Hotel and casino entertainment company Caesars Entertainment (NASDAQ: CZR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 4.2% year on year to $2.92 billion. Its GAAP loss of $1.23 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Caesars Entertainment? Find out by accessing our full research report, it’s free.

Caesars Entertainment (CZR) Q4 CY2025 Highlights:

- Revenue: $2.92 billion vs analyst estimates of $2.88 billion (4.2% year-on-year growth, 1.1% beat)

- EPS (GAAP): -$1.23 vs analyst estimates of -$0.19 (significant miss)

- Adjusted EBITDA: $901 million vs analyst estimates of $896.3 million (30.9% margin, 0.5% beat)

- Operating Margin: 11.4%, down from 23.9% in the same quarter last year

- Market Capitalization: $3.70 billion

Company Overview

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

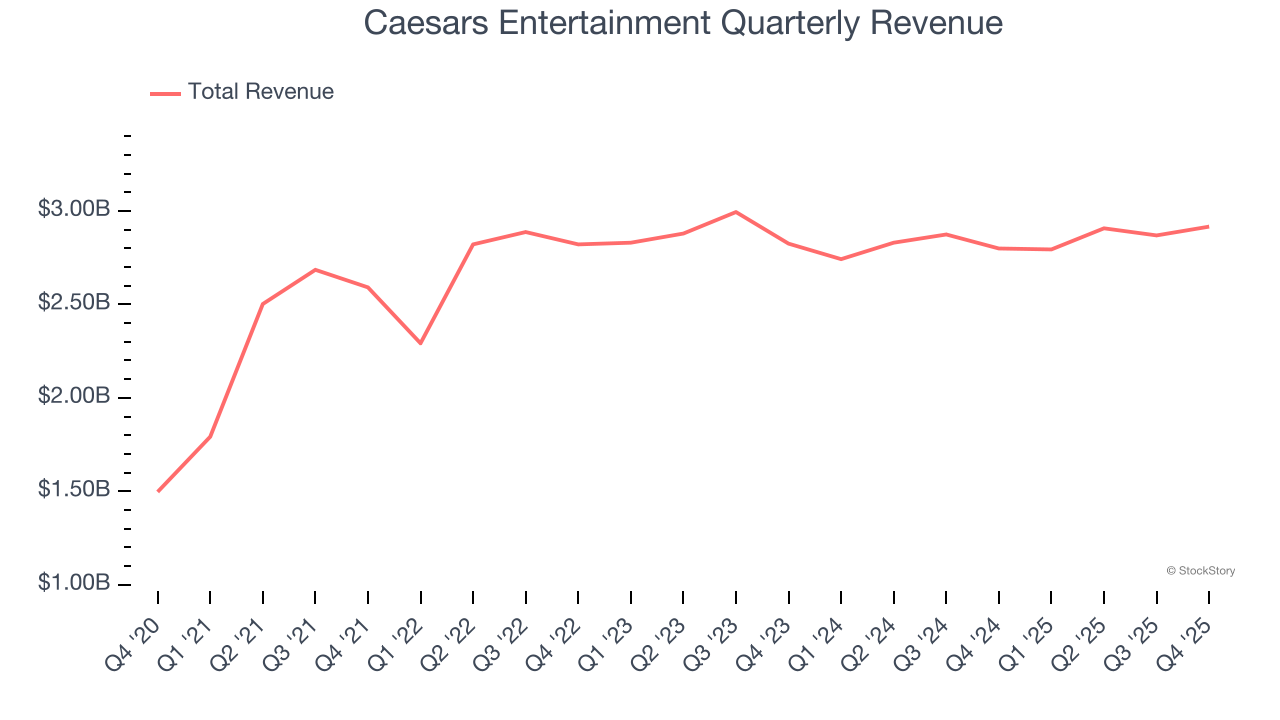

Revenue Growth

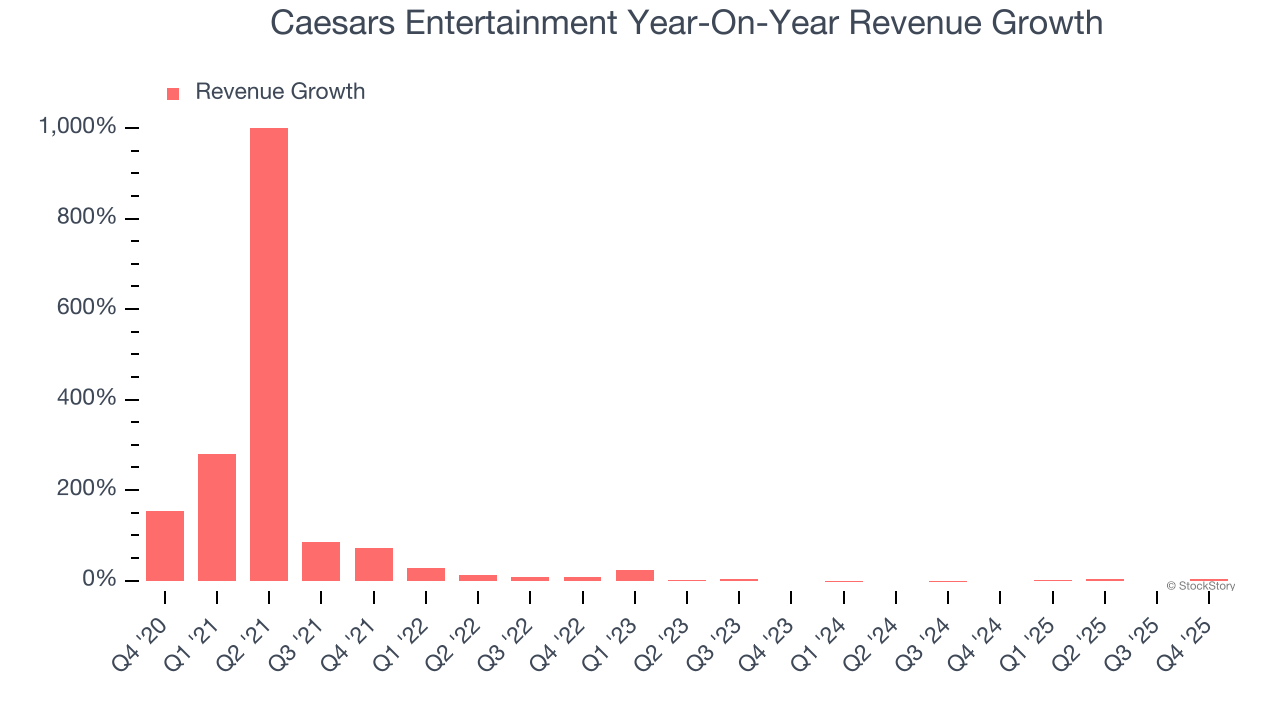

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Caesars Entertainment grew its sales at a 26.5% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Caesars Entertainment’s recent performance shows its demand has slowed as its revenue was flat over the last two years. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

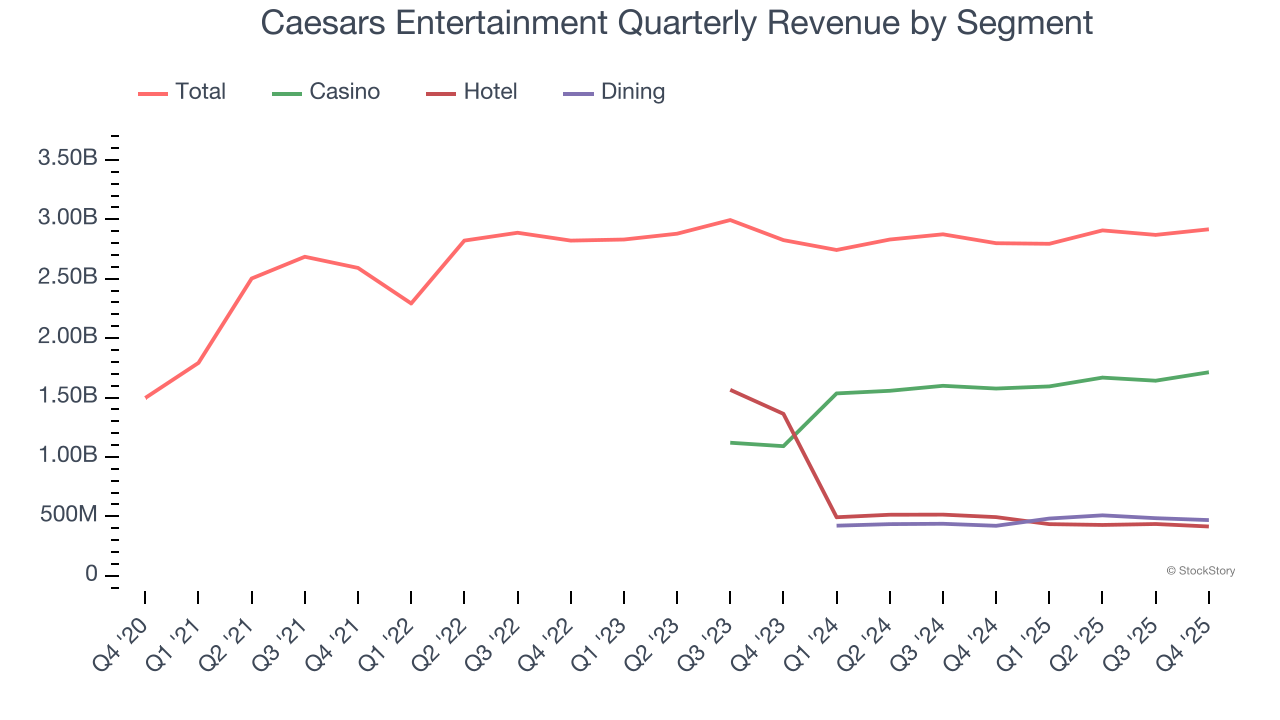

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Casino, Hotel, and Dining, which are 58.7%, 14.2%, and 16.1% of revenue. Over the last two years, Caesars Entertainment’s Casino (Poker, Blackjack) and Dining (food and beverage) revenues averaged year-on-year growth of 18.3% and 13.3%. On the other hand, its Hotel revenue (overnight bookings) averaged 31.8% declines.

This quarter, Caesars Entertainment reported modest year-on-year revenue growth of 4.2% but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

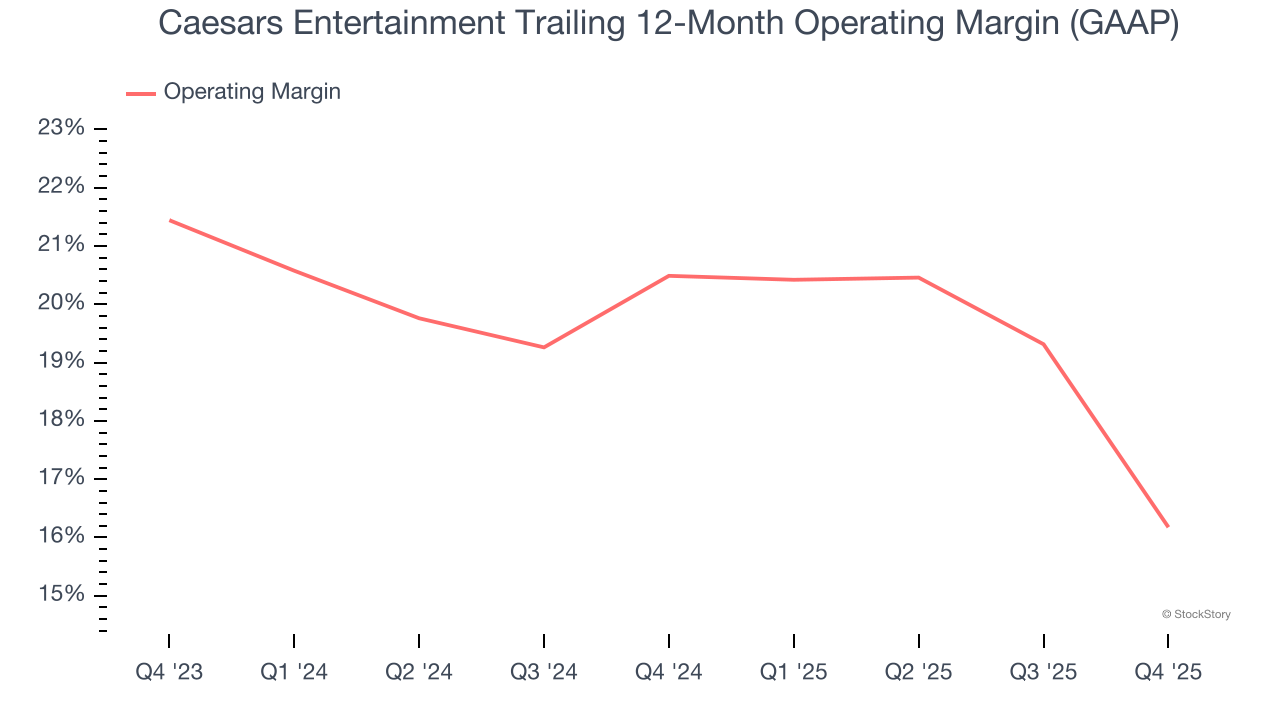

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Caesars Entertainment’s operating margin has shrunk over the last 12 months and averaged 18.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Caesars Entertainment generated an operating margin profit margin of 11.4%, down 12.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

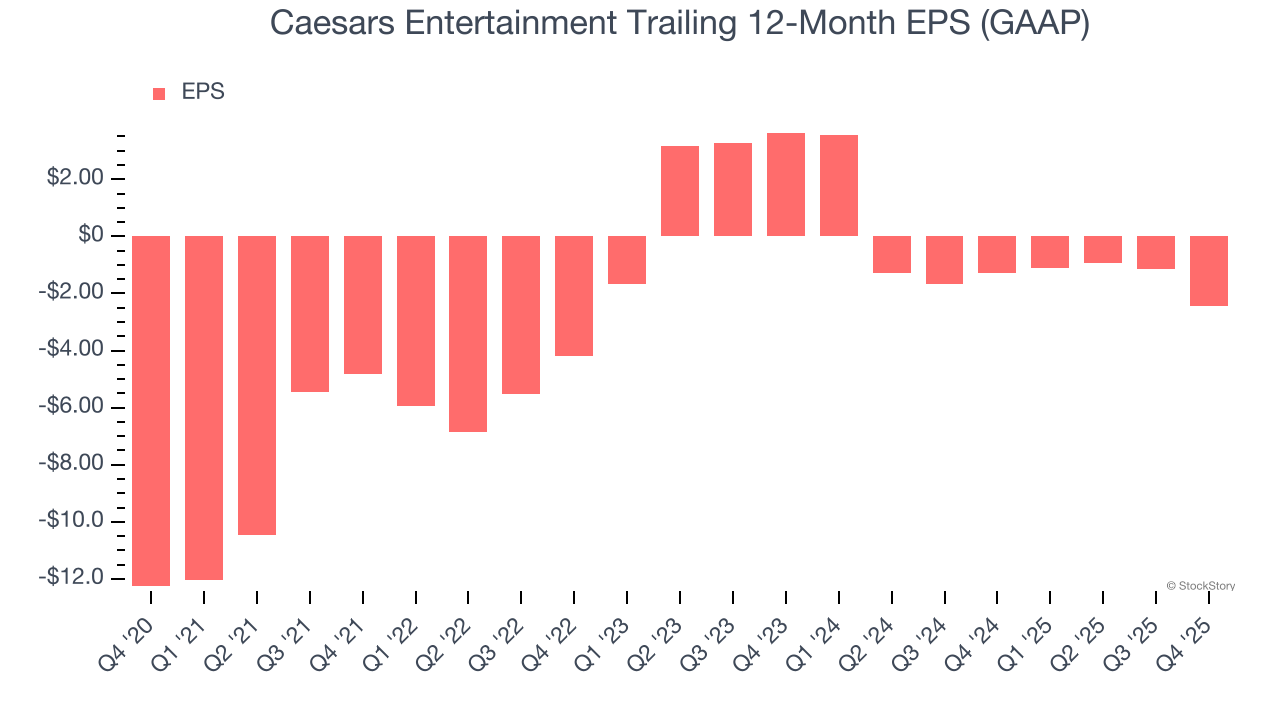

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Caesars Entertainment’s full-year earnings are still negative, it reduced its losses and improved its EPS by 27.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Caesars Entertainment reported EPS of negative $1.23, down from $0.05 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Caesars Entertainment’s full-year EPS of negative $2.43 will flip to positive $0.05.

Key Takeaways from Caesars Entertainment’s Q4 Results

It was good to see Caesars Entertainment narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded up 4% to $19.70 immediately following the results.

Is Caesars Entertainment an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).