GE Vernova trades at $622.75 per share and has stayed right on track with the overall market, gaining 12.2% over the last six months. At the same time, the S&P 500 has returned 10.4%.

Is GEV a buy right now? Find out in our full research report, it’s free.

Why Does GE Vernova Spark Debate?

Born from the energy business of industrial giant General Electric in a 2023 spin-off, GE Vernova (NYSE: GEV) designs, manufactures, and services power generation equipment and grid technologies to help customers build more reliable and sustainable electric systems.

Two Things to Like:

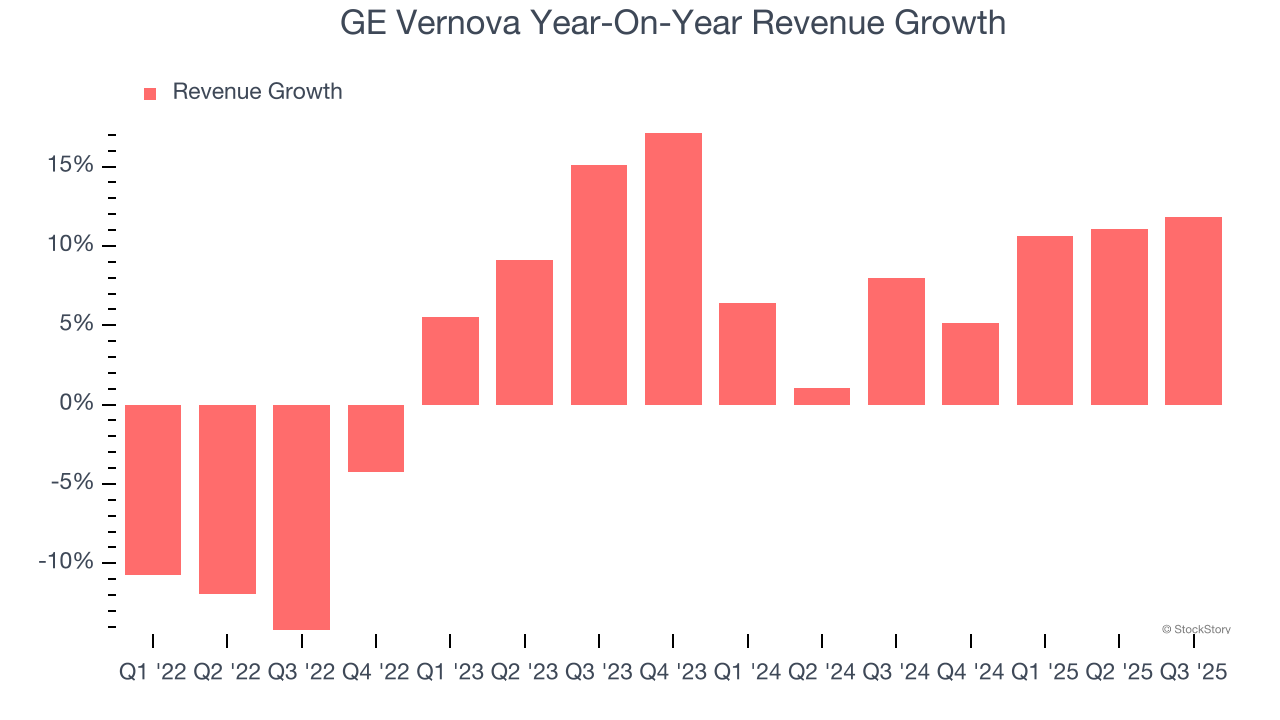

1. Revenue Climbing Higher

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. GE Vernova’s annualized revenue growth of 8.9% over the last two years is above its four-year trend, suggesting some bright spots.

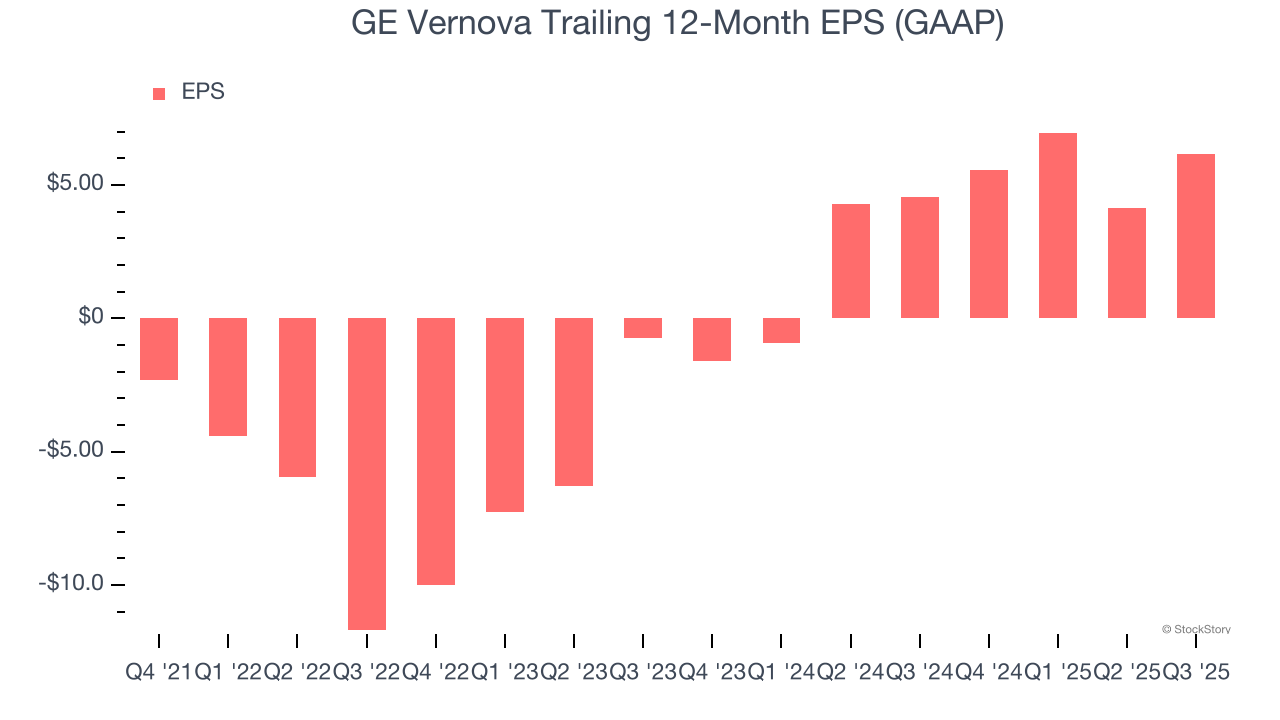

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

GE Vernova’s full-year EPS flipped from negative to positive over the last four years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

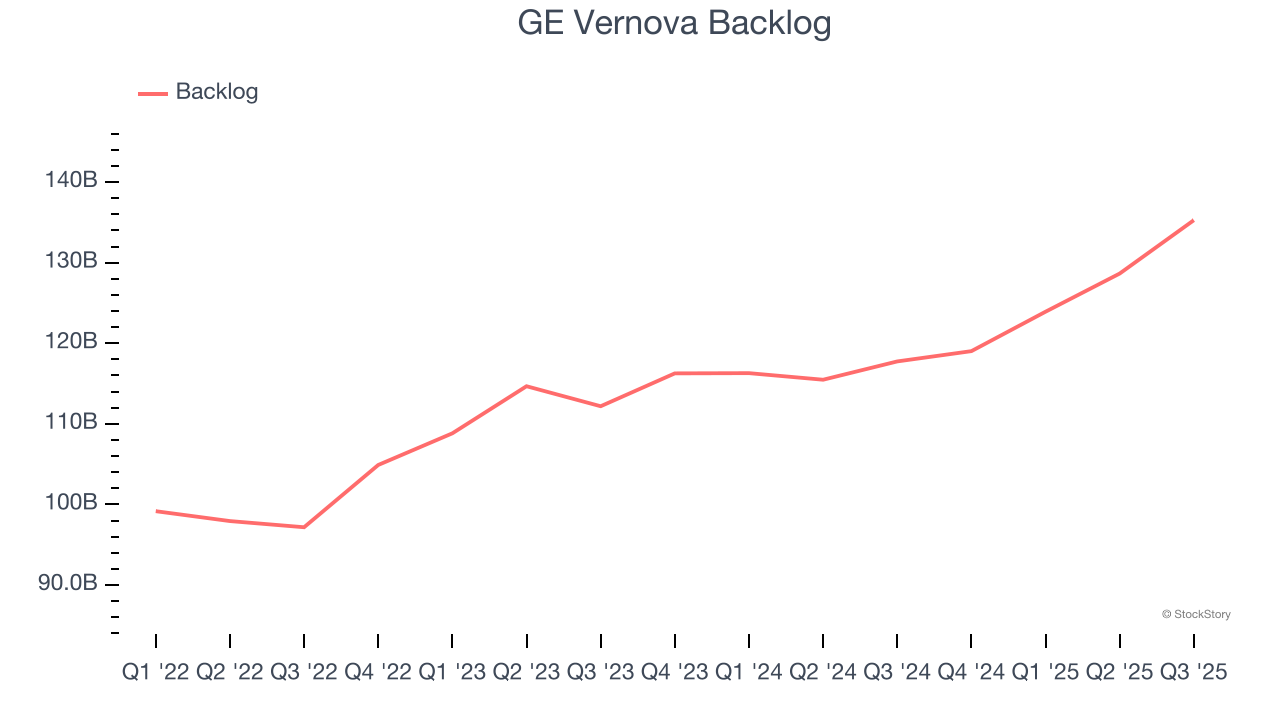

Weak Backlog Growth Points to Soft Demand

In addition to reported revenue, backlog is a useful data point for analyzing Electrical Systems companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into GE Vernova’s future revenue streams.

GE Vernova’s backlog came in at $135.3 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 7.3%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in winning new orders.

Final Judgment

GE Vernova has huge potential even though it has some open questions, but at $622.75 per share (or 57× forward P/E), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than GE Vernova

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.