Is now the time to buy El Pollo Loco? Access our full analysis of the earnings results here, it’s free.

Best Q2: Dutch Bros (NYSE: BROS)

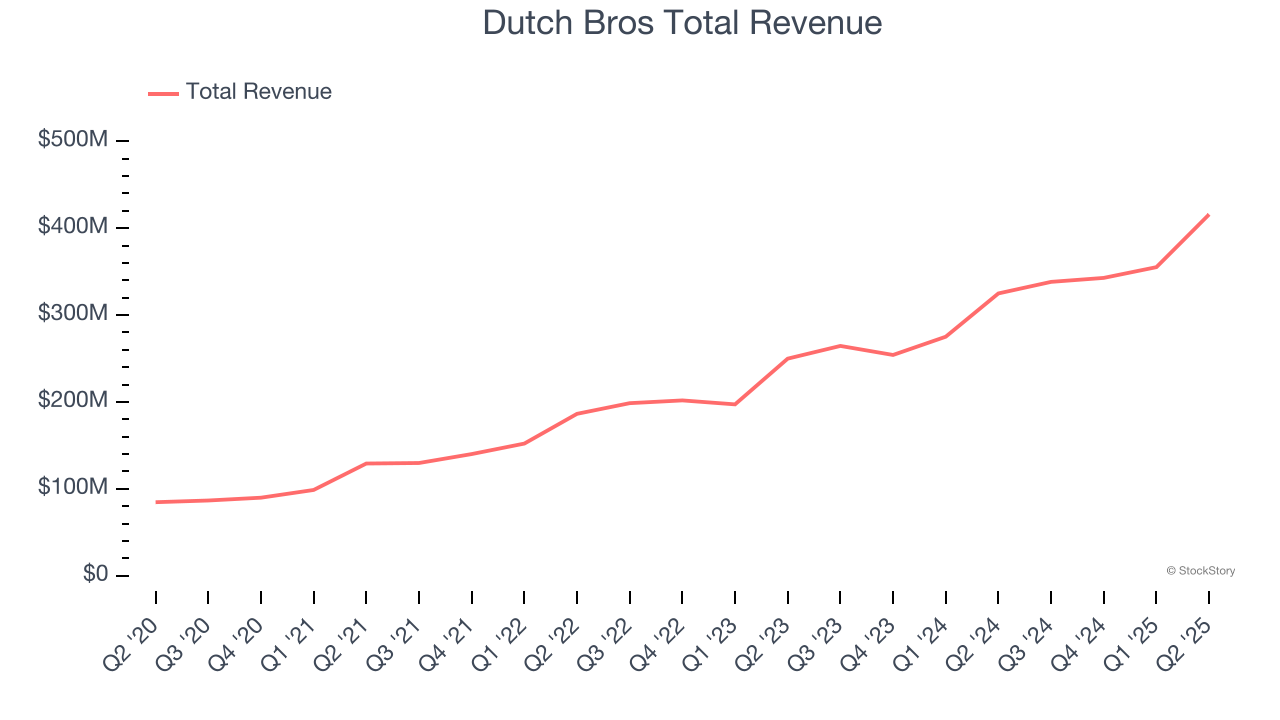

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $415.8 million, up 28% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA and same-store sales estimates.

Dutch Bros achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 3% since reporting. It currently trades at $59.50.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Jack in the Box (NASDAQ: JACK)

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ: JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Jack in the Box reported revenues of $333 million, down 9.8% year on year, falling short of analysts’ expectations by 2.1%. It was a softer quarter as it posted a miss of analysts’ EBITDA and same-store sales estimates.

Jack in the Box delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1.2% since the results and currently trades at $19.16.

Read our full analysis of Jack in the Box’s results here.

Papa John's (NASDAQ: PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Papa John's reported revenues of $529.2 million, up 4.2% year on year. This result surpassed analysts’ expectations by 2.7%. It was a very strong quarter as it also recorded an impressive beat of analysts’ same-store sales and EPS estimates.

The stock is up 18.5% since reporting and currently trades at $48.

Read our full, actionable report on Papa John's here, it’s free.

Starbucks (NASDAQ: SBUX)

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ: SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Starbucks reported revenues of $9.46 billion, up 3.8% year on year. This print beat analysts’ expectations by 1.7%. However, it was a slower quarter as it logged a significant miss of analysts’ EBITDA and EPS estimates.

The stock is down 9.2% since reporting and currently trades at $84.38.

Read our full, actionable report on Starbucks here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.