LendingTree’s stock price has taken a beating over the past six months, shedding 38.1% of its value and falling to $39.72 per share. This may have investors wondering how to approach the situation.

Is now the time to buy LendingTree, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think LendingTree Will Underperform?

Even with the cheaper entry price, we're cautious about LendingTree. Here are three reasons there are better opportunities than TREE and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

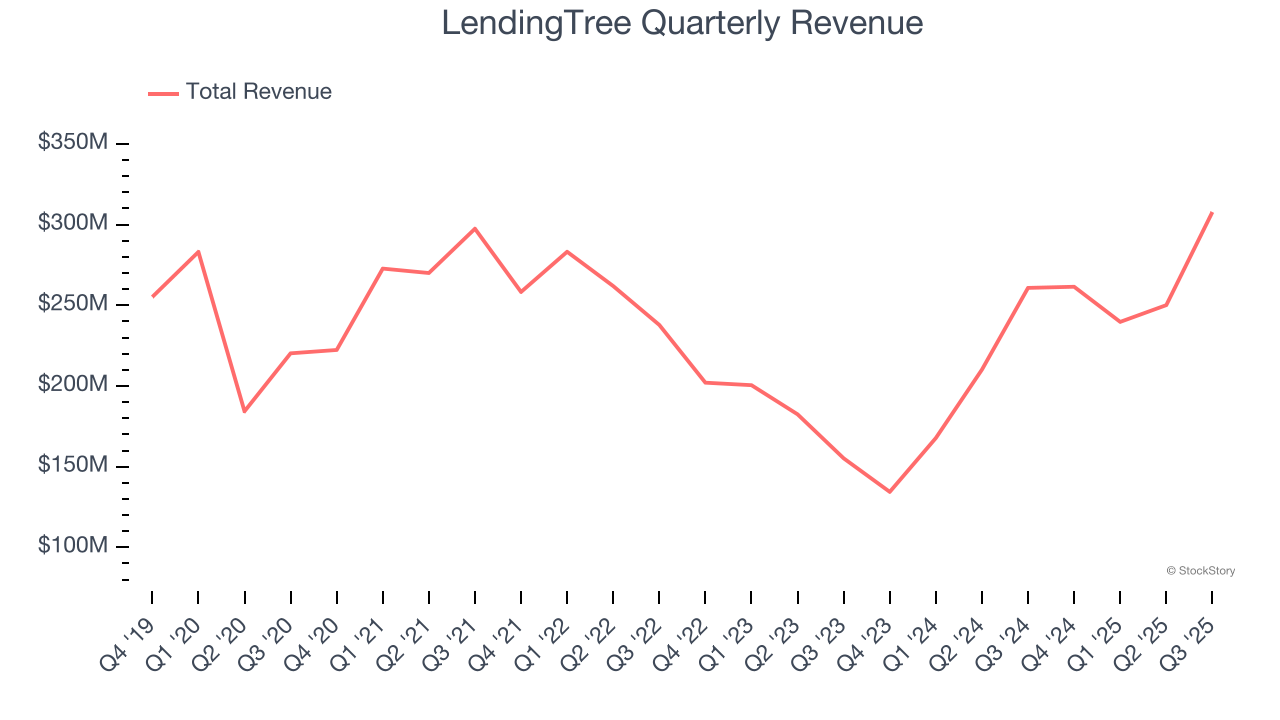

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, LendingTree struggled to consistently increase demand as its $1.06 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and signals it’s a low quality business.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect LendingTree’s revenue to rise by 8.5%. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

3. Poor Marketing Efficiency Drains Profits

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like LendingTree grow from a combination of product virality, paid advertisement, and incentives.

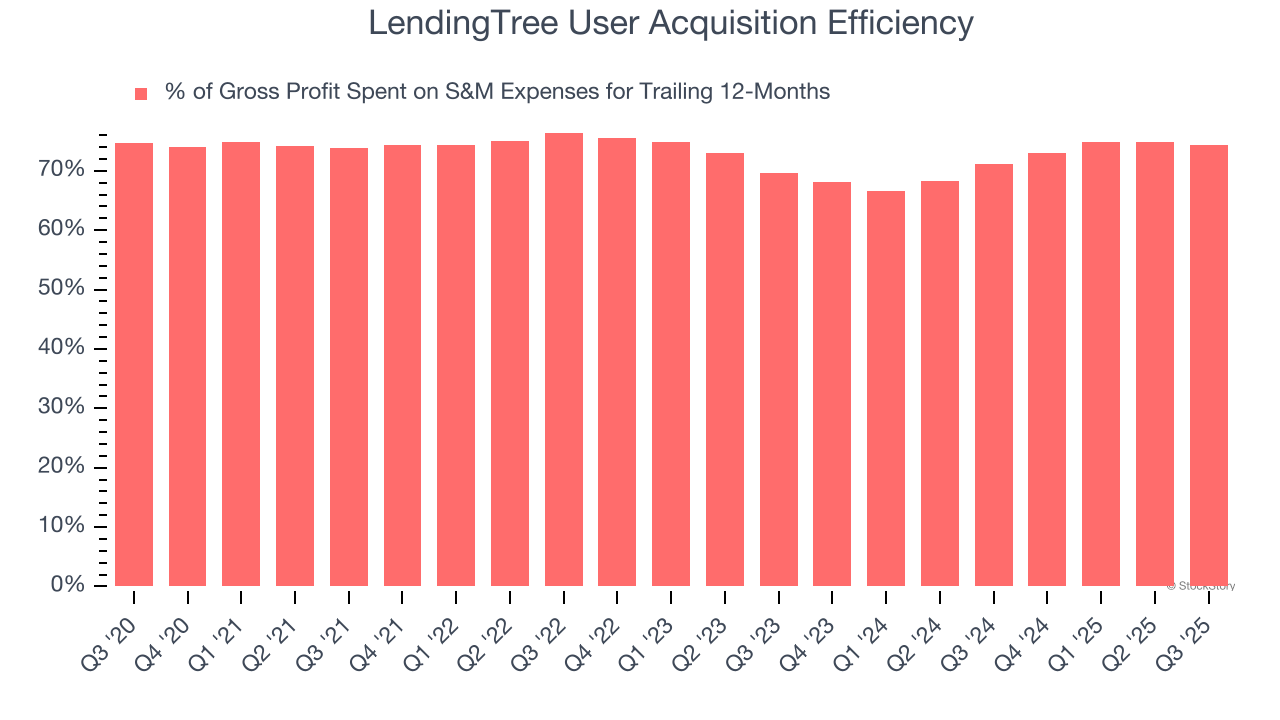

It’s very expensive for LendingTree to acquire new users as the company has spent 74.4% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between LendingTree and its peers.

Final Judgment

We see the value of companies helping consumers, but in the case of LendingTree, we’re out. After the recent drawdown, the stock trades at 6.4× forward EV/EBITDA (or $39.72 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of LendingTree

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.