Since July 2025, Shutterstock has been in a holding pattern, posting a small return of 3.7% while floating around $19.54. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Is now the time to buy Shutterstock, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Shutterstock Not Exciting?

We're sitting this one out for now. Here are three reasons why SSTK doesn't excite us and a stock we'd rather own.

1. Customer Spending Decreases, Engagement Falling?

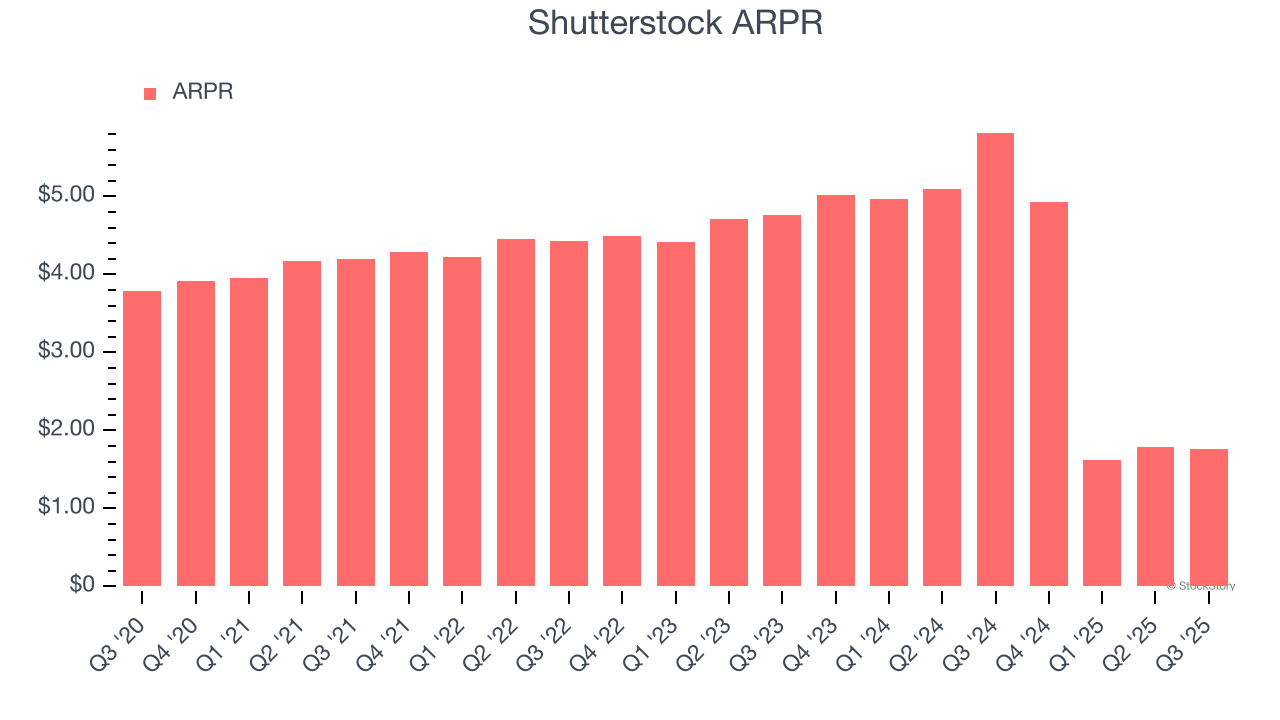

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR fell over the last two years, averaging 18.6% annual declines. This isn’t great, but the increase in paid downloads is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Shutterstock tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Shutterstock’s revenue to drop by 1%, a decrease from This projection is underwhelming and indicates its products and services will see some demand headwinds.

3. EPS Barely Growing

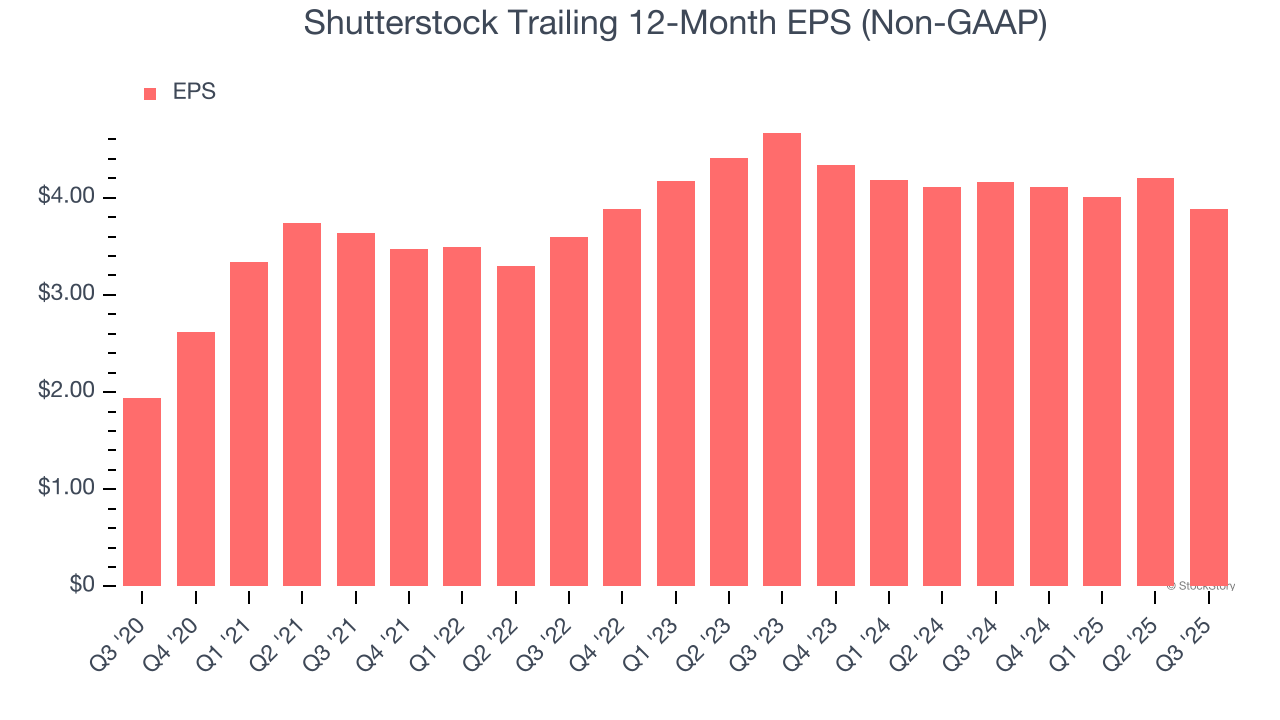

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Shutterstock’s EPS grew at a weak 2.5% compounded annual growth rate over the last three years, lower than its 7.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Shutterstock isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 3.1× forward EV/EBITDA (or $19.54 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Shutterstock

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.