As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the aerospace industry, including Curtiss-Wright (NYSE: CW) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 15 aerospace stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 0.7% below.

Thankfully, share prices of the companies have been resilient as they are up 8% on average since the latest earnings results.

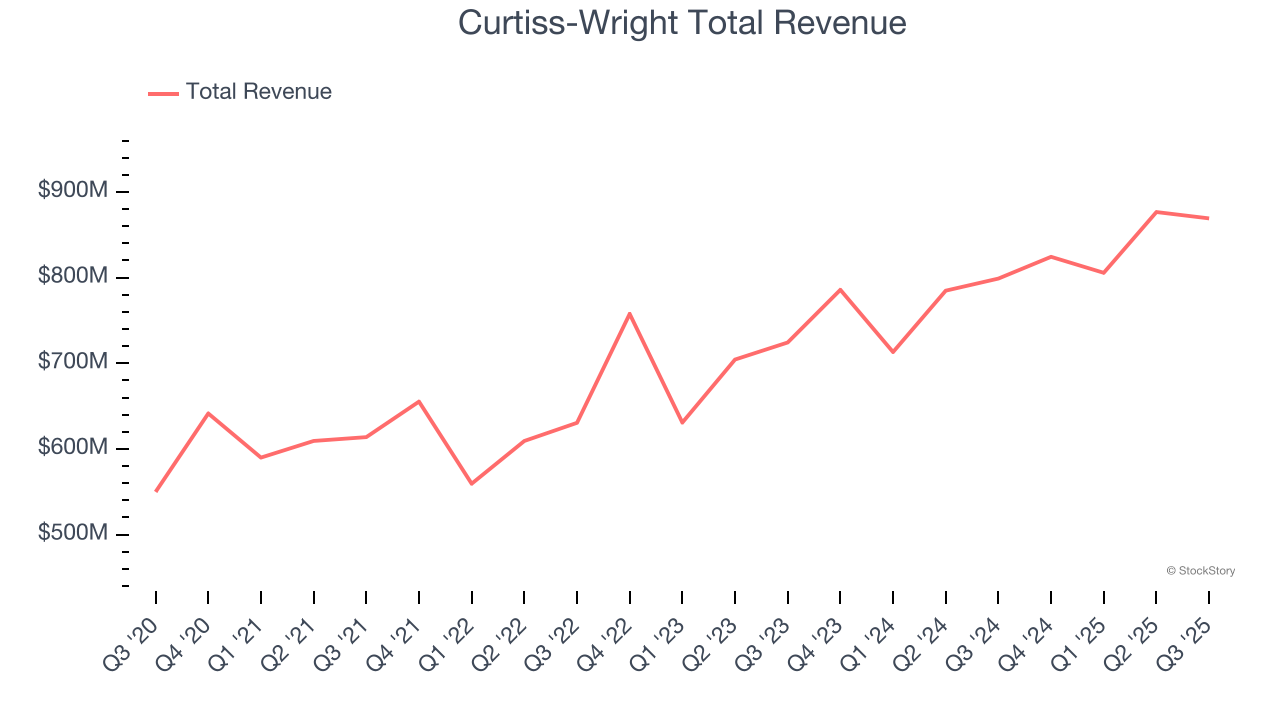

Curtiss-Wright (NYSE: CW)

Formed from a merger of 12 companies, Curtiss-Wright (NYSE: CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Curtiss-Wright reported revenues of $869.2 million, up 8.8% year on year. This print fell short of analysts’ expectations by 0.5%, but it was still a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ revenue estimates.

"Curtiss-Wright continued to deliver strong results under our Pivot to Growth strategy. Based on our strong year-to-date performance, we raised our full-year guidance for sales, operating income and diluted EPS," said Lynn M. Bamford, Chair and CEO.

Unsurprisingly, the stock is down 5.8% since reporting and currently trades at $551.27.

Is now the time to buy Curtiss-Wright? Access our full analysis of the earnings results here, it’s free for active Edge members.

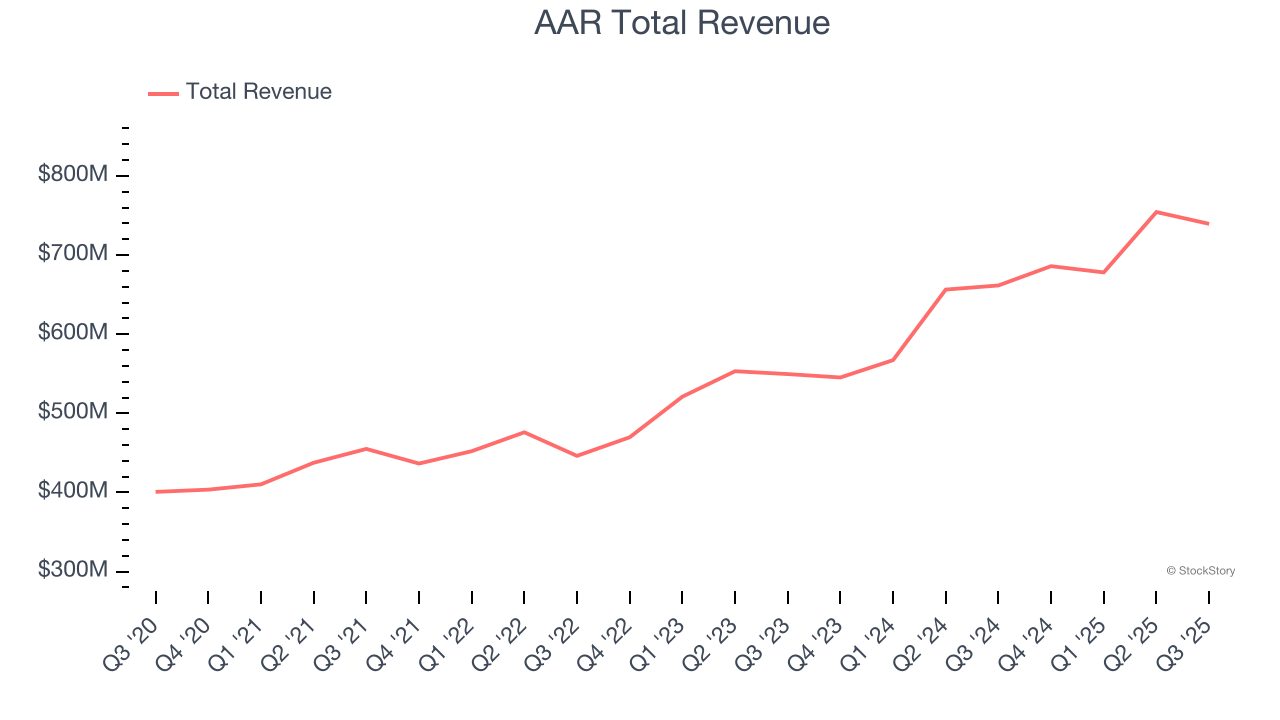

Best Q3: AAR (NYSE: AIR)

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE: AIR) is a provider of aircraft maintenance services

AAR reported revenues of $739.6 million, up 11.8% year on year, outperforming analysts’ expectations by 7.4%. The business had an exceptional quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

AAR achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.9% since reporting. It currently trades at $82.79.

Is now the time to buy AAR? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Redwire (NYSE: RDW)

Based in Jacksonville, Florida, Redwire (NYSE: RDW) is a provider of systems and components used in space infrastructure.

Redwire reported revenues of $103.4 million, up 50.7% year on year, falling short of analysts’ expectations by 22.4%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Interestingly, the stock is up 4.4% since the results and currently trades at $7.72.

Read our full analysis of Redwire’s results here.

Astronics (NASDAQ: ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ: ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $211.4 million, up 3.8% year on year. This result was in line with analysts’ expectations. It was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The stock is up 12.9% since reporting and currently trades at $54.19.

Read our full, actionable report on Astronics here, it’s free for active Edge members.

Ducommun (NYSE: DCO)

California’s oldest company, Ducommun (NYSE: DCO) is a provider of engineering and manufacturing services for high-performance products primarily within the aerospace and defense industries.

Ducommun reported revenues of $212.6 million, up 5.5% year on year. This print met analysts’ expectations. Overall, it was a strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is up 3.5% since reporting and currently trades at $95.13.

Read our full, actionable report on Ducommun here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.