Over the past six months, Pitney Bowes’s stock price fell to $10.60. Shareholders have lost 12.4% of their capital, which is disappointing considering the S&P 500 has climbed by 10.4%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Pitney Bowes, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Pitney Bowes Not Exciting?

Even with the cheaper entry price, we're swiping left on Pitney Bowes for now. Here are three reasons we avoid PBI and a stock we'd rather own.

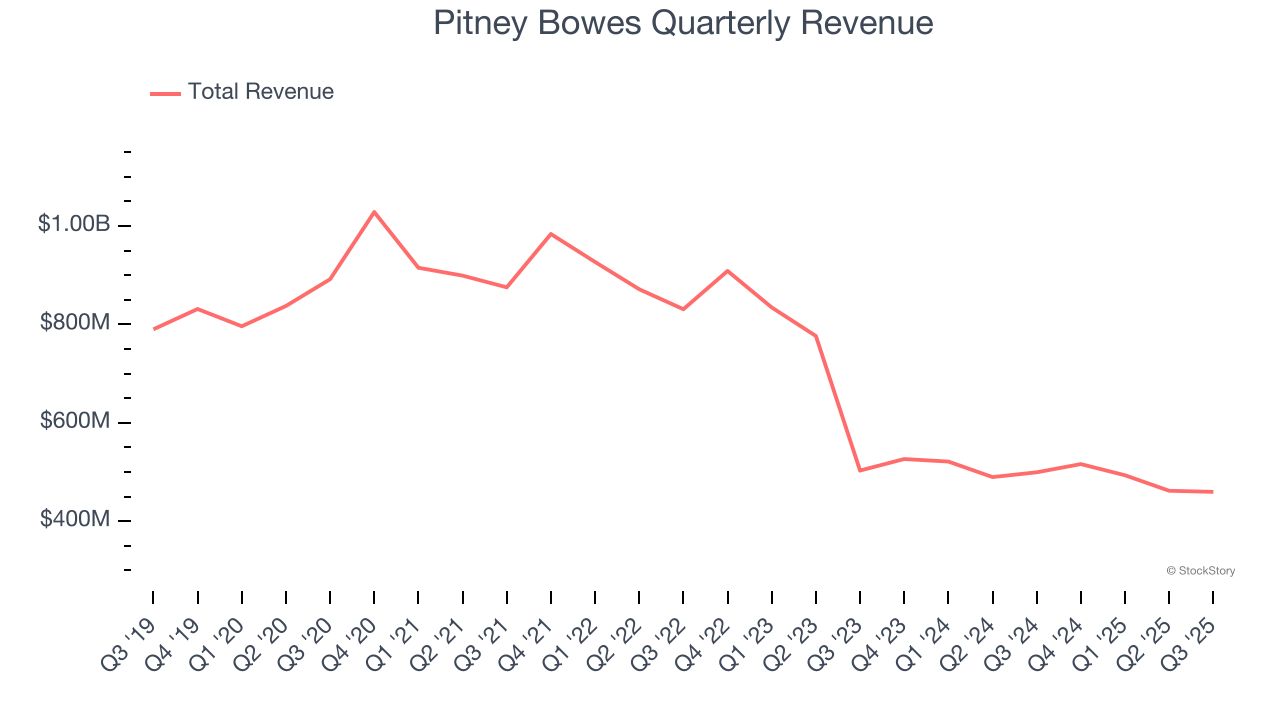

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Pitney Bowes’s demand was weak and its revenue declined by 10.5% per year. This wasn’t a great result and signals it’s a lower quality business.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Pitney Bowes’s revenue to drop by 4%. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

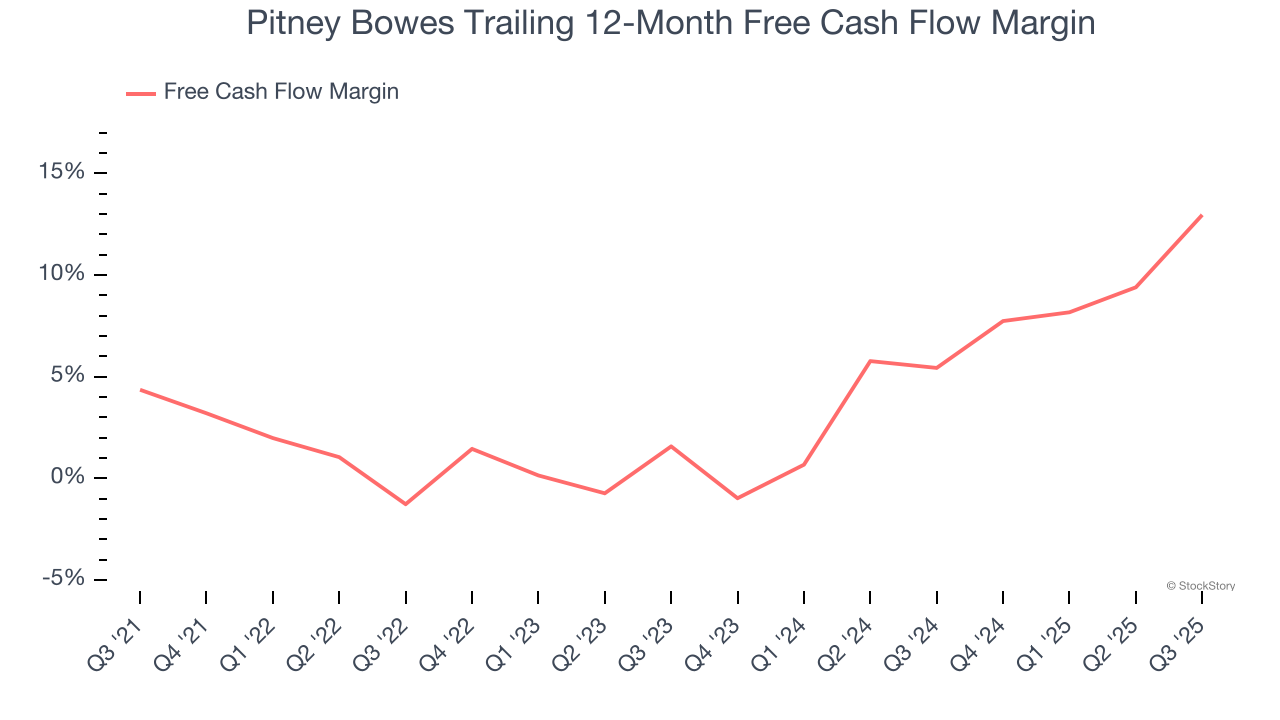

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Pitney Bowes has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, subpar for a business services business.

Final Judgment

Pitney Bowes isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 7.4× forward P/E (or $10.60 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Pitney Bowes

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.