Over the past six months, Arlo Technologies’s stock price fell to $14.31. Shareholders have lost 11.9% of their capital, which is disappointing considering the S&P 500 has climbed by 10.1%. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy ARLO? Find out in our full research report, it’s free.

Why Does ARLO Stock Spark Debate?

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

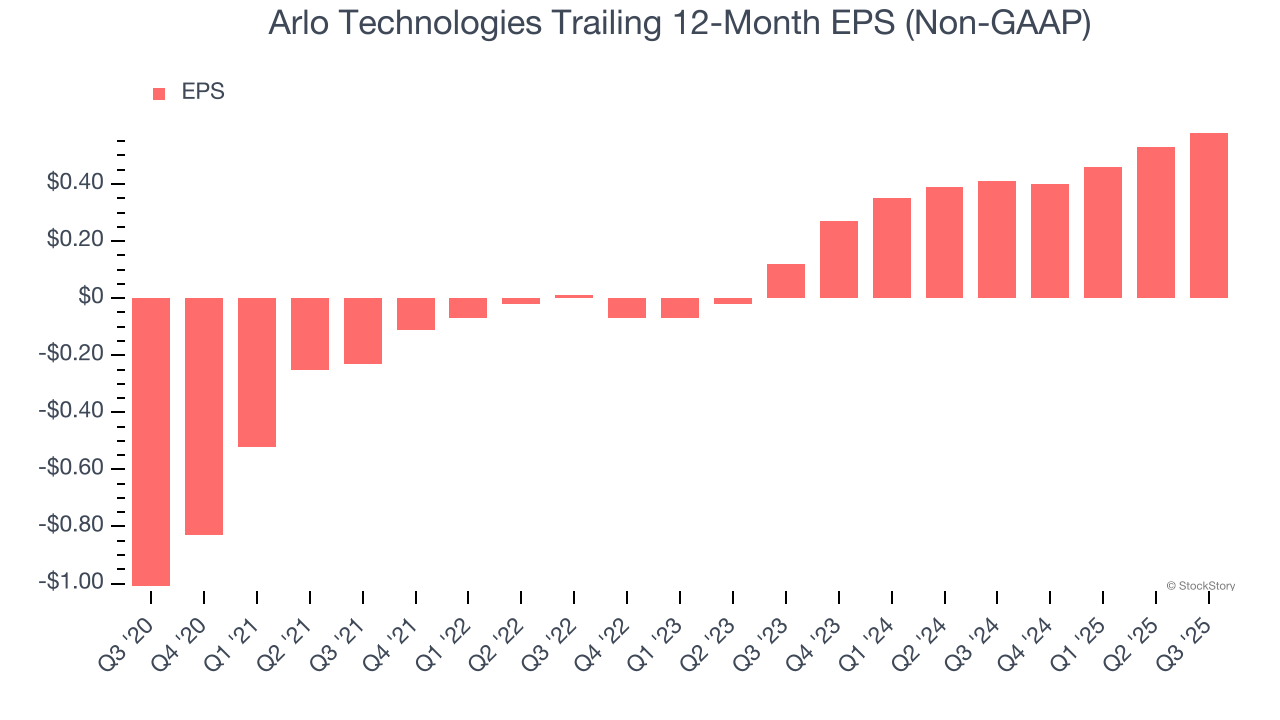

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Arlo Technologies’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

2. Increasing Free Cash Flow Margin Juices Financials

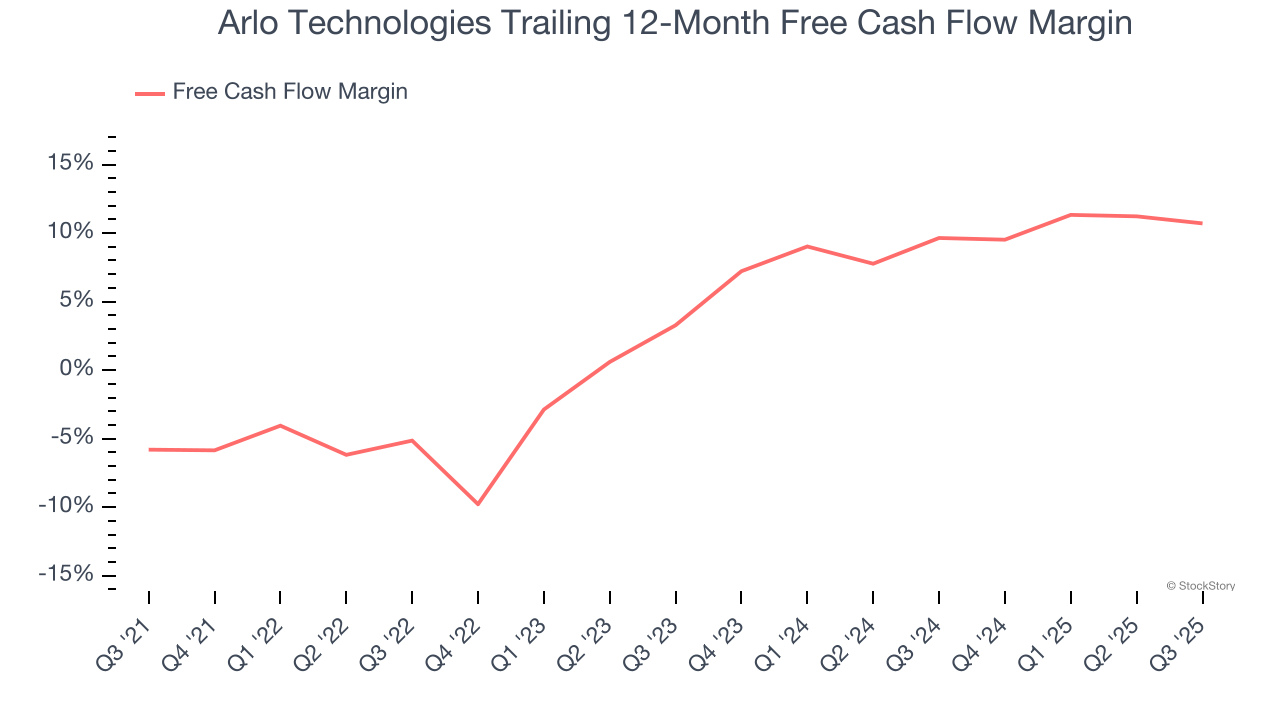

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Arlo Technologies’s margin expanded by 16.5 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Arlo Technologies’s free cash flow margin for the trailing 12 months was 10.7%.

One Reason to be Careful:

Lackluster Revenue Growth

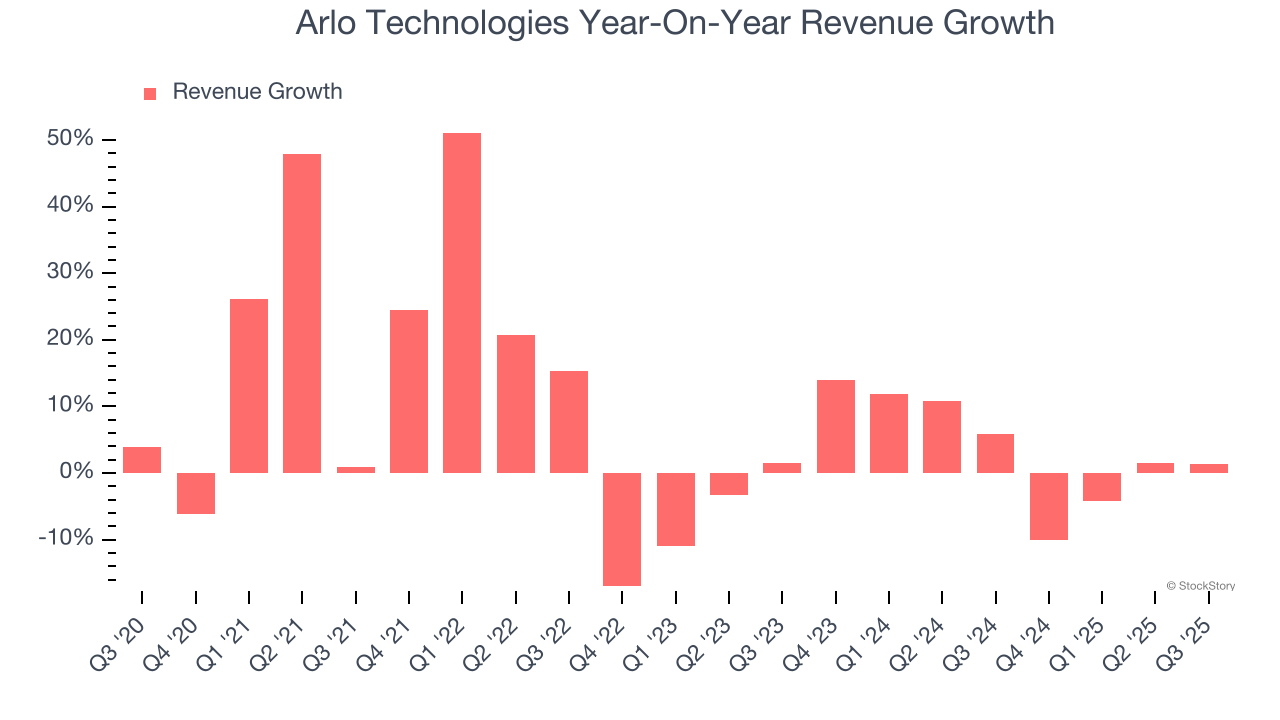

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Arlo Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend.

Final Judgment

Arlo Technologies’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 18.9× forward P/E (or $14.31 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.