Columbus McKinnon has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10% to $17.25 per share while the index has gained 11.2%.

Is there a buying opportunity in Columbus McKinnon, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Columbus McKinnon Will Underperform?

We're swiping left on Columbus McKinnon for now. Here are three reasons why CMCO doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

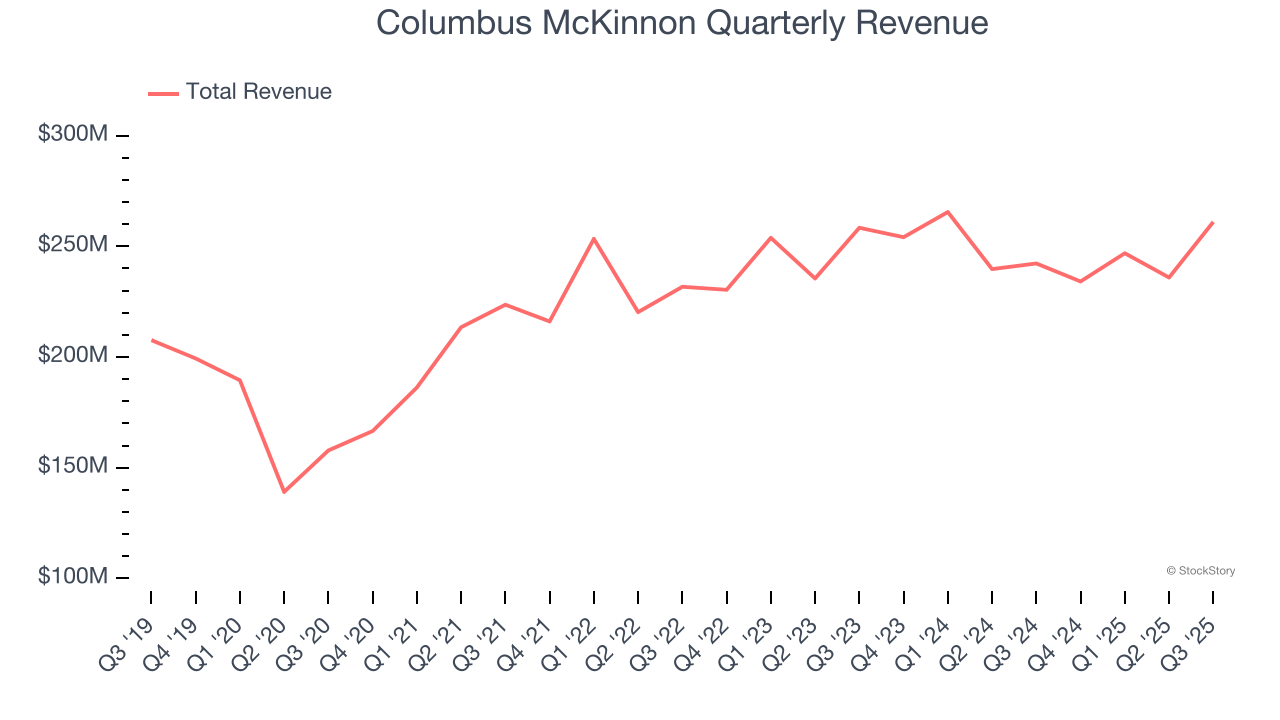

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Columbus McKinnon’s 7.4% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector.

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Columbus McKinnon’s unimpressive 6.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Columbus McKinnon’s margin dropped by 3.8 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Columbus McKinnon’s free cash flow margin for the trailing 12 months was 3%.

Final Judgment

Columbus McKinnon falls short of our quality standards. That said, the stock currently trades at 6.5× forward P/E (or $17.25 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Columbus McKinnon

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.